The text that landed Paddy McKillen in the fight of his Irish life came out of nowhere, in January 2011. “Greens are talking to Barclay twins who have contacted Derek,” it read.

“Seems incredible… Don’t blow a gasket.” Three years on, the epic billion-pound battle precipitated by that brief message is still raging. McKillen is down what most men might consider a gasket-shattering £30 million in lawyers’ fees - and no one has a clue how it will end.

Under the circumstances, he seems pretty cheerful. He is, mind you, striding up a flower-strewn hillside behind his place in Provence. It is a bright and absurdly beautiful morning, the air so clear that the blue-green mass of the Luberon hills 20km away seems close enough to touch.

“This place, I swear to God,” he sighs, pausing to look back, a slight, silver-haired figure in jeans and open-necked shirt: soft voice, a proper smile, just the tiniest sliver of granite in the eye. “You come down here, breathe it in. It’s like you expand. Become a different person.” He stoops and breaks off a sprig of thyme. “Just smell that, will you? Most magical place on Earth. It’s where I get my peace. And determination.”

McKillen has needed that of late. A little-known and somewhat unlikely property tycoon so averse to publicity that for decades the only photograph of him was in black and white, he is waging a bitter and increasingly public battle for three of London’s grandest hotels.

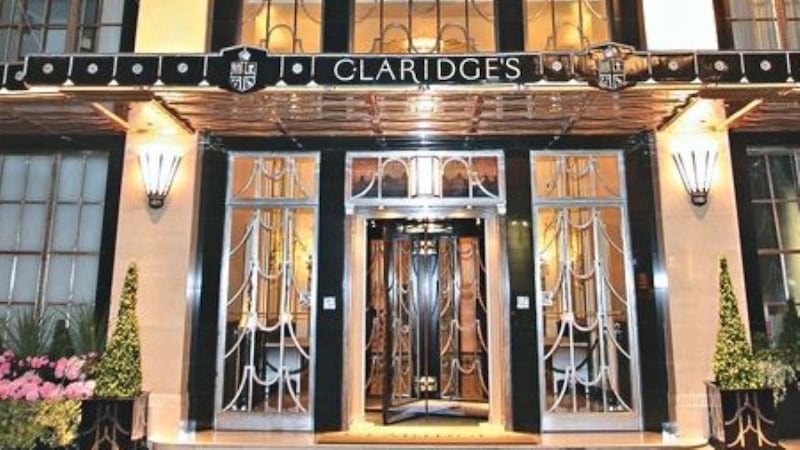

His rivals for Claridge’s and the Connaught in Mayfair, and for the Berkeley in Knightsbridge, hushed haunts of the landed and the loaded, are Sir David and Sir Frederick Barclay. The septuagenarian brothers, owners of the Telegraph media group, the Ritz on Piccadilly and a huge home-shopping empire, commute between Monaco and a mock-Gothic castle on their own private Channel island, while nursing an estimated £2.3bn fortune. (McKillen, by contrast, scraped into the 2009 Sunday Times Rich List on £66m, and hasn’t been seen there since.)

The Barclays are reclusive, too - the last published pictures of them seem to have been taken when they were knighted, nearly 15 years ago - but for the past three years they have been ruthlessly stalking the three trophy hotels in which McKillen has a one-third stake.

The saga of this do-or-be-done struggle between unfeasibly wealthy men might make a fun movie. The locations are exotic enough (Paris, Qatar, LA, Dublin, Vietnam) and the cast eclectic: ageing rock stars, venal bankers, celebrity chefs, a spectacularly bust Irish developer or six; plus half the world’s greatest living architects, a Nobel Prize-winning economist and Tony Blair.

But, in his mild way, the whole thing makes McKillen mad, and not only because he’s spent nearly €40 million on lawyers. “My father,” he says, “gave me two pieces of advice: stay out of court and out of the newspapers. I’ve let him down, on both counts.”

There are those who wonder how much of McKillen’s empire of shopping centres, offices and hotels, strewn across four continents, is built on sand and soft-spoken blarney. But there is no doubting he has come a long way from Andersonstown, west Belfast, where he was born 58 years ago.

He left school at 16 to work in his father’s Dublin car exhaust business, DC Exhausts, a company that did “very well, very fast. We did all the building work on the workshops ourselves and when we started selling, we found we were making more on them than we had from the business done in them. That was the first step, I guess.”

By the mid-1980s, McKillen had converted Dublin’s magnificent early 18th-century Treasury building into prime office space; soon after, he built the city’s highly successful Jervis Centre shopping mall. He is annoyingly cagey about what exactly his portfolio consists of - some reports have suggested 60-plus buildings worth as much as $4bn, but he won’t be drawn. It is, he will say, divided broadly into hotels, retail centres, office blocks and renovations, in the UK, Ireland, France, the US, Japan, Argentina and Vietnam. With U2’s Bono and the Edge, McKillen co-owns the Clarence Hotel in Dublin (he is also mates with Michael Stipe, the former REM frontman, and Madonna). He and a partner have a 21-storey office block in Boston, assorted buildings on the Place Vendôme in Paris, bits and pieces on Oxford Street, London, and in LA. In June, he and a partner bought a prime Dublin site for €40.5m.

