What has happened to Irish living standards over recent years is contested territory politically, complicated by Covid-19 and the cost-of-living crisis. New figures from the Central Statistics Office (CSO) this week look for the first time at what happened to disposable incomes per household between 2016 and 2022, the two years in which a census of population was taken. They show a rise in disposable income over the period, but the details of this – and how households have benefited – are interesting and cast some new light on what is driving living standards in the Republic.

1. How disposable income has changed

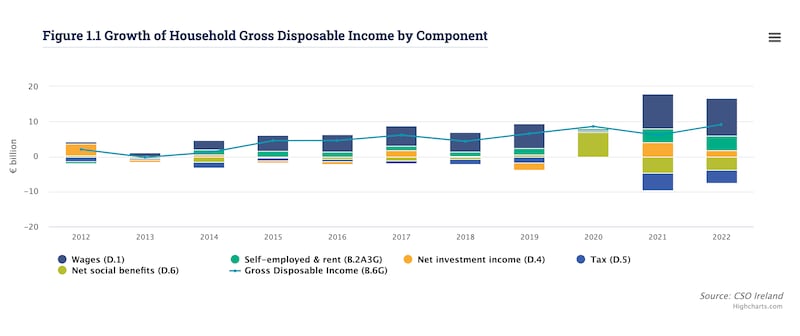

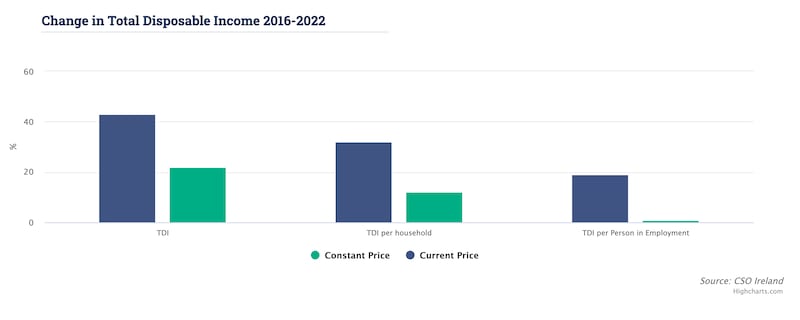

Disposable income is the amount of cash available for households to spend, after taxes on income have been paid. Total disposable income of Irish households rose from €99 billion in 2016 to €141.7 billion in 2022, an increase of 43 per cent. However we need to make a few adjustments to find out how this has affected actual purchasing power.

The first is to account for the rise in the State’s population, which increased by 8 per cent between 2016 and 2022 to 5.149 million. The number of households also increased by 8 per cent over the same period to reach 1.841 million. We might note in passing here that being able to support more households is in itself a sign of economic progress. In terms of the living standards of individual households, the rise in income since 2016 was split among an increasing number. Accounting for this, we can see that income per household rose from €58,152 in 2016 to €76,959 in 2022, a gain of 32 per cent.

An adjustment also needs to be made for inflation, as it takes more money to buy the same goods and services in 2022 than it did in 2016. Taking this into account, the rise in disposable income per household over the period reduces to 12 per cent which, as the CSO puts it, is “a more modest but still significant amount”.

Cliff Taylor: How the return of SSIA-style incentives might be on the cards for Irish households

What will the election tax promises mean for your pocket?

A group of borrowers is trapped in the never-never land of Irish mortgage arrears

Another interest rate cut is coming for borrowers next week, but the economy doesn’t need it

2. The impact of increasing employment

One of the success stories of the economy has been the increase in the number of people at work. Total employment grew from 2.158 million in 2016 to 2.555 million at mid-2022. This meant that the average number of people at work in each household rose from 1.25 in 2016 to 1.39 in 2022.

This rise in the average number of people at work in each household was the key reason for the increase in disposable income – as opposed to increases in real earnings for those already in employment, or more social welfare supports. Disposable income for each person at work – adjusted for inflation – rose by just 1 per cent between 2016 and 2022, with real earnings hit hard by the cost-of-living crisis of the last few years. The rest of the 12 per cent increase in average household disposable income was accounted for the fact that more people were working.

So the rising employment has been the key factor in increasing Irish living standards. In many cases a second partner may have returned to the workforce, a younger person leaving education will have got a job, or someone will have moved from unemployment to employment. Disposable income increases have been concentrated in households where these kind of things happened.

