Houses and apartments in Dublin, Wicklow and Kildare are no longer "affordable", with costs relative to incomes almost back at 2008 levels, according to the State's Housing Agency.

It said a minimum of 63,000 homes need to be built nationally within the next three years, half of which are required for Dublin households.

The affordability problem was largely down to a “mismatch” between supply and demand, with 11,000 homes completed last year, at least 4,000 less than was needed, the agency said in its first National Statement of Housing Supply and Demand

The number of homes built fell from 93,419 in 2006 to 11,016 last year, but the decline in housing construction was even more pronounced in Dublin with an 88 per cent decrease in activity over the same period.

The situation was improving, it said, with an almost two thirds increase last year in the number of homes on which construction started, from 4,708 in 2013 to 7,717 in 2014. However the number of planning permissions is still too low to meet future demand. Just 3,606 permissions were granted last year, only 290 more than the previous year.

Rental prices have also increased, particularly for apartments. Nationally rents were almost seven percent higher in the first three months of 2015 compared with the same period in 2014. Dublin bore the brunt of this rent increase with rents up almost 10 per cent, compared to just over 5 per cent for the rest of the State.

The report is the first of a series of annual Housing Agency assessments designed to guide how demand for housing into the future will be met, and act as an “early warning system” to prevent future boom bust cycles.

"We need to see if we are on target or drifting from it," agency chairman Conor Skehan said. "We are making progress on housing supply...We are back. The trick is to control it next time."

The next report would examine the various factors influencing affordability, he said, to determine “where and how the costs cause Irish housing to be more expensive than other European States .”

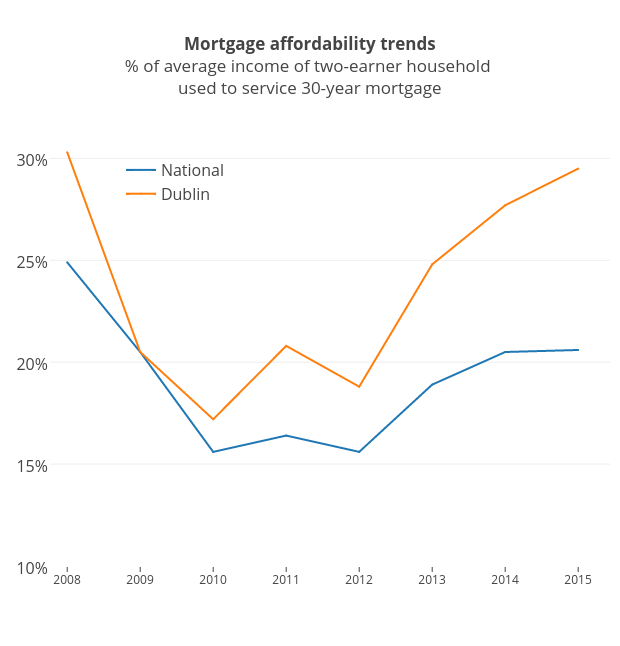

In almost all counties housing was “affordable” the agency said. This means that a two-earner household on average incomes would be able to service a 30 year mortgage on less than 17 per cent of their net income.

However, for those living in the eastern region, particularly Dublin, buying a home has become unaffordable in the last two to three years. Dublin, Wicklow and Kildare homes have all now exceeded affordability levels, with Meath and Cork just below the threshold. In Dublin mortgages are costing 29.5 per cent of income, almost the same as in 2008 when mortgage costs reached 30.3 per cent of incomes.

“Affordability is a key issue, and while both residential prices and rents reduced during the economic crisis, both have increased recently,” Mr Skehan said.

The type of housing needed has also changed with fewer traditional three-bedroom houses and more apartments needed, according to population changes. The average household size fell from an average of 3.04 in 2002 to 2.77 in 2011. “Based on an assessment of regional trends, it has been calculated that it will fall further to 2.67 by 2018 – the majority of new housing will now accommodate fewer people.” Mr Skehan said.

Homes for smaller households did not mean “tiny houses” he said. “We’re not talking about people having tiny houses we’re talking about housing with less bedrooms. Smaller units not tiny houses.”