The acquisition of a major US financial services group by another such group, both of whom have significant Irish operations, will not lead to any lay-offs here, the chief executive of the acquiring company said yesterday.

In a stock transaction valued at approximately $4.5 billion (€3.48 billion), State Street Corporation, one of the largest financial services employers in Ireland, is to acquire Investors Financial Services Corporation.

State Street employs more than 1,500 staff in Dublin, Naas, Kilkenny, and Drogheda. Investors Financial employs some 400 Irish staff.

Worldwide, State Street employs 21,000 people and Investors Financial 4,400.

The merging of the organisations is expected to lead to 1,700 job losses.

Both groups are service providers of fund accounting to the mutual fund industry and to hedge and offshore funds. Both are headquartered in Boston.

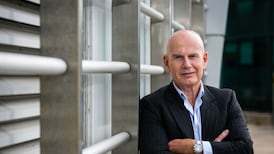

Asked about the effect on Irish operations, State Street chairman and chief executive Ron Logue said it "probably won't have a lot of effect".

He added: "The fastest growing segment of the business is in Ireland and we're going to need as many people as we can get there."

He said that accommodating the growth of the hedge fund business sited in Ireland was difficult in terms of finding staff. "I don't really see any real issue other than finding the staff to facilitate the growth."

Mr Logue said that while his company might look at where other aspects of the business might move to, he did not envisage any business moving from Ireland. "The critical mass and the intellectual capital are in Dublin."

The transaction will bring to $14 trillion the total assets under custody held by State Street, with $2.2 trillion coming from Investors Financial. State Street will become the number two company in the world, after Mellon Financial Corp and Bank of New York, which announced a tie-up late last year.

Jay Hooley, vice chairman at State Street, said the combined companies administered approximately $330 billion in hedge fund assets, roughly split between Dublin and north America.

In offshore funds, the combined operation will have more than $298 billion in assets under administration domiciled in Ireland, Luxembourg and Jersey.

Both areas of business were "growing like blockbusters", he said. Hedge fund business was growing at a rate of 20 per cent per annum, and offshore funds business was growing at close to 30 per cent.

Investors Financial's total revenue has risen at a compound annual growth rate of 18 per cent over the past three years, with fee revenue up at a rate of 24 per cent over the same period.

Yesterday Mr Logue cited these growth rates when asked if State Street had paid a high price for its acquisition.

State Street said it anticipated that savings from the purchase would arise primarily from technology, staffing and real estate consolidations.