This week’s publication of bumper corporation-tax receipts reflects largely increased income from multinational companies. It comes hot on the heels of a regular financial-health warning that, were it not for the multinational sector, this tax wouldn’t be generated.

In June, a report from the Public Accounts Committee recommended the Department of Finance should identity ways to reduce our “overreliance” on corporation tax. The Irish Fiscal Advisory Council issued a similar dire warning last month.

The implication here is that the tax take is in some way fragile or about to evaporate at the stroke of a corporate pen somewhere far away. As a result, much of the commentary about the Irish corporation-tax take seems to suggest that we should not count on it.

The tax take from the multinationals is not temporary. It has been flowing for a long, long time and there is no reason to believe that it is about to come to an abrupt halt

Obviously, counting on transient revenues is the way to go bust if the flow of such cash is patently temporary, but the tax take from the multinationals is not temporary. It has been flowing for a long, long time and there is no reason to believe that it is about to come to an abrupt halt.

Before we focus on why the multinational revenue is steady and likely to remain so, let me introduce you to what I call the AYB School of Economics. AYB stands for “ah yeah but . . . ”.

This is the school that reacts to news of an increase in the corporatio- tax take with the takedown “ah yeah but, that’s only the multinationals”; or it dismisses an increase in employment with the “ah yeah but, that’s only the multinationals”, or it writes-off an increase in commercial office space demand in Dublin with the “ah yeah but, it’s only the multinationals”.

The AYB School of Economics suffers from commercial attachment issues, based on mercantile insecurity and a proto-nativist, almost Trumpian misunderstanding of globalisation. The deep-seated AYB fear of foreigners governs much of its thinking.

At the moment the AYBs are worried about immediate volatility in the tax take, but this is only the latest in a long list of concerns, reflecting an assumption that the presence of multinationals in Ireland is transient.

The supposition is that simply because these firms are not headquartered in Ireland, using Irish-based capital (whatever that means), or don't have a board made up of Irish citizens, in some way their presence in the economy is illegitimate and built on sand.

AYBs live in constant fear of being dumped. As a result, income tax, employment, demand and most obviously corporation tax created by and garnered from these companies shouldn’t be counted in the same way as corporation tax paid by an Irish sweet shop.

Why is there a sense that the multinational corporations are not here for the long haul when all the evidence is that they are not pulling out of Ireland but piling in? What informs the AYB School of Economics? Could it be an Irish thing based on childhood experiences two generations ago of poverty and economic neglect?

The British don’t have it. Nor do the Belgians.

In the past I worked in the City of London for two large multinational banks, one Swiss, the other French. My wife also worked for a Japanese bank. Around us, within the Square Mile, banks and finance companies from all over the world – German, American, Chinese, Australian, South African, Spanish, Dutch, Belgian – traded, employed, paid taxes, demanded office space and contributed enormously to the economy of London.

Their employees kept restaurants, bars and taxi companies in business. Their taxes also built council houses in Belfast, Glasgow and Brixton. No one ever dismissed the huge and impressive London economy with the words "ah yeah but, it's only the multinationals".

No one suggested the taxes paid in London were in some way unreal or illegitimate or that the English should construct economic indicators ex-London to give a better sense of the English economy. The international presence in London is taken as a given, as legitimate as the English sweet shop, retailer or farm.

We used to refer to the foreign companies in London as the Wimbledon model of economic development. This referred to the fact that Wimbledon is one of the premier global tennis tournaments, hosted in England, yet few English players ever feature. That doesn’t mean that the tournament is not real or about to leave because English players are not as good as foreign ones.

It’s not just the British who don’t suffer from AYB. The Belgians or Luxembourgers don’t make allowances for the fact that Brussels and Luxembourg are home to many multinationals and most of the EU institutions. They don’t calculate their economies net of these foreign bodies. They are there. They exist. Simple.

Maybe we should similarly look at the multinationals based in Ireland. They are here, they exist and they are not going anywhere soon.

When I get the Dart into Dublin and the carriage fills up at Grand Canal Dock, this is real. It is not a sleight of hand or a bit of tax trickery. These are real people, real employees, real managers, real "intrepreneurs", and their existence is not ephemeral or in some way to be discounted when compared to the allegedly more solid and genuine Irish Rail worker who drives the Dart.

Foreign-owned multinationals accounted for 80 per cent of corporation-tax receipts in 2017. This should be welcomed, not shamed or discredited

In an internationally open world, foreign direct investment is completely normal and these investment decisions are not taken lightly. Doubtless, multinational companies will be affected by the market. Creative destruction waits for no man, no company or no product – that is capitalism. The companies will be judged by how they compete in the market and as long as they do that, and we look after them, they will stay here. (If the world closes, the entire tax base shrinks, not just corportation tax).

Multinational companies live or die by the market, but if they compete effectively in it, and we look after them, they will stay here. There is no “ah yeah but”.

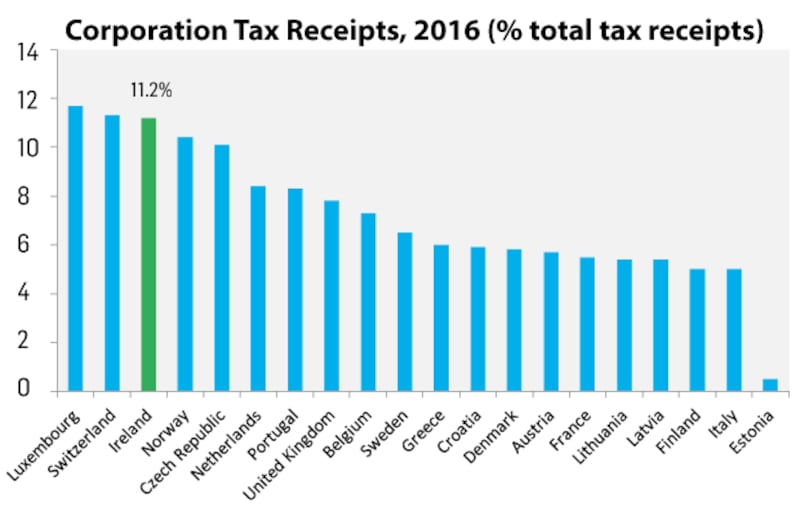

Ireland collected €8.2 billion in corporation tax in 2017 (2.7 per cent of GDP and 11.6 per cent of total tax receipts). This was an increase of 11.5 per cent on 2016. The 10 largest corporation-tax contributors accounted for 39 per cent of total receipts. And here is the big figure: foreign-owned multinationals accounted for 80 per cent of corporation-tax receipts in 2017.

This should be welcomed, not shamed or in some way discredited.

Revenue.ie calculates that a quarter of all employees – or about 530,000 – were in multinational companies or serviced multinational companies.

The multinationals are part of us and we are part of them. They are not about to up sticks. It’s time to get over our attachment issues.