Profits at the ESB have more than doubled to €847 million. So will this quickly lead to a cut in the electricity and gas bill for households? Unfortunately it is not that simple.

1. Where the profits are being made

The ESB is split into a number of separate arms, of which the main ones are energy generation, its networks arm and its customer business. The largest element of the customer unit is Electric Ireland. The vast bulk of the profits – close to €775 million – were made in the generation arm. This was due to the high prices it could attain for selling the electricity it generated to its own retail arm and to other suppliers in the market, Because of the way prices are set in the market – which are heavily influenced by wholesale gas prices – 2022 was a profitable year for those generating electricity, especially using lower-priced inputs such as renewables.

Electricity is a highly regulated market – as it typical of utility markets which were previously supplied by State companies and subsequently opened to competition. This means that the ESB cannot cross-subsidise from one arm of its business to another – in other words it cannot get its generation arm to sell power cheaply to its customer arm. Or – to put the same point a different way – use the profits earned in generation arm to allow it to sell electricity below cost to consumers.

Its pricing and business policies would be closely monitored by the Commission for Regulation of Utilities (CRU). With other significant players in the consumer electricity and gas market, the regulator needs to ensure competition was fair and the ESB did not use its power to squeeze out competitors. Whether these rules could, or should, have been eased or amended in some way during the height of wholesale energy prices last year is open to debate. The UK, for example, imposed a cap which led to the ESB’s UK arm losing money – this pushed its entire customer business into loss last year.The Electric Ireland business is profitable, though the company says that after returning €50 each to 1.1 million customers late last year the retail part of this operation did not make any profit last year. It also has 80,000 business customers.

READ MORE

It has said it plans to return €327 million to the exchequer as a dividend and much of the rest will go towards investment and debt management. New legislation being brought forward by the Government will act as a cap on its generating profits for this year by effectively imposing a kind of supertax on money earned above a certain level. The impact of this will depend on wholesale prices. But either way a significant part of the cash returns to the exchequer.

After length negotiations, the European Commission is also proposing a suite of policies which would have a somewhat similar impact, clawing back excess profits for exchequers and also obliging suppliers to offer longer-term fixed rate contracts as an option to customers. However the Commission has stopped short of calling for a change in the way short-term wholesale prices are set. These are over-reliant on the – potentially volatile – price of gas, (though studies by the ESRI in Ireland have shown that the increasing use of renewables is having some impact in lowering prices.) However reforming this pricing mechanism is proving complicated and for now the Commission will focus on measures to limit profitability, boost national exchequers and allow them to protect households.

2. But wholesale prices are coming down now?

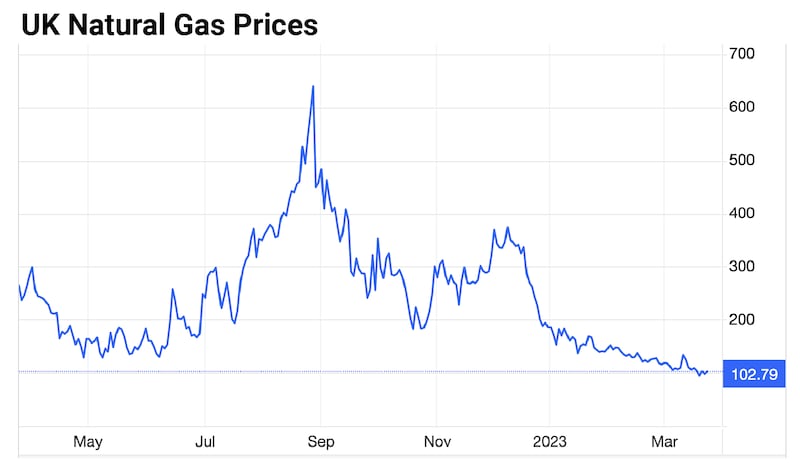

Yes, there has been a big fall in wholesale prices from the peaks of last summer. In the UK market, where Ireland purchases about 70 per cent of its gas, prices rose form 35p a therm in late 2020 to average 350p to 400p for much of last year – peaking at around 750p. They have now fallen back to around 100p, So they are well off last year’s levels, but still 2.5 to 3 times the historical average.

There are two reasons why lower wholesale prices have not fed through to retail customers. One is that the original increase in prices was not fully passed on to households. The second is that electricity customers engage in hedging – entering into contracts to buy energy in future to ensure they have supply. As power would typically be bought a year to 18 months forward, a significant element of current pricing to customers is still based on last year’s prices. These hedges allowed energy suppliers to be slow to pass on the initial rises in wholesale prices – but they also mean prices will be slow on the way down.

To make things even less transparent for consumers, electricity companies cannot “signal” price cuts as this is seen as illegal, anticompetitive behaviour, potentially allowing all companies to move prices at the same time. So ESB chief financial officer, Paul Stapleton, when presenting the company’s results, could only fall back on generalities that any fall in prices to consumers who require a sustained drop in wholesale prices. The “sustained” point is important, however, as the outlook for wholesale prices remain unclear, if less worrying than it looked last summer.

3. Would current wholesale prices, if sustained, lead to a fall in retail prices?

Retail gas prices have, on average, risen by 150 to 200 per cent and electricity prices have gone up around 150 per cent since prices started to go up. There are other factors apart from wholes prices which affected the retail gas price – network and distribution charges, for example. And for electricity, around 40 to 50 per cent comes from gas-fired stations. A back of the envelope calculation would suggest some scope to cut prices if current wholesale prices held. These cut come could through in the months ahead as existing more expensive hedges, particularly those taken out in mid-2020, start to run out. But while there might – on the basis of current wholesale levels – be cuts of 10 to 20 per cent, prices would remain way above the levels we had all come to see as normal for many years.

[ Cantillon: Energy crisis sends State laughing all the way to the bankOpens in new window ]

4. What are the policy issues?

If wholesale prices remain above historical norms, Ireland and other energy importers will have suffered a long-term net loss and the only question then is how this is divided across society. A key issue for Government would be supporting lower income and exposed households through long-term measures. On the other hand, if wholesale prices do continue to fall back over summer, then bigger price falls could be in prospect and there will be less pressure on the Government to intervene again.

The energy crisis – and the need to secure supply – also of course puts the focus on the longer-term imperative of boosting renewable energy supply, particularly via wind generation. While trying to reform the current price-setting mechanism is proving complex, the balance should shift as renewables take up a larger and larger share of energy supply. A key issue for the Government in short-term interventions in the energy market – as well as longer-term issues around planning and incentives – is to do everything possible to encourage renewable investment.