In the 1970s, Switzerland’s watchmakers were almost put out of business when they underestimated the importance of the quartz watch. Though the industry recovered and is prospering, today it faces a new technological challenge from smartwatches, such as Samsung Electronics’s $299 Galaxy Gear. As with quartz four decades ago, the devices are being met with a shrug.

According to a survey by consultants Deloitte, two-thirds of executives in the Swiss industry say smartwatches pose no threat. “How would you like it if your boyfriend brings you a smartwatch instead of a nice diamond watch?” said Johann Rupert, the billionaire controlling shareholder of Cie. Financiere Richemont , which sells watches under 13 brands including Cartier and Vacheron Constantin.

“I’m not sure it’s going to have a huge impact on classic watches. The industry should brace for the arrival of smartwatches, said Andreas Hofer, a partner at Boston Consulting Group in Zurich. Researcher Strategy Analytics predicts global sales of 1 million smartwatches this year and 7 million in 2014. Sanford C. Bernstein forecasts that Apple could see iWatch revenue of $2.3 billion to $5.7 billion in the first year of selling such a device.

Swiss watchmakers “shouldn’t say too quickly it’s a trend that won’t affect them,” said consultant Hofer, who checks his iPhone to be on time. “There should be some modesty.”

The high-end Swiss watch is so low-tech that from a practical standpoint, it should no longer exist. When battery- powered quartz watches arrived on the scene in the 1970s, many consumers abandoned older mechanical ones -- both those that require winding and self-winders, which tap energy from the motion of the wearer’s wrist. The number of Swiss employed in the industry fell from about 90,000 in 1970 to just over 30,000 in 1984, and companies decreased from 1,600 in 1970 to 600 today, according to the Federation of the Swiss Watch Industry, a manufacturers’ group.

A big reason: Quartz watches were cheaper and more reliable. Even the most expensive mechanical watches lose several seconds a week and require maintenance every few years that can cost more than two new iPhones. Timezone, a watch- enthusiast website, calls them “an anachronism.”

Despite its continued reliance on centuries-old technology, the industry has fortified itself since the 1980s. Switzerland’s exports of timepieces rose 11 percent last year to a record 21.4 billion francs ($23.7 billion), based on wholesale prices, according to the Federation of the Swiss Watch Industry. Exports climbed 8.5 per cent in September from a year ago, data from the federation showed today. Mechanical watches made up a third of revenue in the $58 billion watch market last year, and the segment will expand 33 per cent by 2016, researcher Euromonitor International forecasts.

High-end Swiss watches can fetch stratospheric prices: Patek Philippe’s Sky Moon Tourbillon runs $1.3 million and Franck Muller’s Aeternitas Mega 4 is $2.9 million. “The more you learn about watches, the more you realize there is real know-how behind them,” said Gabriel Vachette, 30, who runs a website about watches and owns roughly 20. He got the bug from his father, who has 100. “You can tell a story with a beautiful watch,” Vachette said. “People who buy a Galaxy Gear will get rid of it in a year or two.”

Many Swiss watchmakers will likely continue to do well because a smartwatch may often be an addition to a collection rather than a replacement for a $5,000 Rolex, according to Jon Cox, an analyst at Kepler Cheuvreux in Zurich. “If you’re a successful young investment banker you can probably afford to own both a luxury watch and a smartwatch,” Cox said. “A Swiss watch really is a statement about yourself so other people can clearly see you’re wealthy. You don’t get the same ‘wow’ factor with a smartwatch.”

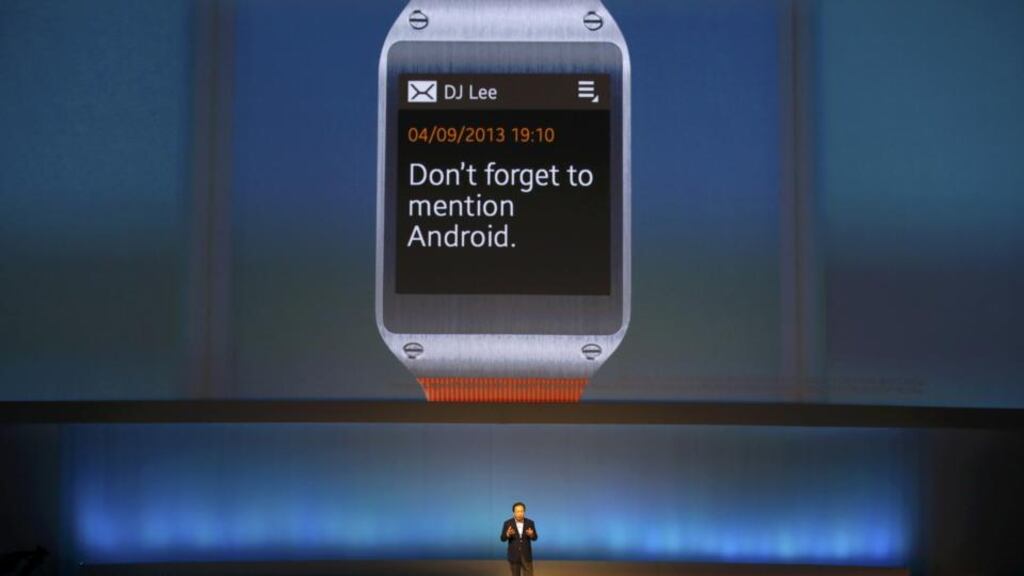

At greatest risk are low- and mid-range brands such as Swatch and Tissot, Cox said. With many timepieces in the $200- $400 price range, they’ll often be in direct competition with smartwatches in the minds of buyers. Samsung’s watch “shows nothing new,” said Swatch Chief Executive Officer Nick Hayek. Swatch has made interactive watches for 20 years, he said, “and has gained precious experience.” Tissot, a Swatch unit whose watches have had electronic touch screens since 1999 and incorporate altimeters and electronic compasses for hikers and divers, has said it will continue adding technology. Investors are backing the Swiss watchmakers. Swatch and Richemont shares have both outpaced Switzerland’s benchmark SMI Index this year, and 20 analysts recommend buying Swatch while none recommend selling the stock.

“So far the concept of the smartwatch is questionable,” said Michel Keusch, a portfolio manager at Bellevue Asset Management AG in Kuesnacht, Switzerland, which holds Richemont and Swatch shares among its 2.2 billion francs of assets. “You need to charge it every day. It’s a miniature screen. Everybody has a smartphone anyway.” Keusch said consumers may initially snap up

smartwatches amid media hype, but that the product may fade like calculator watches did in the 1980s. He says sales may start around 2 million units a year -- a fraction of the 1 billion timepieces sold annually. HTC is developing a smartwatch that uses Google’s Android software and can take pictures. The smartwatch will join a growing segment of wearable technology that already includes devices from Samsung and Sony.

History is littered with high-tech watches that are no longer on store shelves. Microsoft formed alliances in 2003 with Fossil and Citizen for watches that could receive information such as news, sports, weather, and stocks. Swatch and Tissot joined the software maker with similar products the following year. By 2008, they had all been pulled from the market. One Swiss watchmaker embracing new technology is Arny Kapshitzer. His startup, Hyetis, says its $1,200 Crossbow-- a self-winder with a camera and GPS that can pair with phones -- is the first Swiss smartwatch. Kapshitzer presented his idea to several Swiss brands, and the few that actually met him said smartwatches are just a fad that will quickly die out.

“I don’t believe it: I think it’s a real market and the future of the watch industry,” Kapshitzer said. Swiss watchmakers “are still in a comfortable situation. We’re in a situation of resistance to innovation. It’s a big mistake.”

Bloomberg