As the Government comes forward with yet another fantastical target for homebuilding and pretty much every relevant housing metric heads the wrong way, it is hard to believe that, 14 years ago, it had total and utter control of the housing market.

The National Asset Management Agency – which the Cabinet agreed last week is to be wound up by the end of 2025 – was the vehicle through which this power was exerted.

Nama controlled pretty much every bit of development land in the State. Not only that, but it had an iron grip over the State’s property developers and the backing of the Department of Finance and the Dáil.

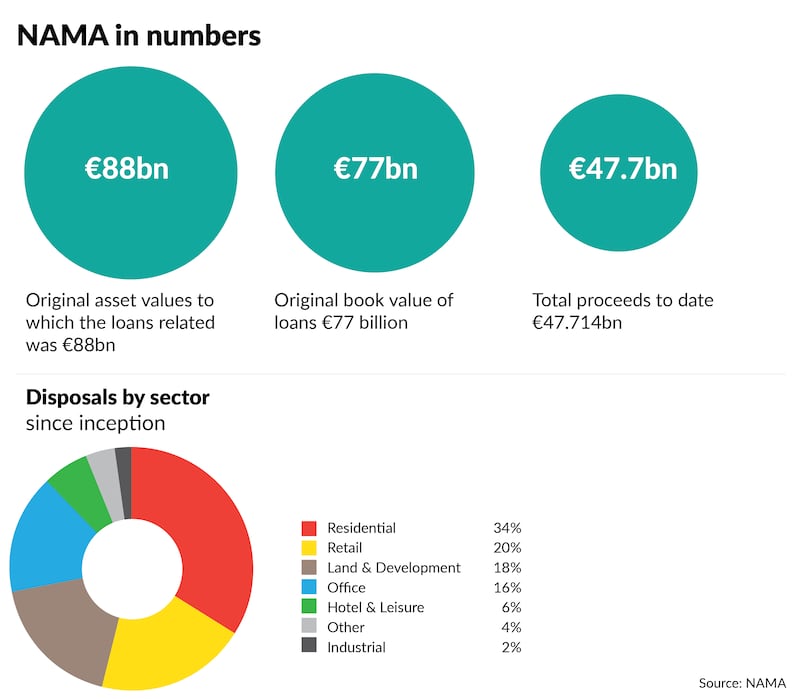

It was set up to rescue a banking sector that was sunk by bad lending to property developers. The banks were forced to sell their property loans and associated assets to Nama, at a large discount reflecting the market value of the loans. The banks got 57 cent for every €1 they had lent.

READ MORE

Nama raised the money by borrowing €31 billion with the support of the Government.

It was a lifeboat for the banks, but Nama was also a once-in-a-lifetime opportunity to reset the Irish property market. Once it was up and running, it controlled the supply of development land and thus set the price. It could also dictate what was built, where and when. It is hard to think of any government in a Western democracy having such power to deliver affordable housing.

It would be incorrect to say the Government squandered the opportunity. It would be more accurate to say that they didn’t see it or realise its significance.

if the last crash taught us one thing, it is that nobody really knows what will happen when the music stops

The creation of Nama has to be seen in the wider context of the national bankruptcy that was taking place and which resulted in the acceptance of a €85 billion bailout from the IMF, ECB and EU in December 2010. The Troika stumped up €67.5 billion with the State raiding the National Pension Reserve Fund for the balance.

The large haircut that Nama imposed on the banks when taking over their property loans rendered them bankrupt. The Government was forced to take them over and pump in some €64 billion of capital that it didn’t really have, bankrupting the country in the process.

In this context, the absolute priority for Nama was to repay the money it had borrowed, the idea that it would use its unparalleled power to restructure the property market and ensure that there was no repeat of the speculative bubble that led to its creation was not on the agenda.

And that remains the case. Nama’s goal of repaying all its debt on time was, and is, completely aligned with rising property prices.

It would be incorrect to say the Government squandered the opportunity. It would be more accurate to say that they didn’t see it or realise its significance

Nama’s commercial mandate has played its part in many of the policy mistakes that have been made since. Initiatives to encourage overseas investors, such as the tax breaks on build-to-let developments, are just one example.

The net result is that Nama will be wound down at the end of next year with a projected surplus of around €5 billion, while the property market is as dysfunctional as it ever was. House prices are back to the ridiculous levels seen in 2006. Even if people could get one, they probably cannot afford one, and the Government seems incapable of getting on top of the problem.

The only real difference this time is that Irish banks are not as exposed to the market as they were in 2006. Commercial property lending accounts for about 10 per cent of their business, compared to 30 per cent before the crash. In theory, their exposure is manageable if things go south again. But if the last crash taught us one thing, it is that nobody really knows what will happen when the music stops. Contagion is the hidden risk in the financial system.

It is easy with hindsight to home in on the failure of Nama and, by extension, the government to take a long-term strategic approach that would have put the supply of cheap building land at its centre.

Nama’s goal of repaying all its debt on time was and is completely aligned with rising property prices.

To do so would be to ignore the fiscal strain the State was under. It’s worth remembering in that context that in the dark days of the late 2000s, nobody saw the speed of the economic recovery and the large tax revenues that would flow into the State’s coffers from a handful of US multinationals operating here.

But the grim circumstances of Nama’s birth do not give it a free pass. As the State’s finances improved and priorities changed, its approach could also have changed – or been changed for it – to reflect the pressing need to provide affordable homes.

Why this didn’t happen is a question worth answering. The most likely, and at the same time most prosaic, answer is that a policymaking apparatus that struggles with long-term planning and joined-up thinking at the best of times simply didn’t have the wherewithal to change direction.

- Sign up for push alerts and have the best news, analysis and comment delivered directly to your phone

- Join The Irish Times on WhatsApp and stay up to date

- Listen to our Inside Politics podcast for the best political chat and analysis