Incomes have risen steadily in Ireland in recent years – before Covid-19 hit – with some data showing Ireland as one of the EU's richest countries. But are we really that well off? We know that distortions caused by multinationals are one of the factors affecting the data. But there are other factors too – and data developed in recent years, measuring how much people spend on goods and services, gives a different picture. Here is why.

1. GDP: the flawed indicator

Former central bank governor Patrick Honohan has said that Irish GDP data is "worse than useless."

Irish GDP data is deeply affected by multinational accounting and significantly overstates the size of the economy. Another indicator developed in Ireland , Gross National Income*, which factors out the impact of multinational accounting, measures the size of the economy – and thus incomes per head – as being almost 40 per cent lower. Yet GDP is still the general basis for international comparison.

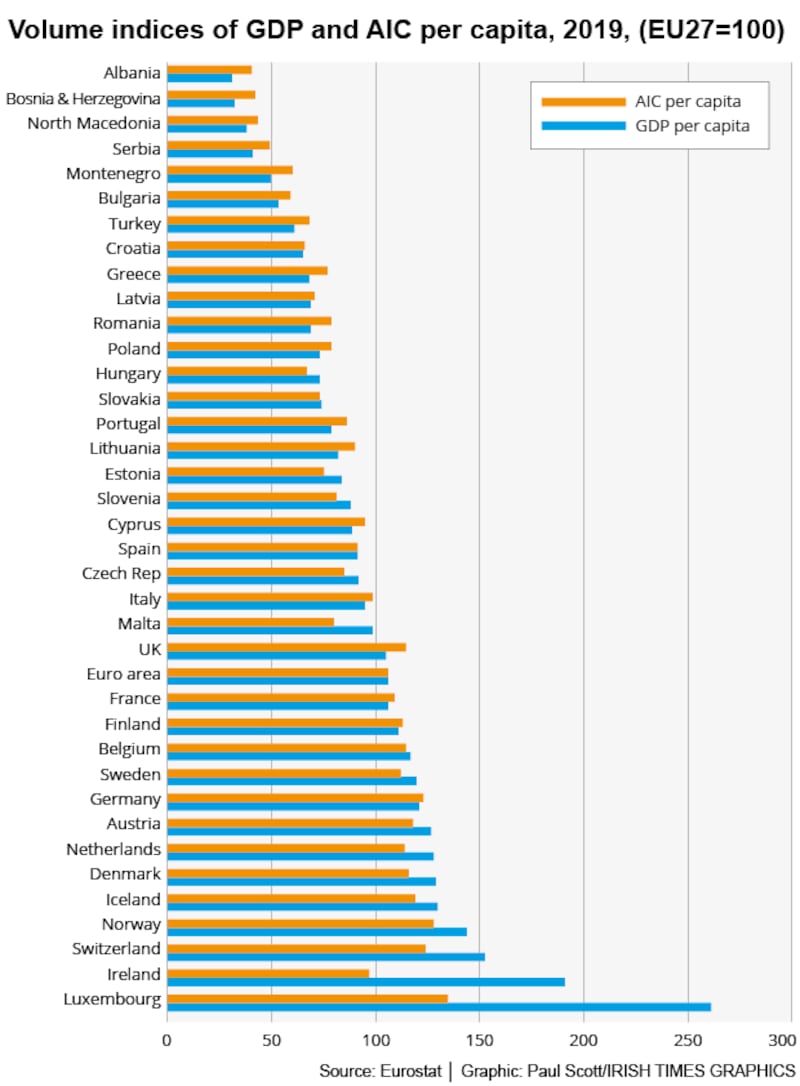

Looking at GDP per head, Ireland’s level is second in the EU only to Luxembourg, where figures are distorted by large numbers who arrive in to work every day and thus contribute to GDP, but are not Luxembourg residents.

Irish GDP per capita is around 190 per cent of the EU average. We are measured as more than a third above the next groups of EU countries, Denmark, Netherlands and Austria and also above non EU members Norway and Switzerland.

Part of the reasons why we rank so highly is the distortion to our GDP data. If we adjusted the figures to reflect GNI* per capita it would reduce our figure to about 120 per cent of the EU average. This would move us down to per capita income levels around the levels of Germany, Sweden and Belgium.

So does this make sense? There is one other factor we need to look at – what money buys in Ireland.

2. Consumption: what we spend and what it buys

This is a slightly different approach, looking at what household spend on goods and services as a measure of financial well-being, as opposed to dividing some measure of national income by the population.

If you look at consumer spending in Ireland, it represents less than one third of GDP. In other countries the average is generally around one half. This is further evidence of the inflated and distorted level of Irish GDP.

Data produced by the World Bank shows that consumer spending per capita in Ireland ranks around 18th in the world, about the same level as countries such as Austria and Germany but well below the US.

This data is known as actual individual consumption (AIC) and it tries to measure the amounts spend in each country on representative goods and services, a massive data exercise. It is, says Eurostat, which also calculates this data, an attempt to measure the "material welfare of households."

Eurostat and the World Bank also do one further adjustment. It is to factor out the impact of different price levels across countries – to look at the amount of goods and services which households actually buy. The same level of income buys less in a pricier country.

When this adjustment is made, the Irish figure (the volume of AIC per capita) actually falls to slightly below the EU average, at 97 per cent in 2019. This puts Ireland on a par with Italy and a bit ahead of Cyprus – and 12 per cent behind France. We are no longer among the rich club.

On the World Bank data we fall back, once the price adjustment is made, to 25th on the international list – in the middle of the pack of industrialised countries rather than at the top. Honohan, in a recent article in The Irish Times, referred to this as “a salutary corrective, with lessons for public policy.”

So this means that in addition to our inflated GDP data, there is a second factor which may mean the headline GDP per capita overstates the wellbeing of Irish households. It is that prices here are relatively high. This is a contentious area, as finding a representative basket of goods and services is very difficult. The spending patterns of a 25 year old renting a house are completely different to a 65 year-old with a paid off mortgage.

Yet on any measure, average prices here are high and the Eurostat data on which the calculations are based show that prices here are the third highest in the EU behind Luxembourg and Denmark, though below non-EU members Switzerland, Iceland and Norway.

As the graphic shows, for most countries the index of GDP and AIC are reasonably similar – and remember the index here compares them to the EU average. But for Ireland there is a massive variation. Statistically, we are truly out on our own.

3. Does this matter?

Economic policy needs to be based on evidence and it is difficult to get a true fix on the material well-being of people in Ireland compared to those elsewhere. The detailed data suggests that while we have made significant gains in recent years, pre -pandemic, we are not amongst the highest income countries, judged by what households actually get to spend.

These kind of measurements do affect Ireland at EU level – for example, the allocation of the recently agreed recovery funding is based in part on national wealth and our allocation was low because we are judged to be a rich country. Likewise it affects our annual contribution to the EU budget.

More fundamentally, looking at indicators like GDP per capita give a misleading impression of both our relatively level of economic well-being and how it is growing from year to year. The Irish economy has made significant gains in recent years and incomes have risen steadily – but we are not, in any real way, one of the best-off countries in Europe.