What’s this about Joe O’Reilly, the property developer, becoming the new Baron of Ballsbridge? This was a title given to the now bankrupt developer Seán Dunne after he splashed €400 million in the boom years to buy the neighbouring Jurys and Berkeley Court hotels in Ballsbridge, in Dublin, from the Doyle group. They were among the highest prices paid for Irish land in the bubble years. Dunne had grand plans for the area, including a 37-storey tower, but planners and the Irish banking crash scuppered his proposals, and the hotels were recently put up for sale by Ulster Bank, his main lender on the project. It has emerged that O’Reilly’s Chartered Land and the Abu Dhabi sovereign wealth fund have won the sale process, after they offered more than €170 million for the prime 6.8-acre plot.

How can O’Reilly pull off this deal when Chartered Land is in Nama? O’Reilly’s companies, Chartered Land and Castlethorn Construction, had their loans transferred to the National Asset Management Agency in 2009 and 2010. He was one of the agency’s biggest debtors, with debts of about €2 billion. The nature of the partnership between Chartered Land and the Abu Dhabi Investment Authority hasn’t been revealed, but it seems likely that the financing will be coming from the Middle East. Chartered Land’s involvement revolves around its strong record of commercial development, including Dundrum Town Centre and parts of Grand Canal Square, including the Bord Gáis Energy Theatre and Facebook’s European headquarters. O’Reilly told the Oireachtas banking inquiry on Thursday that Chartered Land is subject to Project Jewel, a loan sale process with Nama. It began in June, includes Dundrum Town Centre, and is expected to conclude by year end.

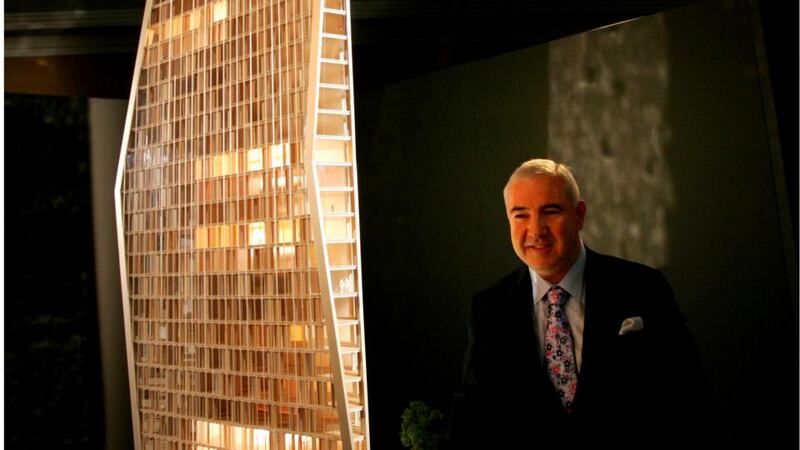

Who is Joe O’Reilly? O’Reilly (left) was one of the most successful developers in Ireland before the crash. He has more than 25 years’ experience, including building thousands of homes and developing many successful commercial projects, including Dundrum and the Ilac and Pavilion shopping centres in Dublin. He expects to exit Nama this year having fully repaid his debts.

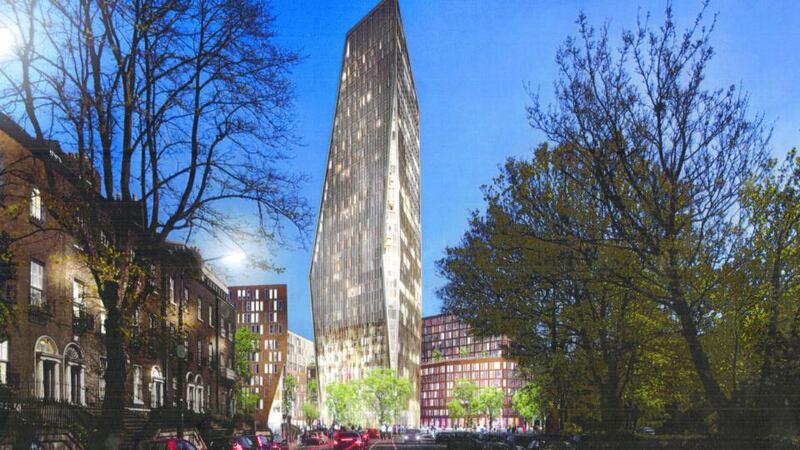

What will happen to the site now? Planning permission already granted provides for a 1.5-million-square-foot urban quarter, including 490 high-end apartments and a 152-bedroom hotel. The permission, which expires in 2021, allows for 11 residential blocks, ranging from six to 10 storeys. Property sources have suggested that the total cost of the project, including the purchase price, could run to more than €500 million. It’s a substantial development, if not quite the Knightsbridge-style quarter that Dunne had aspired to build.

How will the locals react to this news? It’s hard to say. They fought tooth and nail before the crash to oppose Dunne’s original development, with the financier Dermot Desmond among the objectors. Any attempt to revise the existing planning permission might well be resisted.

Has Ulster Bank taken a hit on this deal? It looks like it. Ulster Bank is reported to have advanced Dunne €270 million for the Ballsbridge sites. It later secured a judgment of €164 million against Dunne, who went bankrupt in the United States. The €170 million-plus secured for the loans is considered a good price in the current market, but this will still result in a hefty loss for the Irish bank and its UK parent, Royal Bank of Scotland.