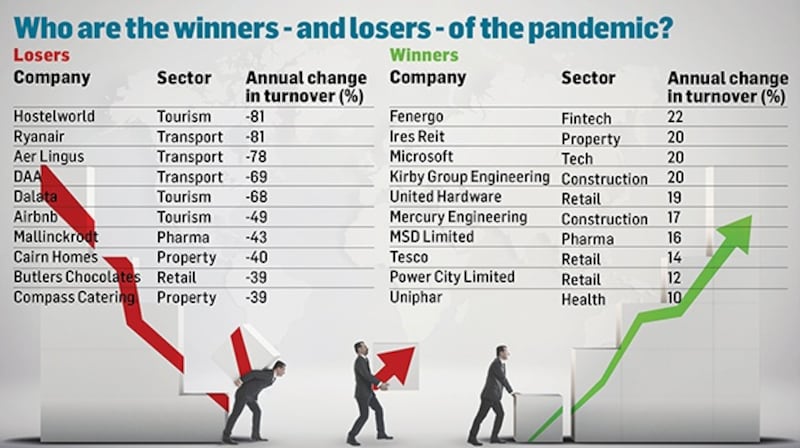

With retail, hospitality and beauty and grooming services closed for much of the year, it’s no surprise that businesses in this sector have struggled. However, as with most things in life, if one sector is floundering, another may be booming. Here we take a look at some of the sectors and businesses that have thrived - and those who haven’t - over the past year. The companies featured in this article are only those who have filed accounts for 2020. Given that many won’t have done so yet, the year ahead will also offer further insight into just how the pandemic impacted businesses across Ireland.

Winners: Supermarkets

Every very little (pandemic) certainly helped the supermarket last year. With a staggering £388 million (€454m) in additional sales in Ireland last year - or an extra £1 million every day - Tesco undoubtedly benefited from several stay at home orders over the past 18 months, which saw restaurants, pubs and non-essential shops close for much of the year. The British grocer remained open, and was able to maximise sales across product lines from alcohol to ready made meals and pizzas, to homeware and the clothing products it was entitled to sell. It reported a 13.7 per cent jump in its Irish sales (on a constant currency basis), considerably greater than the 7 per cent it reported across its business in the UK. Perhaps the Irish just bought more toilet rolls and sanitiser, not to mind wine and crisps during the pandemic?

It was the British grocer’s superior online offering perhaps which helped it achieve such stellar growth. With many vulnerable people cocooning, and others fearful of entering supermarkets themselves, demand for Tesco’s online shopping service was so high during the year, that it was only the early riser that caught a delivery, as slots disappeared as soon as they emerged online.

While Tesco may the only grocer disclosing its Irish sales, it doesn’t mean the others struggled. Figures from Kantar showed that the average Irish household grocery bill increased by €1,000 over the last year, with €2 billion more spent on groceries in the year to end February 2021.

Dunnes Stores, which keeps its financial figures very close to its chest, is likely another key beneficiary of this largesse; particularly considering that a stroll through its homeware aisle was the closest thing to retail therapy for many people this year.

Hardware

The hardware sector also benefited from a lack of spending opportunities elsewhere.

United Hardware, which supplies and operates the Homevalue retail brand, with about 150 stores across Ireland, saw its sales rocket by 19 per cent to about €200 million in 2020. Electrical supplier Power City also got a boost in 2020, growing its revenues by 12 per cent in the 12 months to end September 2020. With subsequent closures however, it may have suffered since, although it was able to remain open as an essential retailer.

Tech

Fintech Fenergo is another climber in this year’s survey, having grown its revenue by some 22 per cent to about €95 million as of the end of March 2021. The Dublin based company has become Ireland’s third official Irish tech unicorn after being valued at over $1 billion (€ 892m) in a deal in April. Founded in 2008, Fenergo develops software for financial institutions that helps them with issues such as regulatory compliance and managing client data. It may only offer a limited insight into its pandemic performance, as Microsoft’s figures only cover the 12 months to June 2020, but it offers a very optimistic one nonetheless. The US software maker grew its business out of Ireland by 20 per cent on a constant currency basis in the year to June, shrugging off the first global lockdown to increase revenues to some € 41.5 billion.