“I build to keep,” he says. “I still have the stuff I did in my 20s. I go weak at the knees for plans and drawings. And for restorations: 30 Georgians in Dublin, some fantastic places in Paris.”

At Château la Coste, the sun-baked vineyard and estate in Cézanne country that he bought in 2002 and opened to the public three years ago, McKillen is building something fairly exceptional, too. Piqued, perhaps, that while several of his sisters are artists, he “can’t draw so much as a straight line”, he has for 30 years been assembling a world-class collection of art architecture. Nestled among the vines, olive groves, meadows and woodland are buildings by Frank Gehry, Jean Nouvel and Tadao Ando, with more to come from Renzo Piano and Richard Rogers. There are sculptures and installations from Alexander Calder, Louise Bourgeois, Tracey Emin, Andy Goldsworthy and Richard Serra. The centre attracts 600 visitors a day. Some artists, McKillen says, he has worked with on commercial projects. Ando is a regular collaborator; Nouvel was responsible for La Coste’s state-of-the art winery; others are “friends of friends”.

Unlike the Barclay brothers. “Traders,” McKillen practically hisses. “Out to turn a quick buck. Highly aggressive. And philistines. I’ve told them: these hotels are jewels, to be cherished. Nearly 200 years of history. Not assets to be sold down to the highest bidder.” Relations between the three men are more than chilly: in written court testimony, Frederick Barclay said that a joke he made about McKillen being unlikely to get past security at the Ritz (because “he was not wearing a jacket and tie and his shirt was hanging out”) did not go down particularly well; McKillen says that David and his son Aidan, who manages the twins’ UK businesses, have deliberately turned their back on him at Claridge’s.

It was almost exactly a decade ago that Derek Quinlan (the Derek of that portentous text message), Dublin tax inspector turned archetypal, insanely-leveraged Celtic Tiger, first got wind that the Connaught, Claridge’s, the Berkeley and the Savoy might be up for grabs, and asked McKillen if he was in. McKillen jumped at the chance. He, Quinlan, the wealthy coalmining heirs the Greens, and a few other short-lived smaller investors (including the creators of Riverdance and the then-chairman of the Anglo Irish Bank), had no trouble raising the €900m-odd needed to buy the group. This was, after all, the giddy height of Ireland’s boom.

The Savoy was soon sold on to a Saudi prince for £230m (“It didn’t sit easily with the rest,” McKillen says. “Just didn’t fit”) and he got to work restoring and renovating, starting with the venerable Connaught. People who worked with him on that £70m project, which saw the dilapidated hotel close for nine months for a near-total rebuild, describe a generally amiable but permanently driven boss. McKillen hired 20 artists and designers, approved furnishings and artworks, and stood firm on details.

It was McKillen who proposed turning an abandoned space beneath the roof that held mostly disused water tanks into the hotel’s grandest suite, a two-bedroom extravaganza for which the more obscenely wealthy Connaught clients will readily pay £14,000 a night; it is booked solid. He persuaded Hélène Darroze (a “friend of a friend from Paris; to be fair, she didn’t think twice”) to move to London and run the hotel’s restaurant, which has two Michelin stars.

During the last couple of months of the project, McKillen pretty much lived on site, taking showers at Claridge’s when there was no hot water. In the final weeks, he organised free burgers for everyone, every day. He didn’t sleep for the final 72 hours, and on the night before the re-opening, someone he sent home at 2am for some shuteye recalls coming back at six to find McKillen rolling out the entrance carpet. “He is the most amazing motivator,” one collaborator says. “For him, people aren’t the plumber, the plasterer and the carpenter - they’re Mike, Phil and Liam.”

By the time the Connaught re-opened, just before Christmas 2007, McKillen’s remodelling had multiplied room-rates, increasing earning potential to a point exceeded only by a handful of hotels in New York or Paris. With occupancy rates of more than 85% and revenues last year of some £130m, the three hotels are now valued at more than £1bn.

Then came 2008. As the markets crashed, banks went belly-up, credit froze and real estate values plummeted, cracks in the original consortium started to appear. The smaller investors sold, leaving three main partners. The unfortunate Quinlan, whose empire was once worth £10bn, was disappearing under a mountain of unserviceable debt. Personally in hock for some €600m, he left temporarily for Switzerland while bankers seized his homes, yacht and art collection (including, pleasingly, a Warhol of a big dollar sign).

Ireland’s “bad bank” set up to deal with all these toxic loans, the National Asset Management Agency (Nama), also made a determined if ultimately unsuccessful bid to seize around £1.4 billion of McKillen’s bank debt, but he fought them. “I’d never gone on the tear,” he protests. “I hadn’t done anything in Ireland since 1998. The place was clearly going mad. My properties were performing fine. My loans were serviced. I hadn’t defaulted on anything in 40 years. It was my banks that had gone bust, not me.”

