Tony Walker has been general manager of the Slieve Russell hotel and golf resort in Ballyconnell, Co Cavan, for two decades. Never before has he experienced the sort of price inflation that has gripped the hotel, and the entire Irish economy, in recent months.

“It is scary,” he said. The same sense of fear is now permeating throughout the entire hospitality industry, as well as other sectors such as grocery retailing. For some businesses in more power-intensive sectors, such as manufacturers and engineering, fear has already started to give way to panic.

During the pandemic, the Government borrowed €30 billion, much of which funded cash transfers to businesses to keep them from collapsing. PwC this year estimated subsidies saved 4,500 companies from going bust. That once-in-a-generation crisis is not yet in the rear-view mirror. Yet another existential challenge for business has already arrived – the inflation and energy crisis.

The State is being called upon once again to stump up taxpayers’ cash to stave off disaster.

Inside Trump’s reversal on tariffs: ‘You almost can’t take a pencil to paper. It’s really more of an instinct’

Look inside: Detached home on elevated perch overlooking Killiney Bay in Dalkey for €3.5m

Miriam Lord: When is a Soc Dem TD not a Soc Dem TD?

Emer McLysaght: The Irish live for a sunny day, but with it comes the pressure of having the ‘perfect’ day

The growing pressure on businesses is real. In July, Walker’s accommodation manager got a quote from a supplier for 40 new mattresses. Last week, he asked her to place the order. When she called the supplier, the cost had gone up by 33 per cent since the original quote weeks before.

‘We’ve had a really good summer. But the winter is when you really start to consume energy. The thought of what could happen this winter is terrifying’

From August 2020 until July of last year, the Slieve Russell paid an average of 11 cent per kilowatt hour (kWh) for its electricity. Then the price more than doubled to 24 cents per kWh. That contract ran out in recent weeks. The hotel is now on a floating variable rate while it tries to negotiate a new electricity contract: its current cost is 63 cent per kWh for a day rate, and a night rate of 51 cents – roughly five times higher than its average rate two years ago.

“The thing that gets me is, in June, I moved my account at home to the same electricity supplier,” said Walker. “I pay 27.5 cents for a day rate, less than half what they want to charge the hotel now. I asked them: why is that? They couldn’t explain it. Is there profiteering going on here at the expense of businesses?”

Read more on the Cost of Living

- Share your story: is your business facing significant energy price hikes?

- Q&A: Energy bills are becoming more and more expensive, but what is causing the price rises?

- Opinion: Covid response should be the model for tackling the cost of living crisis

- Energy crisis hits fuel suppliers: ‘We were buying coal for €16.50 a bag and the price today is €45.50′

- Budget 2023: What you can expect — from housing to taxes

With a swimming pool to heat, a leisure centre and extensive conference and dining facilities along with its 220 bedrooms, energy is one of Slieve Russell’s biggest costs. But at least it isn’t a manufacturing business with fuel as a core operating expenditure. The hotel’s crockery manufacturer recently contacted it to say that if it requires any new stock for Christmas, it must place the order within the next two weeks. Why so early?

“They’re not running their furnaces at full blast to save money on energy costs. They say they have to reduce their manufacturing capacity,” said Walker.

‘Out of control’

Down the other end of the country, in Killarney, Tom Randles and his family own two four-star hotels – the Dromhall and Randles. Costs have “spiralled out of control”, he said.

“We’ve had a really good summer. But the winter is when you really start to consume energy. The thought of what could happen this winter is terrifying.”

He expects the hotels’ energy costs to be at least 50 per cent higher this winter than they were last year. The Randles group is scrambling to try to minimise the cost rises. For example, both hotels are due to be fitted with PV solar panels in the coming weeks.

“Energy is one of our top four costs. But what worries me more is all the talk of possible power cuts. We can’t deal with that – not every hotel has a backup generator. So what do we do? What happens to the food in the fridges and freezers if the power goes off? How do we get the keycards to work?”

The Government, Randles says, must give businesses “some sort of indication” regarding State assistance for SMEs with their energy bills this winter. The answer is likely to be come soon, on September 27th, when the Government presents its budget for 2023.

In the meantime, businesses must roll with the punches. Michael Martin runs the well-known Pacino’s restaurant on Suffolk Street and its Blind Pig Speakeasy, also in Dublin city centre. The restaurant finished a two-year gas contract in May, when its bill was €400. Its bill for June jumped to €2,700. Most of that is just gas for cooking. The bill will be far higher when the cold of winter arrives.