In contrast, individuals at work have not - on average- seen any significant rise in their own disposable income since 2016. This is important politically as well as economically. As inflation has returned, wages have not keep pace.

Separate CSO figures show that wage increases have varied significantly from sector to sector in recent years; many in higher tech sectors will have benefited from above-inflation increases, while others in domestic industries – some hit hard by Covid – will not have been so lucky.

The latest figures give some further insight here. Over the last decade, foreign multinationals have grown their presence here, and this is visible in the share of the total cost of employment across the economy which they pay. In 2013, 21 per cent of the total cost of employment was paid by multinationals (excluding financial firms). By 2022 this had risen to 30 per cent, or 36 per cent if foreign financial firms are included. The domestic sector took a hit, as we know, during Covid, with the Government stepping in via hugely increased social supports.

3. Household finances

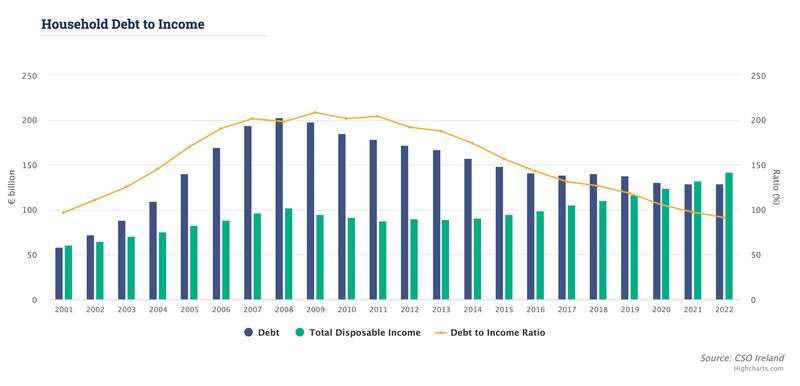

The figures confirm that household finances are, on average, on a much more solid footing than they were before the financial crash of 2008, offering some hope that most can ride out the cost-of-living crisis and higher interest rates, albeit that these are heavy hits. The ratio of income saved by Irish households was a bit lower than the EU average in the run up to the pandemic – the younger average population here may be a factor, as older people save more. But it shot up during the pandemic to peak at 24 per cent of income during 2020, above the EU average of 19.6 per cent and was still at a relatively high 12.5 per cent in 2022. We know from separate Central Bank figures that this has left record amounts in Irish bank accounts.

Meanwhile, as incomes rose here and the repayment of old borrowings after the financial crash for many years outpaced new loans, the underlying financial position of Irish households has become much stronger. At the 2009 peak, the debts of Irish households were on average more than twice annual incomes, reflecting the massive property-based spending binge. By 2022 this figure had fallen to 91 per cent, in other words total debts – at €129 billion – were a bit less than total income of €142 billion.

While household wealth has been supported in recent years by rising house prices, investments in financial assets such as equities and bonds have been hit as markets had a dreadful year in 2022. This left the total value of household financial assets at the end of the year at €359 billion, down €12 billion on one year earlier.

4. Measuring the State’s standard of living

The appropriate measurement of the Republic’s standard of living has become contested territory, in relation both to trends in recent years and in comparison with other countries. Data showing GDP per head near the top of the EU league – in second place to Luxembourg – is clearly misleading, given the distortions to Irish GDP caused by the presence of multinationals here. Even on the basis of GNI* – the adjusted figure taking out some multinational distortions – Ireland ranks fourth. Economist John FitzGerald has said that this still looks unrealistically in measuring Irish living standards, particularly given the capacity constraints in the economy at the moment. These constraints mean that we can’t spend that income on what we really want – houses and infrastructure, both of which have to be produced in Ireland.

On the other side of the equation, a measure called Actual Individual Consumption (AIC) per capita, where 2022 data shows Ireland in 15th place, below countries such as Italy and Romania, looks too low. The AIC data tries to adjust to take account of the different purchasing power of money in various countries. Given the high level of prices here, Ireland will always fall down the league on this calculation, but FitzGerald and some other Irish economists have questioned the methodology in the Irish case.

A separate measure of disposable income per capita puts the Republic in 10th place, below other Northern European countries but above Southern and Eastern Europe. This seems intuitively a better guesstimate of Ireland’s relative position. But people can and will continue to use the figure of their choice as Ireland’s economic data makes comparison very difficult. Living standards here and how they compare will remain contested territory.