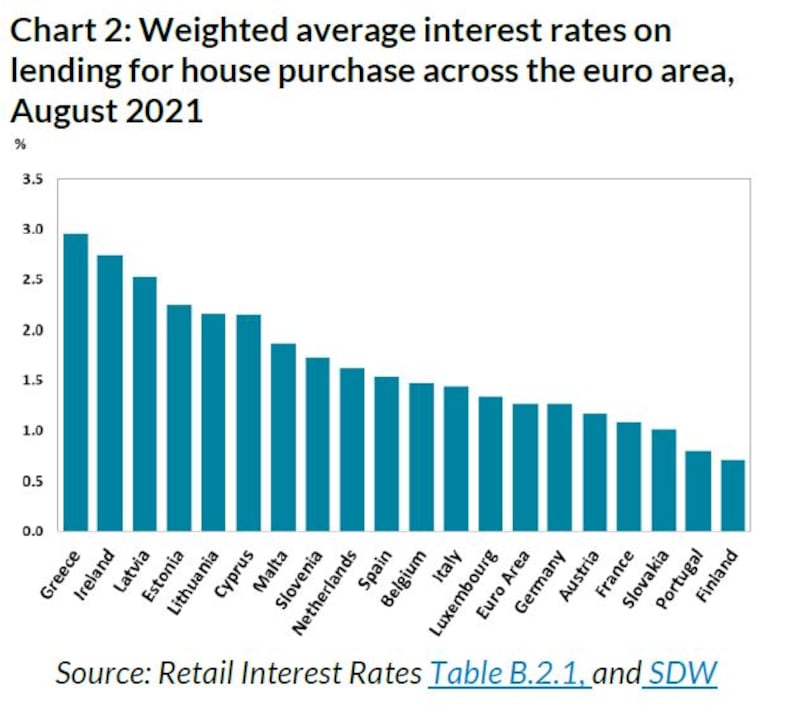

Average interest rates offered to mortgage borrowers have softened slightly over the past year, with the weighted average rate on new Irish home loan agreements standing at 2.74 per cent in August, according to figures from the Central Bank.

This was down 9 basis points on August 2020, when the average was 2.83 per cent, but the rates borrowers pay in the Irish market still remain well above the euro zone average of 1.27 per cent.

Rates are higher only in Greece, the Central Bank statistics show.

The weighted average interest rate on new fixed-rate mortgages was 2.62 per cent in August 2021, down four basis points, and fixed-rate loans accounted for four-fifths of new agreements in the month.

For new variable rate mortgage agreements, the weighted average interest rate stood at 3.31 per cent in August, down 15 basis points year on year.

The volume of new mortgage agreements arrived at €704 million in August, up 50 per cent on August 2020, when volumes had declined due to the Covid-19 crisis.

Renegotiated mortgages amounted to €183 million in August, a decrease of 19 per cent on the previous year.

"While Ireland's rates remain higher than our European counterparts, we are seeing a steady reduction in the rates offered by various providers across the board," said Trevor Grant, who chairs the Association of Irish Mortgage Advisors.

“This is likely to continue as the cost of credit remains low and as competitors vie for business from Irish mortgage customers.”

Mr Grant said the volume of inquiries to mortgage brokers from borrowers considering switching their mortgage had “increased significantly”.