“At the moment we can cope because Dublin has a lot of tourists, and locals are spending, too. But once locals start to feel the squeeze on energy costs themselves, what happens to their disposable income? It isn’t sustainable. The spending tap could be turned off very quickly,” said Martin. “We’re doing well at the moment. With the tourists, business is good – I admit that. But how long is this going to last?”

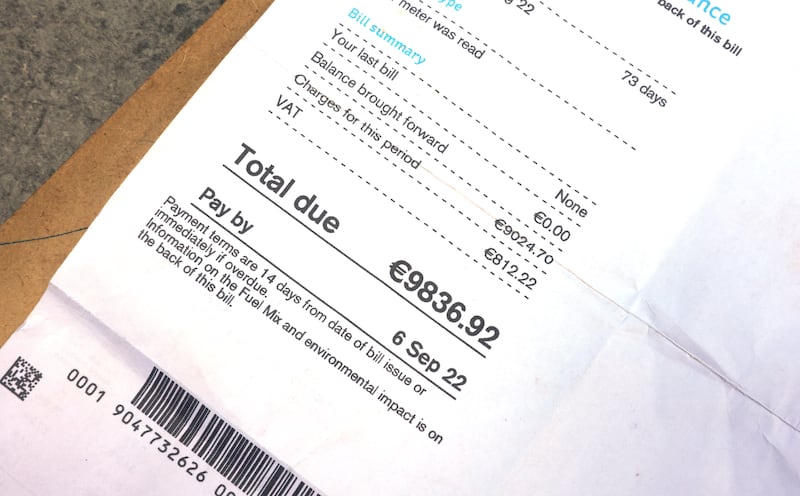

There was widespread amazement this week in business and media circles at the story of the Poppy Fields cafe in Athlone, Co Westmeath. Its owner, Geraldine Dolan, tweeted an image of its latest electricity bill: almost €10,000 for 73 days. For a small cafe. It worked out at about €123 in electricity costs per day. Dolan ended up appearing in most major media outlets in the State on Tuesday. Her story seemed to encapsulate the craziness of the price rises sweeping the retail energy sector.

Chilled shelving

Similar pressure is being felt in most other corners of the economy. Ian Allen, the managing director of SuperValu and Centra, says the annual electricity bill of an average-sized Centra store will jump this year from about €50,000 to €200,000 – grocery stores are relatively heavy users of energy, due in part to the preponderance of open chilled shelving units in many shops. Tesco Ireland has started to install doors on its fridge units to cut energy usage and keep bills down.

Ibec, the employers’ lobby, launched its budget wishlist on Monday, which called for a €2 billion package of spending measures. It also wants the Government to put up an unspecified sum to assist businesses directly with their energy bills. Gas and electricity prices, Ibec says, have become a “significant threat to the viability of many firms”.

While small businesses are most at risk of going under from soaring energy bills, Ibec says some larger businesses are also feeling the strain. The organisation this week cited an unnamed large manufacturing business whose annual energy costs have jumped from €20 million to €100 million.

“Governments has previously identified the need to support households. Now it needs to step in and support enterprises that are becoming extremely vulnerable,” Fergal O’Brien, Ibec’s director of lobbying, said on Monday. He suggested many low-margin manufacturing businesses would scale back production by dropping shifts due to energy costs.

Speaking to The Irish Times, Ibec’s chief executive Danny McCoy warned the Government against “letting energy prices rip”. Ireland has one of the highest national debts in the world, at almost €50,000 for every man, woman and child in the State. McCoy said he did not see this as a barrier to an expansionary approach in the budget that included State payments to businesses to help with fuel bills.

‘We need to make sure that any taxpayers money is used to support businesses that are viable but vulnerable and can adapt to the new conditions with time’

He said the nation’s debt situation this time around was different from when it entered the last financial crisis, in 2008: “As well as the State, you also have to look at households and businesses. This time round, households have a lot of savings, while companies have strong balance sheets.”

The State might be in hock to the tune of almost €250 billion, but recent Central Bank of Ireland figures show Irish households have €140 billion on deposit, against just €80 billion in debts. That is a near perfect reversal of the situation 14 years ago.

