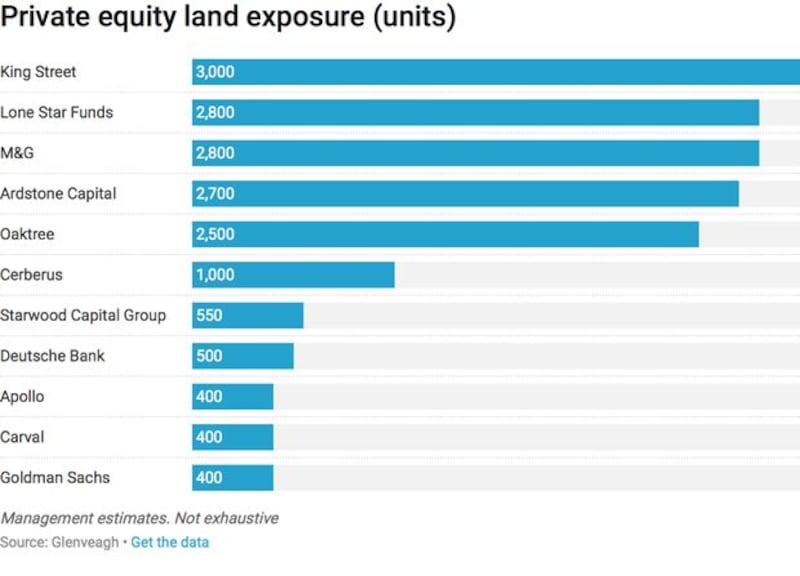

Glenveagh Properties, the fledgling Irish housebuilder that floated on the Irish Stock Market last October, estimates that 11 of the most active overseas acquirers of Irish property and distressed loans in recent years are sitting on land capable of delivering 17,050 homes.

Many of the funds on the list, which includes US private equity groups King Street Capital, Lone Star Funds, Cerberus, Deutsche Bank and Goldman Sachs, are now in talks about selling land to Glenveagh and others, the company's chief executive, Justin Bickle, told reporters as it unveiled its maiden set of financial results on Tuesday.

“We’re in dialogue with most of the people on this chart,” Mr Bickle said as he pointed to the list on a presentation slide.

End of cycle

The development comes as many of the funds approach the end of their natural investment cycle, and as they eye the impact of a vacant site levy, aimed at penalising landowners for hoarding development property, according to Glenveagh executives.

Sites that appear on local authorities’ vacant sites register face a 3 per cent levy this year, rising to 7 per cent in 2019.

Glenveagh's chief operating officer Stephen Garvey said that private equity or financial firms are behind about 30 to 40 per cent of the €440 million of sites that the group is actively considering as it continues to deploy the €550 million of equity raised in its initial public offering (IPO) last October.

Glenveagh, created by combining property accumulated by Oaktree in Ireland following the property crash and the assets of Maynooth-based builder Bridgedale, has so far invested almost €300 million of the money raised from its IPO. Mr Bickle is a former Oaktree executive, while Mr Garvey was chief executive of Bridgedale.

Two portfolios

The company's executive chairman is John Mulcahy, a former senior executive at Nama.

The land purchased to date includes two portfolios announced on Tuesday that it has bought for a combined €106 million, and which are capable of delivering 2,235 homes across seven development sites.

These include Tallaght and Donabate in Co Dublin, Bray in Co Wicklow, Dunboyne and Stamullen in Co Meath, and in Galway city.

Glenveagh now owns a diversified landbank capable of delivering more than 7,340 units and which has doubled in size since the IPO. It will have 700 units under construction this year, with a separate pipeline of more than 1,200 planned for development for third parties by its Glenveagh Living brand.

Pre-exceptional loss

The company has secured a €250 million three-year working capital facility from HSBC, AIB and Barclays.

Glenveagh reported a pre-exceptional loss of €3.3 million last year. It also booked a €47.5 million non-cash exceptional cost for an expense relating to founder shares issued at the time of the IPO. This incentive scheme entitles the company’s top three executives to receive up to 20 per cent of total shareholder returns over a five-year period.