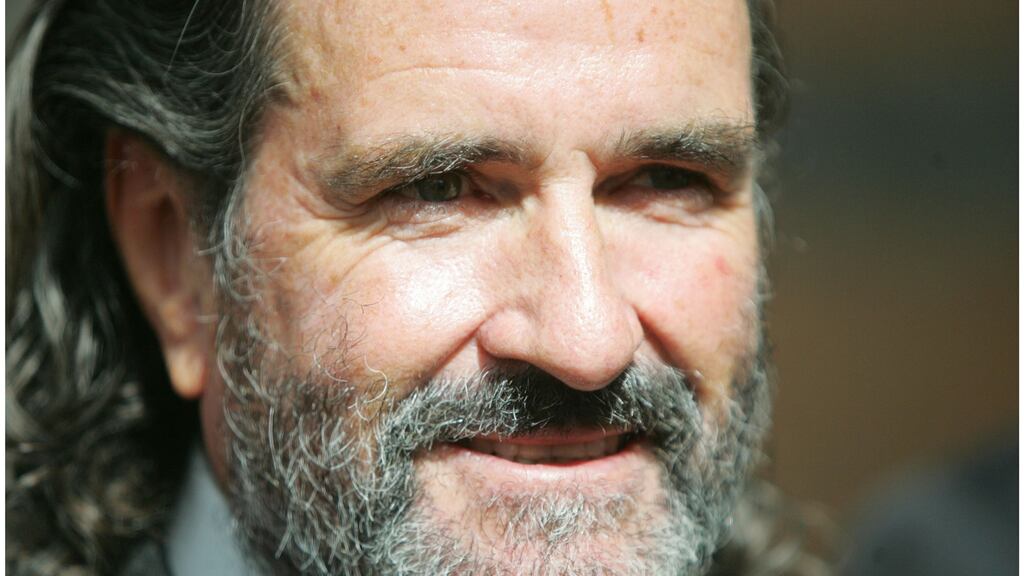

Johnny Ronan once described getting out of the National Asset Management Agency (Nama) as being like getting out of a bear trap.

He delivered it a little more colourfully than that, in classic Ronan fashion, but the achievement was no less impressive, he clearly felt, having managed to refinance all his loans with the State’s bad bank at full value with no discounts.

Yet in the nine years since, things have not always run as smoothly. The mere headlines tell the tale. He has had virtually endless litigation in the High Court with a varying cast of fellow developers, planning authorities and financial backers. He has had an ongoing war of words with Dublin City Council over building heights – a war he has largely lost, in truth. And he has had a long-running and very expensive battle with the operator of Bewley’s cafe over some stained-glass windows, the value of which must be nearly exceeded by the cost of litigation by now.

But in recent months things have grown even more serious as the commercial real-estate sector has been walloped by a confluence of events. Interest rates have risen, making the cost of debt substantially higher, and the sector has been punched in the gut by the rise in working from home in the aftermath of the pandemic, hitting property values.

As a result, Ronan’s portfolio has been severely affected and his financial backers have closed in on him lately, trying to seize valuable chunks of that portfolio.

Now, he’s locked in yet more litigation, while he conducts parallel negotiations with new financial backers to once again get himself out of a bear trap.

A pair of receiverships

At the core of the problem are two separate receivership processes, one of which Ronan has described as consensual, the other of which is definitely less so.

The first of those processes, the consensual one, began in November, when Bank of Ireland and AIB appointed receivers over a portfolio of assets including commercial properties on Grafton Street, such as Bewley’s and a PTSB branch, and offices including Connaught House, Percy Exchange and Kilmore House in Spencer Dock, among others.

It came after a period of a few months during which Ronan Group been reportedly trying to sell about €300 million worth of assets, but a sale apparently couldn’t be completed and ultimately the company consented to have Bank of Ireland and AIB begin a receivership to sell the assets themselves.

At the time, the company insisted that it “[recognised] the need to restructure the financing of these assets” and that it was “delighted we have been able to work with our current lenders to begin a steady, managed process to introduce a new investor to our business and put a new lending arrangement in place that satisfies all parties”.

The company insisted, through a spokesman, that “the assets entering this receivership process are performing robustly and we are confident that RGRE Holdings Ltd will emerge stronger and better geared for the future”.

Ronan Group’s chief executive Rory Williams was even more bullish at the time, saying it was “unthinkable” that assets would be sold on to new owners, and the company was still negotiating with new financial backers to buy back the assets.

A few days after the consensual process with the banks was announced, another receivership emerged. Fortress Investments, another of Ronan’s lenders, swooped in to appoint receivers over a separate portfolio of five assets, including a site on Appian Way and a house on Fitzwilliam Square, as well as sites in Enniskerry, Delgany and near Carrickmines.

In the last day or so, the first property has gone up for sale, 65 Fitzwilliam Square, a Georgian office building just off Fitzwilliam Square, which has been offered at a price of €2.85 million

That brought the number of assets in receivership to 17, with a total debt value of about €220 million, according to the Business Post at the time.

At the time, Ronan Group was quick to assure onlookers that the situation was under control. Firstly, the structure of Ronan’s empire meant those properties sat in discrete corporate vehicles with no “no cross-guarantees or cross-collateralisation” – meaning no possibility of affecting any other part of the group.

And, secondly, a spokesman seemed to suggest it was all part of a wider plan, saying the second receivership “aligns with the restructuring programme planned by the Ronan Group”.

