The Association of Chartered Certified Accountants (Acca) would appear to subscribe to the view that, rather than having a silver lining, every cloud can in certain conditions release static electricity and kill you.

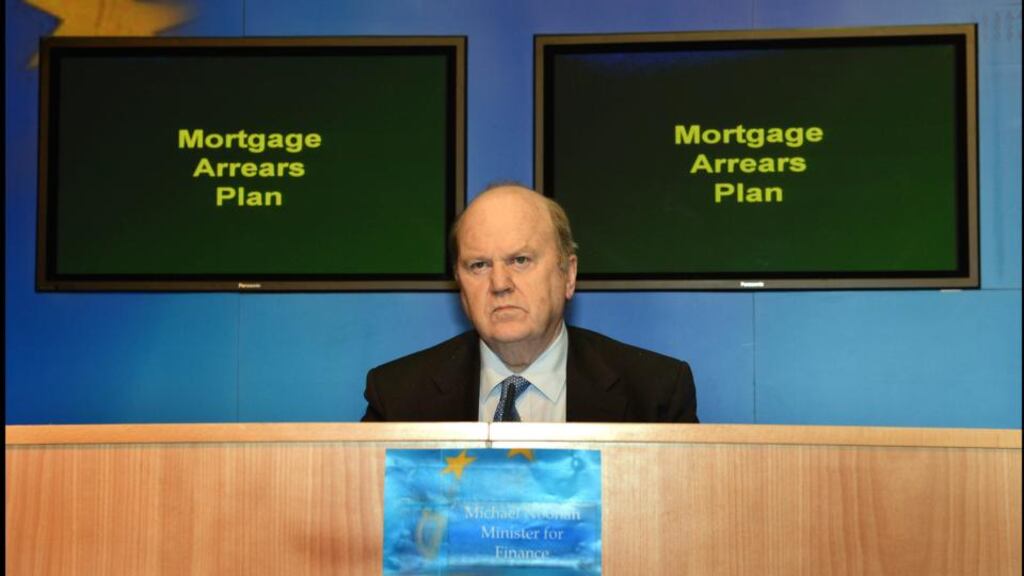

The accountancy body pointed out yesterday that any debt write-off under the Mortgage Arrears Resolution Process (Marp) involving banks and borrowers may actually be taxable, which rather defeats the purpose. According to the Acca, a borrower who has their mortgage written down is subject to capital acquisitions tax at 33 per cent plus interest and penalties if they fail to file a return and pay the tax due on time.

Private debt that is forgiven is generally treated as a gift under capital acquisitions tax and taxable at the rate of 33 per cent on amounts over certain limits, the Acca explains. The definition of a taxable gift in the legislation includes “the release, forfeiture, surrender or abandonment of any debt”.

The reason for this is to prevent the use of debt write-offs to circumvent income and other taxes, but it is obviously counterproductive in the case of mortgage debt being forgiven by a bank.

Thankfully the Acca has alerted the Government and Revenue Commissioners to this potential problem and asked them to clarify the position.

And lest anyone think the accountants are engaging in scaremongering to generate publicity, they explain that their concerns are based on the Finance Bill 2013, which specifically stated that write-offs under the alternative to Marp, the Personal Insolvency Act, are not subject to tax.

Something similar is required in respect of the write-offs that may be agreed under Marp, or hapless debtors may find themselves hit with a big tax bill once they are back on their feet, the accountants warn. The problem is that every case is different and “a review of the banking documentation in each situation is necessary. How the banking documents themselves are constructed will have a big impact.”

Who is capable of carrying out this difficult and, one suspects, expensive work? Acca members presumably.