Europe’s medicines regulator sits down today to consider approval for a vaccine that has from a long way out been expected to be a game changer in finally getting to grips with a Covid-19 pandemic that has crippled the Irish economy over the last 12 months.

Costing a fraction of the two vaccines currently approved for use, and not requiring the kind of super-chilled storage that makes the existing options much trickier to use in a speedy mass rollout, it has been seen for months as the panacea to a virus that has so far killed close to half a million people in the European Union and infected at least 18 million.

But the prospects for the vaccine developed by Oxford University and AstraZeneca have become clouded. A trial twice halted over adverse patient reaction and results that were quickly called into question have slowed the progress for a vaccine candidate that was originally seen as the most likely to be the first over the line.

Now the discussions at the Amsterdam-based European Medicines Agency (EMA) take place against the background of a most undiplomatic spat between the European Commission and AstraZeneca over a dramatic cut in likely supply just as Europe anticipated a game changer in tackling the third wave of the pandemic.

To make matters even worse, questions have been raised at the 11th hour about the efficacy of the vaccine among older people – those most at risk from the virus.

The EMA's Irish chief, Emer Cooke, told a European Parliament public health committee meeting this week that studies done by Oxford and AstraZeneca "that have been included in the file [submitted for marketing approval] so far have a very small quantity of elderly populations".

She held out the prospect that the vaccine could yet be approved only for a more limited younger cohort, although she was careful to stress that she was not going to pre-judge a decision.

Other sources have reported that only between 3 and 4 per cent of those recruited for the pivotal Covid vaccine trials by AstraZeneca were over the age of 70.

There is clear concern at the EMA at the paucity of evidence on how older patients have fared with the vaccine. The British-based company is understood to have been delivering additional data to the regulator right up to today’s meeting – almost a month after it received temporary emergency approval for its vaccine in the UK and more than two weeks after formally submitting its application to the European regulator.

German public health authorities on Thursday announced formally that the vaccine should not be given to people over the age of 65, citing a lack of sufficient data to recommend use in older age groups in what is a significant blow for AstraZeneca.

“Our scientific committee is looking at the totality of the data to see what that data means in terms of the populations that were studied and what could reasonably be expected in populations that maybe have not been studied yet and this is a normal process in relation to any vaccines,” Ms Cooke said. “We have to look at the data that is there, look at the science behind it and what we can expect that data to mean.”

But the alarm over the potential fallout for national vaccination campaigns of a more limited approval has been overshadowed by the war of words over just how much vaccine will actually be available over the coming months. It’s a tense time. Tempers are short and the row has featured the sort of language rarely heard in public from EU commissioners.

The EU has accused the drugmaker of bad faith. Health commissioner Stella Kyriakides said the updated delivery schedule announced by AstraZeneca last Friday was "not acceptable to the EU".

“The EU has prefinanced the development of the vaccine and its production, and wants to see the return,” she said. Adding that engagement with the company had not been satisfactory to date, she said: “The EU wants the ordered and prefinanced doses to be delivered as soon as possible and we want our contract to be fully fulfilled.”

Speaking at the World Economic Forum this week, EU Commission president Ursula von der Leyen said: “The EU and others helped with money to build research capacities and production facilities,” she said. “Europe invested billions to help develop the world’s first Covid-19 vaccines, to create a truly global common good.

“And now, the companies must deliver. They must honour their obligations . . . Europe is determined to contribute. But it also means business.”

Delays

Delays are not uncommon with the production of new drugs and vaccines. Entire new production lines and processes can be required. And, in the case of the Covid-19 vaccines, the development timeline has been condensed to a level that would have been unthinkable even 12 months ago.

AstraZeneca is not alone in facing problems. Pfizer, first to market with the vaccine it developed with German group BioNTech, has twice had to warn of supply bottlenecks. In December, it announced that delays in the supply chain of raw materials and later-than-expected data from its clinical trial meant it would deliver only 50 million doses of the vaccine before year-end, down from 100 million projected earlier in the year.

Earlier this month, it also warned of a cut in supplies as it upgraded its plant in Belgium.

Johnson & Johnson, too, has warned of supply shortages for its one-jab vaccine, which is expected to produce data from its Phase 3 trial early next week ahead of an expected launch in the US at least in March following FDA approval.

Chief scientific officer Paul Stoffels said earlier this month that the company expects to deliver one billion does of its vaccine this year in line with its publicly-announced target. But he said it was premature to say how much would be available at the outset. The New York Times reported that Johnson & Johnson was experiencing manufacturing delays that would reduce the number of doses on hand initially.

The difference is that the warnings from Pfizer and Johnson & Johnson came ahead of market approval. AstraZeneca is already supplying vaccine – at least in the UK. And the irony is that it was EU-based production plants in Germany and the Netherlands that made that possible back in December and early January when the network of plants it had put in place in the UK were unable to deliver.

Which plants should supply which markets has become a central issue in the row over supply. And it hasn’t been helped by the jingoistic flag-waving from elements in post-Brexit Britain delighting in the discomfiture of their former EU partners.

In a careful but contentious interview with Italy's la Repubblica and Germany's Die Welt, AstraZeneca chief executive Pascal Soriot said the contract with the UK was signed three months ahead of the one with the EU "and the UK, of course, said 'you supply us first', and this is fair enough.

“Basically, that’s how it is. In the EU agreement it is mentioned that the manufacturing sites in the UK were an option for Europe, but only later.”

That is sharply at odds with the European Union position, which is that the UK plants were the first listed in the contract as sources for EU doses and that nothing in the contract says that EU supply is dependent on the performance of the Belgian and German plants.