Things have not gone as smoothly with Fortress as with the consensual receivership, however, and the two sides have been in the midst of an escalating dispute in recent weeks.

Just this week, for example, Ronan’s lawyers accused Fortress of having been involved in a conspiracy to “stifle” the legal proceedings by putting new directors in charge of Ronan Group companies, who then dropped a law suit just as the parties were about to exchange discovery documents.

This, according to the affidavit filed this week, constituted a “conspiracy” with intention to “stifle proceedings which alleged serious wrongdoing” on the part of Fortress-related entities.

Fortress’s lawyers, in a court hearing this week, disputed that characterisation and told the court that they would be objecting to Ronan’s effort to amend his claim.

That case will play out over the coming weeks, but it is unlikely to smooth relations between the two parties, especially as the receivers have already begun the sale of some of the assets.

In the last day or so, the first property has gone up for sale, 65 Fitzwilliam Square, a Georgian office building just off Fitzwilliam Square, which has been offered at a price of €2.85 million.

Market woes

Of course, Johnny Ronan has been here before. He has struck plenty of new finance arrangements since exiting Nama, and he has had a few close shaves with receiverships.

But there’s something different in the background here, of which the main element is the collapse in values in the commercial real-estate market, which constitutes the majority of Ronan’s interest.

That sector has taken a huge hit lately, thanks to a perfect storm of rising interest rates, falling investment interest and the collapse of occupancy rates thanks to the strong appetite among office workers for work-from-home arrangements.

The predictions have not been heartening. Last year, the Central Bank’s financial stability review concluded that the value of Irish commercial property stock had fallen from €50 billion in 2020 by more than 20 per cent.

Earlier this week Bank of Ireland announced it believed there would be a further 15 per cent decline in the value of commercial property assets over the next two years.

The Central Bank weighed in again yesterday, warning that “some participants in the commercial real-estate market have been especially under pressure, with higher borrowing costs compounding post-pandemic structural market changes”. It noted that “a failure to properly measure, monitor and mitigate counterparty risk could result in significant losses due to preventable counterparty default”.

The slump in commercial real-estate values has hit all participants in the market. Take the Square in Tallaght and Blanchardstown shopping centres, both of which are being sold at prices far below what they were bought for.

Ronan Group is no less severely affected, and people familiar with the thinking within the group say there’s a belief inside the group that it is not so much a collapse in commercial property values as the emergence of a two-tier market.

On one tier is the older stock of buildings, many of which have leases coming to an end, and virtually all of which need major investment to bring them up to environmental standards.

And on the other tier are modern, newly-built developments likely to command more interest and demand.

Ronan seems unwilling to give up on either the older buildings or the newer ones, regardless of the difficult market conditions or the circling receivers

Ronan Group has a stock of both, and certainly the properties affected by the consensual receivership with the banks are on the older side – well located, but close to the end of their lease agreements, and needing plenty of investment, which might well make them more difficult to sell in the current market.

Even so, Ronan seems unwilling to give up on either the older buildings or the newer ones, regardless of the difficult market conditions or the circling receivers.

“Ronan Group is resolved to refinance and resume stewardship of the portfolio of properties currently in a voluntary and consensual receivership process,” a spokesman said in response to questions from The Irish Times.

Ronan is just as keenly trying to hold on to control of his chance to build some of those new, environmentally friendly developments – the ones tenants are more likely to go for.

This week he put in planning permission for a 47,225sq m (508,325sq ft) block of offices along North Wall Quay, which at one point will rise to 17 storeys.

Ronan Group wants to demolish the current offices of US bank Citigroup, which it acquired last year, to build a much bigger development with offices, shops, restaurants and arts and cultural spaces.

Meanwhile he is fighting hard to hold on to another high-value site at Tara Street, where he wants to build a 23-storey tower with adjacent hotel known as the AquaVetro project, but has hit a snag with the site’s owner, CIÉ.

In company accounts filed last year, the subsidiary involved in the development noted that there was a “material uncertainty” over its ability to proceed, as it was “seeking finance for its development property project and seeking an extension of the licence with the freehold land owner”.

It noted at the time of the accounts being published that the agreement had expired and negotiations were in train to extend the term, and struck an optimistic note: “The directors are confident that the licence terms will be extended.”

They were wrong. Just this month, CIÉ filed legal proceedings in an attempt to force Ronan to give up the site, claiming that he could not meet the deadline to complete the project, and that he had missed a key ground lease payment in November. Ronan Group is disputing this, claiming CIÉ is acting in bad faith in seeking repossession of the site.

The pipeline

There are many other eye-catching projects left in Ronan’s pipeline. For example, while he may not get to build the 45-storey tower he once wanted on his Waterfront South Central project on North Wall Quay, the 25-storey tower he has been given permission for will still be Dublin’s tallest building.

Then there’s the Glass Bottle site near Dublin Port, upon which is planned a nearly self-contained mini-city, and the billion-euro Bremore Port in Meath, and a pipeline of nearly 6,000 units in planning or pre-planning, which could help to ease the acute housing crisis.

Johnny Ronan, who turned 70 in December, has long insisted he has no plans to retire. He once told The Currency, a business news website, that he would do so “when I am in the box”.

But in order to get to work on those properties any time soon, it seems clear he will have to extricate himself from yet another bear trap.

- Sign up for Business push alerts and have the best news, analysis and comment delivered directly to your phone

- Find The Irish Times on WhatsApp and stay up to date

- Our Inside Business podcast is published weekly – Find the latest episode here