But Nama argued that, good or bad, the bank loans to McKillen were so huge, they represented a “systemic risk” to the financial stability of the Irish state, and the Irish high court agreed. Further outraged (“I’d worked my butt off for 35 years; I wasn’t going to sell my kids out like that”), McKillen got the Nobel prize-winning economist Joseph Stiglitz to plead his case, and took it to Ireland’s supreme court - where he won. But, by now, assorted raiders, including the Barclays, were beginning to see a weakness, and an opportunity.

They had to advance with great care, because the original consortium contract contained a key clause, a so-called “pre-emption agreement”: in essence, anyone who wanted to sell shares had to offer them first to a fellow member of the consortium. The Barclays took control of the Green family’s 25% stake by the simple expedient of acquiring the Cypriot holding company in whose name the shares were registered.

Then they courted the now all-but-bust Quinlan in a series of meetings in Monte Carlo, forked out several million pounds to him and his family, in what they would later tell a court was merely help to a friend fallen on hard times. They eventually bought up the loans secured by the former tax inspector’s 34% stake, handing them his voting rights. By the time the dust had settled in early 2011, David and Frederick Barclay controlled 64% of the hotel group - and Paddy McKillen 36%.

Frank Gehry’s pavillon de musique Frank Gehry’s pavillon de musique at Paddy McKillen’s Provence estate, Château la Coste. Photograph: Alexandre Guirkinger for the Guardian

Between London, LA - where his wife, daughter and two of his three grown-up sons live - and La Coste, McKillen plotted his return. His resolve, he says, was stiffened here. Many of the artists whose work he exhibits have become friends, and stayed in the estate’s 17th-century farmhouse. Some have come as many as six times before finding the right spot for their project. But once asked, McKillen says, no one has said no; several have offered a piece unasked.

On one small rise, Ando has placed his Origami Bench, the better to view the monumental steel plates of Serra’s sculpture, Aix. Gehry, whose deconstructed music pavilion sits behind the visitors’ centre, has designed a series of platforms from which to observe a piece by Californian Tony Berlant - the artist whose colourful 60s tin scraps pinned to plywood inspired Gehry’s award-winning Guggenheim museum in Bilbao. Meanwhile, Nouvel has drawn what McKillen calls “a kind of mini-Turbine Hall”, which will house the three monumental steel towers by Bourgeois that, in May 2000, inaugurated Tate Modern’s cavernous original. “I like people to do things they haven’t done before,” he says. “Edgy, interesting work, pushing their boundaries.”

Here, the high court and its bitter claims and counterclaims are a world away. From the start, McKillen says, the Barclay brothers’ strategy was to “buy my debts from the banks, call it in, and bust me. I was in a weak position because my banks were in trouble - and they knew it. It was a highly aggressive, hostile takeover bid. Over the last three years, they’ve tried every Wall Street hostile takeover tactic in the book.” (One ploy, a rights issue that would have diluted McKillen’s stake, obliged him to seek the temporary backing of a wealthy Qatari investor. At one point, too, Tony Blair’s Middle Eastern connections came in useful, McKillen says.)

He is convinced the Barclay brothers’ plan is to sell the hotels as soon as they get their hands on them, although the brothers have vehemently contested this. Either way, they failed to foresee the determination with which McKillen would defend his stake. He has fought three high court legal claims and an appeal, and while the courts have mostly found against him, he remains convinced the brothers’ tactics have been, “if not illegal, at least immoral”. The Barclays would not comment for this article, but their people point out, gently, that the twins have an awful lot more money than McKillen. The brothers’ lawyers have always argued that he is hanging on for as long as he can, in the forlorn hope that the ever-increasing value of the hotels will save him from what they claim is big debt trouble of his own in Ireland.

How will it all end? “They can’t go on supporting Quinlan indefinitely,” McKillen says. “They’re keeping him afloat because, once he goes into bankruptcy, pre-emption will have to kick in. But he’s a time bomb for them. He has massive debts, multiple cases against him. And at some stage, their banks are going to want them to liquidate this thing, and they will have to sell me my portion of Quinlan’s shares.”

He grabs my notebook and draws. When - and he is convinced it is when, not if - the Barclays are forced to sell Quinlan’s stake, the diagram shows, he will be left holding 56 per cent of the group. And he has a new and powerful backer: in March, Colony Capital, an American private equity group worth $31bn, told him, he says, “’We like your story, we like your assets, we’re in.’ They will back me to become majority owner.”

Maybe, though, the feud has become too personal for either side to step back. McKillen has written five letters, without reply, to Aidan Barclay, offering to buy out the brothers. “We have to sit down, sort this out,” he says. “It can’t go on for ever. But I’m their only buyer. And I’m not for moving. I love those buildings, and I’m not letting them go. After 11 years, they must surely have got that message.”

Guardian