Asking prices for homes have fallen “marginally” in the past year despite a pick-up in recent months, according to the latest Daft.ie housing market report, as rising interest rates continue to dampen demand.

However, the construction sector here is expected to expand this year, overcoming worsening project financing conditions as the Republic proves “more resilient” than many of its counterparts, a separate report by consultancy Turner & Townsend has indicated. The report says Dublin is the second most expensive city in Europe in which to build.

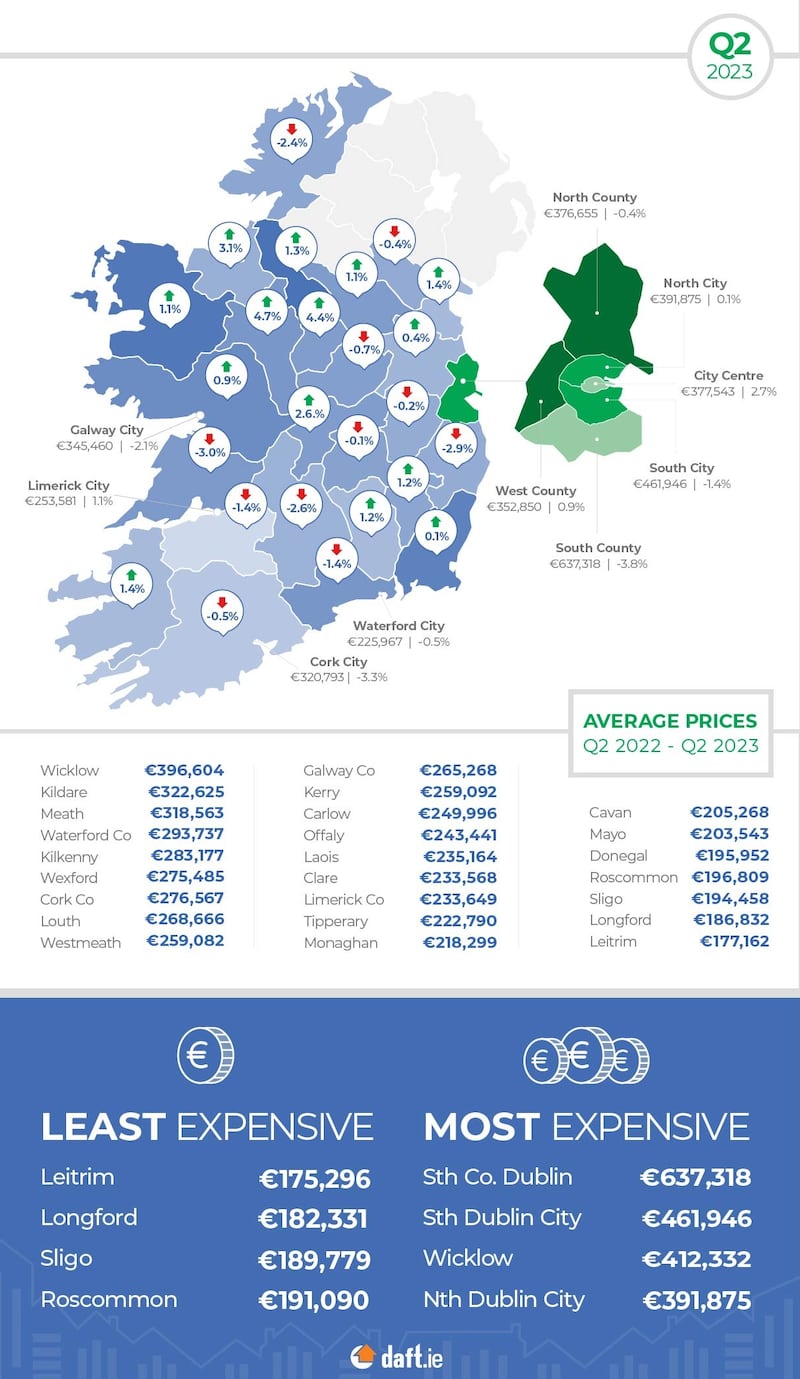

The average listed price for a home in the second quarter of the year was €309,648 nationally, down 0.5 per cent from the same period last year, property website Daft.ie said on Monday. Although this represents a 2.4 per cent pick-up in asking prices from the end of March, that is lower than the price growth over the same period last year.

It is the first time annual asking price inflation has turned negative in three years.

READ MORE

Few parts of the State bucked the trend. Prices in Dublin were, on average, 0.6 per cent lower than a year previously, while in Waterford city they were 0.5 per cent lower. “Cork and Galway cities saw larger falls in year-on-year terms, of 3.3 per cent and 2.1 per cent respectively,” the property website said.

Limerick city was an outlier with prices increasing 1.1 per cent in the year to just 2.4 per cent below their boom-era peak.

The number of homes available to buy stood at 13,000 in the second quarter, 5 per cent ahead of last year but “but well below the 2019 average of 24,200″, Daft.ie said.

Overall, report author Ronan Lyons said that quarter-on-quarter increase in listed prices nationally was likely due to “seasonality” within the market.

“This is not a trivial increase, almost matching the average quarterly increase in the Covid surge between mid-2020 and mid-2022. And it is the first time since mid-2022 that prices have increased quarter-on-quarter,” said Dr Lyons, who is assistant professor of economics at Trinity College Dublin.

However, quarterly falls in prices in the final three months of last year and the first three months of 2023 clearly “add up”, contributing to a decline in annual prices, he said, amid shifting market conditions.

Dr Lyons said there is a growing gap between underlying demand within the economy and effective demand – demand backed by the ability to pay – due to soaring borrowing costs for homeowners.

While underlying demand remains robust due to the “incredibly strong” performance of the labour market, rising interest rates are dragging on effective demand and, in turn, asking prices.

“Whether the latest quarterly figure represents a temporary bounce, after three weak quarters, or a resumption of strong upward pressure, remains to be seen,” he said.

A separate report published on Monday by consultancy Turner & Townsend indicates that Dublin has slipped in a global ranking of the most expensive cities in which to build. However, with average construction costs of €3,409 per square metre, the capital is now the second most expensive city in the EU after Munich.

Despite the challenges the industry is facing into globally amid tightening financing conditions, the Irish construction sector is expected to grow this year, “partly helped by relatively low labour costs” in the Republic, according to the report.

Construction wages in Dublin average €43.80 per hour, compared with €48.30 in London, €74.80 in Munich and €11.06 in Geneva.

“Against a backdrop of rising costs of construction, higher interest rates and market uncertainty, Ireland is proving more resilient than many of its counterparts,” said Philip Matthews, Ireland managing director at Turner & Townsend. However, he warned that construction companies cannot afford to be complacent and must pay close attention to their supply chains to keep down costs.