The Central Bank of Ireland is poised to set up a public inquiry in the coming weeks into RSA Insurance Ireland’s former chief executive Philip Smith for suspected regulatory breaches relating to accounting issues at the general insurer a decade ago, The Irish Times has learned.

The regulator said in its latest annual report, published last week, that an inquiry commenced last year “concerning a person formerly concerned in the management of a regulated firm”. It did not name the individual involved.

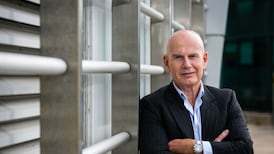

The Irish Times has established that the individual is Mr Smith, who quit RSA Insurance Ireland in late November 2013, claiming at the time he was made a “fall guy” and that his fate had been “predecided” amid an investigation at the time into the insurer’s accounting practices.

[ Former RSA Ireland CFO fined €70,000 and disqualified ]

[ Row between insurers over liability for worker’s injuries goes to Supreme CourtOpens in new window ]

Details of a public inquiry into the former insurance executive are expected to be published within weeks. Mr Smith is currently general manager of Cricket Leinster, a provincial governing body for cricket in Ireland.

READ MORE

A phone call, email and text message to Mr Smith were not returned. Representatives for the Central Bank and RSA Insurance Ireland declined to comment.

UK-based RSA Insurance Group suspended Mr Smith and two other senior individuals in early November 2013 as it investigated how the Irish unit timed the setting aside of reserves to cover insurance claims and whether it had booked premiums from customers earlier than it should have.

Mr Smith settled a legal dispute with RSA in January 2016, after the insurer appealed an earlier Employment Appeals Tribunal ruling that he be awarded €1.25 million relating to how his exit from the company was handled.

The Central Bank subsequently fined RSA Insurance Ireland €3.5 million in late 2018 for regulatory breaches relating to the accounting issues that emerged at the general insurer five years earlier.

[ Motor insurance premiums fall 5%, Central Bank figures suggestOpens in new window ]

The Dublin-based insurer’s UK parent injected €423 million of cash between 2013 and 2015 into its Irish subsidiary, which was once the largest general insurer in the country. The funds were used to fill a hole in the Irish unit’s balance sheet and shore up its finances.

The regulator said that individuals in RSA Insurance Ireland were able to “deliberately manipulate claim reserve estimates” by setting aside less money than needed for large insurance loss claims between October 2009 and 2013. This served to artificially inflate the company’s profits.

The regulatory breaches were a result of “serious shortcomings” in the Irish unit’s internal controls and corporate governance framework, the Central Bank said.

The exact alleged suspected contraventions that Mr Smith is being investigated for are not known. However, under the Central Bank’s long-standing sanctions regime – before new laws were passed late last year – it had to find that RSA Insurance Ireland breached regulations in the first instance before investigating individuals.

The regulator fined former RSA Insurance Ireland chief financial officer Rory O’Connor €70,000 in late 2020 and disqualified him from working in a regulated financial firm for more than eight years over his role in the matter.

The maximum fine that the Central Bank can impose on an individual for a breach of financial regulations was doubled in August 2013 to €1 million. The period covered by the investigation into RSA Insurance Ireland spanned between 2009 and October 2013.

RSA Group was taken over two years ago by Canada’s Intact Financial Corporation and Danish insurer Tryg and split the operations. Intact took on the group’s UK, Irish and Canadian businesses and certain other international units.