McCoy suggested the Government should consider making “lump-sum transfers” to businesses and households: “Handout is the pejorative term. But essentially, you use blocks of money to help them.”

‘There needs to be pain’

He said any help for businesses must be targeted at those in need, and it should not cover all the extra expenditure they are facing on energy due to the crisis, but only part of it: “Some high-margin businesses don’t need help. But low-margin businesses are suffering. The incentive is not to make them fully whole. There needs to be pain to be had by all.”

In response to queries this week from The Irish Times, Tánaiste and Minister for Enterprise, Leo Varadkar, reiterated his position that he “does not get people’s hopes up too high” about taxpayer subsidies that might be coming the way of companies. But McCoy is still “pretty confident” that the message of employers will be heeded come budget day.

“Running a €4.5 billion surplus looks to be pretty tone deaf when you look at it against what is happening on the streets,” he said. “Fiscal policy is supposed to be counter-cyclical. You should be running deficits when your people are stressed. It is not a good look otherwise.”

Most economists agree that, despite the towering national debt, the Republic still has the capacity to borrow further to step in once more to try to directly subsidise businesses in a time of crisis. However, Conall Mac Coille, the chief economist of stockbrokers Davy, said one problem the Government faced if it intervened on energy costs was that it could have no idea of the scale of the problem it is facing – nobody knows how high gas, and hence electricity, prices will go.

“We could certainly borrow more,” he said. “But with the scale of what is going to happen, the Government cannot shield everyone from that. I haven’t seen Ibec cost all of these interventions it proposes. I heard Fergal O’Brien talking about that one company whose energy bills have risen by €80 million. For how much of that are taxpayers supposed to pay?”

While Ireland has the capacity to borrow further, Mac Coille said the Government needed to calculate the extent to which it should add further to national debt carefully.

“Borrowing costs are still favourable, and while debt is high, we don’t have to refinance much of it any time soon. But the national finances are still in an uncomfortable place regarding the heavy reliance on corporation taxes. We can borrow. But the question is whether it is something we should be doing.”

Where there was broad-based intervention to prop up businesses, he said, it would be important to avoid the “trap” of having to provide ongoing or long-term support to troubled businesses, especially so soon after the State intervened widely during the pandemic. Mac Coille cited the example of the UK, where banks, under pressure from the government there, were said after the last financial crisis to have created a swathe of “zombie companies” that should have gone to the wall but were propped up by cheap loans.

‘Creative destruction’

“There is such a thing as ‘creative destruction’. It will always be the weakest and least efficient businesses that get into trouble first, and maybe it is better to just let some of those go into liquidation,” said Mac Coille.

Echoing comments that he made earlier in the summer, Varadkar said the Government had “not been found wanting” during the pandemic in its support for businesses to get through the crisis, and it was looking at how to help them once again now with energy costs. “But I don’t want to raise expectations too high,” he added.

“We have submitted proposals for an inflation crisis-related loan scheme for businesses, which will be similar to those in place for Brexit and Covid currently, with low interest rates being an important characteristic. We’ve also just got European Union state aid approval for a direct grants too and we’re working on the details of that. That part would only be for businesses that are in the manufacturing and exporting sectors, under the terms of state aid. Both should be up and running in the fourth quarter of this year.”

Varadkar said he envisaged a long-term upwards shift in energy prices, on top of rises in interest rates and labour costs: “We need to make sure that any taxpayers money is used to support businesses that are viable but vulnerable and can adapt to the new conditions with time and help and become profitable again.”

McCoy, meanwhile, warned that domestically focused businesses should not be left behind. Senior figures within the retail sector, such as Centra and SuperValu’s Allen, have also called for retailers to be allowed in to whatever subsidy schemes are opened to manufacturers and exporters.

Meanwhile, for the hospitality sector, the calls for help always come back to its desperation for the Government to retain the sector’s special 9 per cent VAT rate, which is due to be scrapped at the end of February.

This week, the industry’s lobbyists at the Irish Tourism Industry Confederation devised a plea with nine reasons why the 9 per cent should be retained. Near the top of the list were “inflation” and “cost of business”. It argues that the middle of an energy crisis is no time to raise VAT on the sector by 50 per cent, which is what would happen if the rate is restored, as planned, to 13.5 per cent.

“It would be absolutely insane to do that now,” argued Killarney hotelier Randles. “It would force us to put up prices even more during an inflation crisis.”