State supports for households and businesses, together with the strong performance of Ireland’s multinationals, mitigated the effects of Covid-19 and provided a solid platform for recovery once the economy reopened last spring. The post-lockdown rebound has been stronger than expected. Employment was up 9.9 per cent in the year to June, with nearly all of the Covid job losses being regained. Meanwhile, output has rebounded with GDP growth of 16.3 per cent year on year in the first half of 2021.

The consumer

Income supports have sheltered vulnerable workers from the worst pandemic effects, and in the wider labour market earnings are currently rising by 3.9 per cent per annum. With spending curtailed by lockdowns, Irish householders deleveraged by more than €9 billion between February 2020 and September 2021, while savings deposits rose by €22.75 billion in the same period. This creates headroom for a spending rebound, assuming that consumer confidence holds up.

Sales

Retail sales snapped back after stores reopened last spring. Inevitably the pace of recovery has moderated in recent months as a more normal shopping environment re-emerged.

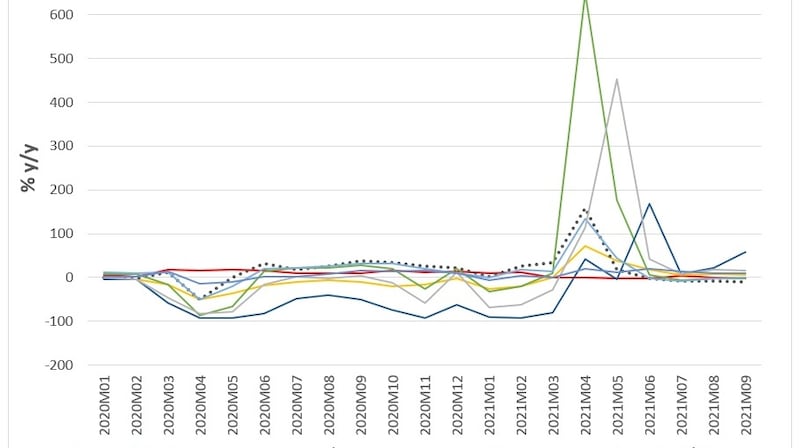

The graph (see graph) shows sales trends by store type over the last two years. Three groups are evident. Group One includes “defensive” retailers selling essential items; grocery stores, pharmacies, hardware shops and petrol stations. Sales held up well throughout the pandemic due to these stores remaining open.

Group Two includes non-essential retail outlets, such as furniture and fashion stores. These were affected by public health restrictions resulting in weak sales during lockdown. However, trading rebounded sharply once the economy reopened.

Finally, recovery from the contraction in the third group, which includes bar sales, has been delayed due to indoor dining only reopening in July.

E-commerce

Internet sales rose steadily as a proportion of total card sales between 2016-2019. However, consumers had to migrate online during the lockdowns. Consequently e-commerce sales rose to almost 70 per cent of total spending during 2020 and 2021. While it is too early to call a trend, the latest data suggest a swing back to traditional face-to-face retail channels as shops reopened.

Occupier market

The high street has been the hardest-hit sector with lockdowns decimating footfall and in-store spending. This, along with Brexit, UK company voluntary arrangements (CVAs) etc, has led to a spike in vacancy. However, we are encouraged by the depth of active occupier demand in both high street and shopping centre locations (also impacted by the pandemic, albeit to a lesser extent).

A noticeable trend is the “direct-to-consumer” retailer. These international brands control their entire manufacture and sale process, via online retail and retail from company-run stores. Lululemon, which recently opened at 84 Grafton Street, is a good example. The upsizing trend continues, as physical retailers embrace the omni-channel approach and need more space to accommodate click-and-collect sales.

While the high street and shopping centres have been challenged, retail parks, supermarkets and neighbourhood centres have proven resilient with minimal supply chain disruption.

Rents

Grafton Street rents have fallen 17.4 per cent from €6,189 per sq m (€575 per sq ft) pre-Covid to about €4,496 per sq m (€475 per sq ft). Sharper declines of 38.9 per cent have been seen on Henry Street where zone A rents are approximately €2,960 per sq m (€275 per sq ft). The prime shopping centre sector has also seen rents decline, but not as sharply as on the high street. There will inevitably be a rebound once retail occupiers begin to refocus on growth and expansion opportunities.

The other main retail asset classes, grocery and retail parks, showed their resilience against Covid-19 and the rise of online. These sectors saw healthy occupier activity and evidence of rental growth. This should continue.

Outlook

The economy has significant momentum and forecasters have revised up their employment and output projections. Consumption expenditure is expected to rise by 6.8 per cent in 2021 and 9.6 per cent next year (assuming no further lockdowns and the preservation of consumer confidence).

Ireland will remain a lucrative destination for international retailers. Prime shopping centre and high street vacancy figures will drop significantly in 2022 as existing retailers continue to expand and through the arrival of new market entrants. Expect some exciting new names in this space. We anticipate rental decline to taper off in these sectors but it is too early to call a rental rebound in 2022. We remain positive on the rental outlook for retail parks and grocery stores which continue to be the most resilient retail sub-sectors.

Eoin Feeney is deputy managing director and head of retail at BNP Paribas Real Estate Ireland