The banking sector continues to face substantial challenges. Challenger banks can be seen to offer more flexibility, better functionality and are challenging the digital models of the traditional banks. In turn, the banks are being forced to reconsider their own core business models, whilst continuing to grapple with long-term low and zero interest rates, significantly impacting traditional revenue streams.

Across Europe, banks are struggling to convert their revenues into respectable levels of profitability required to ensure their long-term position. Unfavorable economic conditions resulting from Covid-19 is now further impacting their financial performance and will continue to put significant pressure on profitability.

Cost income ratio (CIR) is a key financial measure for the banking sector and shows a company’s costs in relation to its income. Not surprisingly in these difficult times, the cost income ratio of many European banks is too high:

Irish banks are no exception here, with four of the major Irish banks (Bank of Ireland, AIB, permanent tsb and Ulster Bank) reporting cost income ratios (CIRs) ranging from 56 per cent to around 75 per cent. This is not sustainable and must be addressed by the banking industry.

Investment in technology is key

With what seems to be wave after wave of revenue and cost challenges, it is no wonder banks have been turning more and more to cost reduction measures. Banks have a range of plausible options, encompassing: headcount reduction, product rationalisation, new operating models, process re-design and increased technology investment, with all banks leveraging at least one if not several of these levers in an attempt to deliver efficiencies and reduce costs.

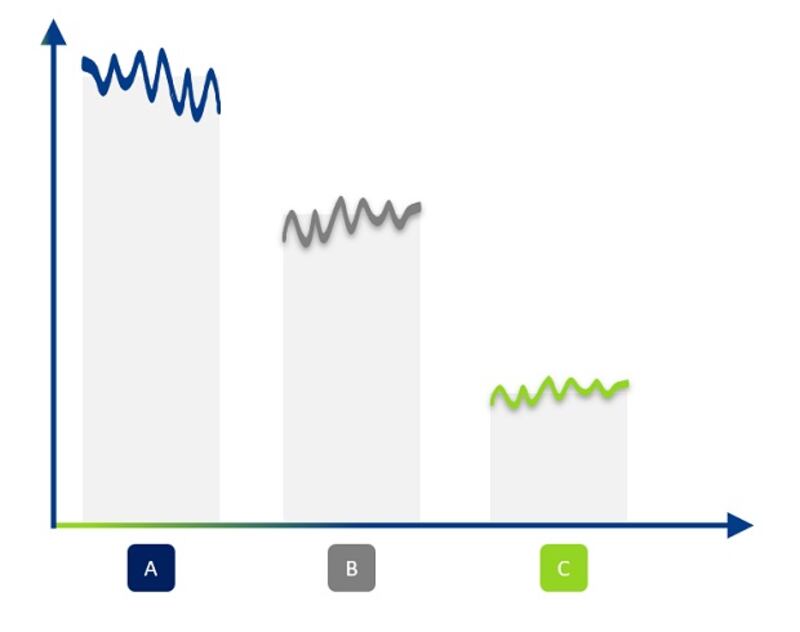

BearingPoint research has identified that the best performing banks improve their cost income ratio by significantly investing in appropriate technology:

- Poorly performing banks (65 per cent) spend less on IT: 5.1 per cent reduction from 2013 to 2018

- Best performing banks (35 per cent) spend more on IT: 14.7 per cent increase from 2013 to 2018

“To facilitate process efficiency, European‘s best performing banks have increased their investments in new technology by nearly 60 per cent since 2009 and freed change-the-bank-budgets to accelerate innovation,” ECB, Financial Stability Report, 2019.

Digital trends in banking

According to the BearingPoint ‘Digital Leaders Survey’, Irish banks are continuing to become more customer-centric through providing multichannel offerings, digital contact centers and leveraging social media. Banks also showed strong growth in digital marketing and digital product experience, enhancing the functionality of mobile and web-based interfaces.

Likewise, the BearingPoint ‘CFO 4.0 Study’ identified that due to its rapid and progressive transformation, the financial services (FS) sector was more advanced than other sectors in terms of digitalisation of the CFO function. FS companies have a high level of understanding of the impact and benefits of digitalization, making them more advanced compared to other industries.

72 per cent of organisations would like to adopt new digital tools even sooner, with banks often frustrated as they cannot make as many interactions or processes as digital as they could be, because of high regulation and product complexity.

Covid-19 is accelerating this digital trend with in-branch banking becoming less accessible. The option to bank online has become more important and has given the banking sector the opportunity to develop their online services, reduce costs and improve the customer experience. In addition, with working from home likely to become the new normal, banks are likely to consider options for highly manual back office processes where appropriate technology investment could deliver efficiency savings and where use cases already exist to leverage technologies such as machine learning and AI in areas such as AML and other manual compliance processes.

How does technology help deliver efficient banking business?

According to Business Insider Intelligence, 39 per cent of retail banking executives say that reducing costs is where technology has the greatest impact, compared to only 24 per cent who say it is improving customer experience.

So, what are these emerging digital and technology solutions that can support delivering cost efficiencies? Does their deployment always guarantee success in terms of efficiency savings?

Cloud and Software as a Service (SaaS)

Benefits: Low infrastructure costs; offers resilience, scalability, and security.

Considerations: Managing risks around location and security; ensuring compliance with EBA guidelines on outsourcing.

Advanced Analytics

Benefits: Rapid benefits realisation using the right tools in an agile environment.

Considerations: Effective data quality remains a challenge; innovative use case delivery methodologies required for effective change and value generation.

Robotic Process Automation (RPA)

Benefits: Scripting tool used for automating repetitive manual tasks.

Considerations: Has been around for a while. Limited benefit when deployed in isolation.

Machine Learning / Artificial Intelligence (AI)

Benefits: Delivers efficiencies when deployed for processes including AML, fraud detection and in support of credit decisioning.

Considerations: Compliant and ethical use of data; can improve customer experience but only if well designed.

Low Code

Benefits: Offers a rapid and low-cost solution to validate, consolidate and transform data from multiple sources.

Considerations: Full benefits have yet to be realised.

In summary

There are no ‘silver bullets’ in terms of implemented technology solutions guaranteed to reduce costs. There are many factors to consider, from the wider future strategic priorities and operating model of the bank to considering the technology architecture in existence today. “The ability to understand and leverage new technologies will be a key differentiator in the future. An increase in the use of technologies should be considered as a means to achieve an efficient banking business: improve cost efficiency, outsource non-strategic functions, make or reconsider strategic acquisitions, divest underperforming assets/divisions, etc,” concludes Noel Crowley, head of banking & capital markets at BearingPoint Ireland.