“Production capacity” was “one of the selection criteria” in choosing which vaccines the EU helped to fund, in exchange for early delivery agreements, according to an EU spokesman. “Therefore plants are listed” in the contract: two in the UK, two in the EU, he said.

Brussels, which paid €336 million in advance funding for AstraZeneca to ensure supplies, is demanding that the UK plants contribute to EU supplies while AstraZeneca sorts out its problems with the Belgian site in the same way that Europe bailed out the initial UK rollout of the vaccine.

Part of Europe’s grievance is the late timing of the announcement. The contract with AstraZeneca originally provided for more than 100 million doses to be delivered by end-March, and perhaps as many as 120 million.

In early December, this figure was revised down to 80 million. Perhaps because of the relatively low infection figures and with an understanding of the inevitability to delays in such new processes, there was little fuss at that time.

However, the news last Friday that EU states could expect just 31 million doses by end-March landed like a hammer blow for a Commission already under fire over the perceived slow rollout of its vaccination programme. It came just a week before the company and the EU expected the vaccine to be approved by the EMA and supplies to start flowing immediately thereafter.

For Ireland, it means that supplies of 1.1 million doses over the next two months that were the minimum expected under the original contract will now fall to 343,000.

Mr Soriot says 17 million doses will arrive in February but there is less clarity of what is coming each week in March, which makes planning for the two-dose regime involved even more difficult.

Minister for Health Stephen Donnelly has now been forced to concede that the Government's target of getting 700,000 people vaccinated by the end of March will not happen. The prospects of getting all the adult population vaccinated by September across the EU also seems untenable.

As with all these things, no one side is absolutely to blame. AstraZeneca, like all vaccine producers, has been working flat out to gear up for the challenge of supplying vaccine to a global population of 7.5 billion. It is also supplying its vaccine at cost as part of its agreement with Oxford.

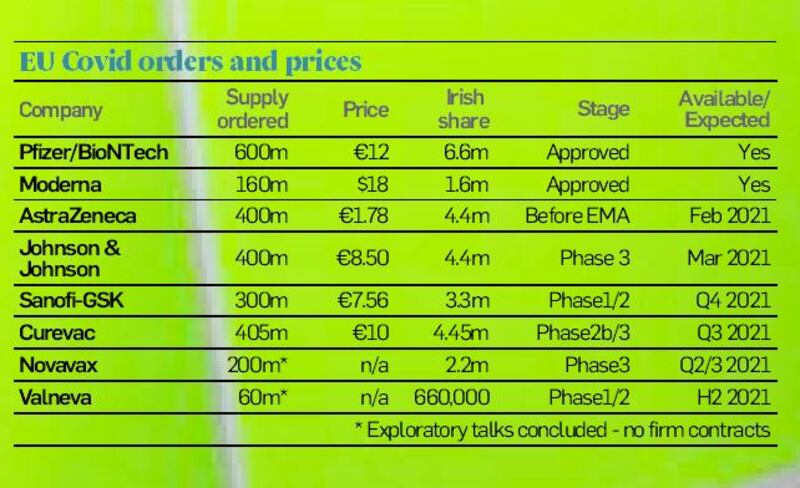

It is by a distance the cheapest of all the vaccines the EU and others have ordered. That had made it the obvious workhorse as countries race to protect the most vulnerable in society – with 400 million doses ordered for this year.

But AstraZeneca’s communications has been beset with issues from the outset. Then New York Times reported that the FDA was stunned that the company failed to inform it that it had halted a trial at a high level meeting two days after that decision had been taken.

It has since run into problems in Europe and the US over what precisely its trial results did and did not show – most particularly that the dosing regime found to be most effective had emerged only by accident, but also just how convincing was the evidence on efficacy in older people.

The blindsiding of the EU has only added to concerns. AstraZeneca is certain to be approved by the European Medicines Agency for use – probably later today – but much damage has been done

Johnson & Johnson

Increasingly, Europe and the US are putting their hopes on a rival vaccine from Johnson & Johnson, for which results are due to be published early next week.

Moncef Slaoui, the outgoing chief adviser for the US Operation Warp Speed vaccine development programme and a former head of GlaxoSmithKline's vaccine business, has said that it should show efficacy at or above 80 per cent. That's shy of Pfizer/BioNTech and Moderna but ahead of the "blended" figure from AstraZeneca.

And while it is more expensive than AstraZeneca’s jab – at €8.50 compared to €1.78 according to leaked figures on EU pricing – it only requires a single injection while being similarly convenient from a storage perspective. That makes it easier to manage from the perspective of national vaccination rollout teams.

Europe has signed up to buy 400 million doses of the Johnson & Johnson vaccine, produced by its Janssen subsidiary. When they might arrive is still unclear. The company has signalled a clear commitment to pitch first for FDA approval – something AstraZeneca has yet to do and has not clarified when it will submit an application to the EMA. It has said it expects to start delivering supplies in March.

Like AstraZeneca, Moderna and Pfizer, the Johnson & Johnson vaccine is being studied under a rolling review process in Europe. This means much of the scientific assessment can be done before a final application is made and hopefully speed up the process.

Speaking this week, Johnson & Johnson chief financial officer Joe Wolk acknowledged this was still some "fluidity" on timelines. But he added: "With respect to supply . . . we intend to meet all of the firm order commitments that we have, whether that be to the United States, to the European Union or to developing countries through the Gavi organization."

The European Commission will hope that Johnson & Johnson brings no nasty surprises as the likelihood is it will be the last major Covid vaccine approval for several months. In the meantime, AstraZeneca’s vaccine will be approved for at least some use. Those waiting will hope the focus moves then from the politics of declamation to the pursuit of a solution.