Property

Also beating the trend last year was Ireland's largest private landlord, Ires Reit, which has a portfolio of almost 4,000 properties, mainly across Dublin. Despite the difficult operating environment, which saw rents weaken as hundreds of thousands of people found they had to rely on state supports such as the pandemic unemployment payment, the property investment company managed to grow its revenues by 20 per cent to almost €75 million in the year to end-2020. Engineering groups also performed well in 2020, despite the impact of restrictions on construction. Limerick founded Kirby Group Engineering reported a 20 per cent jump in revenues to €292 million, while Irish contractor Mercury Engineering broke through the €1 billion barrier for the first time, with revenue growth of 17 per cent for the year.

Losers

U nsurprisingly perhaps, finding losers for this column was a lot easier than pinpointing the winners. With Covid-19 restrictions limiting a vast number of businesses’ ability to trade, 2020 was a tough year right across sectors including hospitality, tourism and retail. And the year ahead may be even tougher, as some businesses look to give up government supports and re-open.

Travel and tourism

The travel and tourism sector was at the “frontline” of businesses hit by the pandemic, as airlines remained grounded and with people largely trapped in their own locales for much of the year, there was little opportunity for the sector. The sector took a further hit with the introduction of mandatory quarantine for travel from certain countries in March 2021. Now airlines will be hoping plans for an EU wide vaccine passport will allow them to take off once more in 2021. Hotels were also hit hard, as restrictions returned in the autumn after a brief return to (near) normality in summer 2020, and hotels also hit by inter-county travel bans. Dromoland Castle owner Mark Nolan said in November that it lost €50,000 in bookings in 48 hours after the Christmas opening up of the country was delayed until December 18th.

Airbnb, which had been the subject of some unwanted attention for its role in reducing supply in the long-term rental market, had a very different experience over the past year. With little demand for short-term lets, its revenues halved amid the crisis. Revenues in Ireland fell by 49 per cent to €1.1 billion in the nine months to September 2020 compared with €2.2 billion a year prior.

Hostelworld, the budget accommodation booking specialist with some 36,000 properties across 178 countries on its platform, was also hit hard as its business almost ground to a halt. Revenues fell by 81 per cent to €15 million.

Revenues at IAG owned Aer Lingus slumped by 78 per cent to €467 million, as it reported an operating loss of €563 million, and slashed employee pay and jobs.

Publically listed hotel group Dalata, which operates the Clayton and Maldron group of hotels, saw its revenues fall by 68 per cent, leading to a €111.5 million pretax loss for the group. So far this year, there has been little to smile about for the sector, but outgoing chief executive Pat McCann said domestic tourism should bolster the sector in the summer months, with international travel returning towards the end of the year.

Retail

With non-essential retail shut for much of the year, shops were another cohort of big losers in 2020, particularly those with no online offering. Of these, Penneys was one of those who missed out in 2020, as it continued to eschew ecommerce. While it reported "phenomenal" trading when it was able to re-open its shops, these openings weren't enough to stave off the decline, and it saw its sales drop across the globe by about £1.5 billion over the Christmas period, due to Covid-19 restrictions. In Ireland, we've estimated that its sales fell by about 27 per cent over 2020. Other Irish owned names also saw their sales drop. With few visitors at the airport, and town and city centres across Ireland bereft of footfall, coffee and chocolate specialist Butlers saw its revenues fall by 39 per cent to €25 million. The sector also saw a host of closures during the year, including Oasis, Monsoon, Abercrombie and Fitch, and Debenhams.

Property

Yes, property prices may have avoided any swingeing declines in 2020, but nonetheless, an uncertain environment, which saw construction suffer long closures, meant it was a tough year nonetheless for those building houses. New homes builder Cairn Homes bore the brunt of work stoppages in 2020, as its turnover in 2020 fell 40 per cent to €262 million from €435 million in 2019, while pre-tax profits sunk to €14.8 million.

The builder, which owns 36 sites, mainly in the Dublin area, is expecting a better 2021 - even if it will only be up and running for eight months of the year, given the Covid-19 related closures until midApril. Glenveagh Properties, another home builder which has had particular success in constructing for the build to rent sector, also saw its revenues and profits tumble in the year, with revenues down 18 per cent to €232.2 million, and it reported a pre-tax loss of €15.7 million.

Increased costs, due to Covid-19 safety measures and operating protocols, as well as prolonged closures, were behind the declines, but the company is expecting a better performance for 2021, with continued interest from institutional investors in the private rented sector.

It wasn’t just builders that saw their businesses decline; those servicing offices and other venues also took a hit. Compass Catering, which offers contract catering services, saw its Irish revenues plummet by 39 per cent in the year to September 2020, as the pandemic hit its business.