The return of Level 5 restrictions means a hit to the economy – and it will be more severe than when restrictions were tightened in the autumn. Lockdown Three may not be quite as severe as Lockdown One, but it is not far off. And it looks likely to go on for some months and to be very gradually unwound.

While economic and public health goals are both met by getting on top of Covid-19, shutting large parts of the economy obviously creates significant costs for the wider economy and the public finances in the short term. What does the evidence show?

1. The key number

Winter Nights

Perhaps the clearest metric is the trend in the Pandemic Unemployment Payment (PUP), paid to people laid off due to Covid-19. We now have data on this going back to the start of the pandemic. The numbers on the PUP quickly jumped during March and April to peak around 600,000 people. The reopening then meant this dropped and the lowest monthly average was 217,000 in September.

The second period of restrictions saw a rise in PUP numbers to 350,000 on average in November and a drop to 336,000 in December. Now, however, the numbers are sharply on the rise and the total reached 460,000 this week. The peak may not reach the heights of the first lockdown – somewhat more is open this time – but it does look likely to break the 500,000 barrier.

Even during the summer, with most of the economy open, albeit with restrictions , very significant numbers remained on the PUP and it has ratcheted higher after each lockdown. Now, the indications are that the economic impact of this lockdown will be closer to that of the first one in the spring than to the shorter period of restrictions later in the year.

Adding those on the PUP to those on the existing Live Register probably leaves us now with a total of around 635,000, or about 25 per cent of the workforce. The Central Statistics Office (CSO) cautions that this significantly overstates the level of unemployment as some on the PUP will return to work or full-time studies in time. Nonetheless, it is a sobering figure highlighting the numbers now on the sideline of the jobs market. Forecasts this week by Davy stockbrokers are that the unemployment rate could end next year still at 12 per cent.

2. The breakdown

Not surprisingly, the accommodation and food sector is the biggest single source of PUP recipients, with a 110,000 total this week, compared to 128,000 at the peak in early May (presumably some takeaway employment explains some of the difference).

The wholesale and retail sector is next, with 73,400, down from 90,000 at peak, followed by construction, which has risen sharply to 56,800 versus 79,000 last May.

The experience of the first lockdown suggests that the numbers have not yet peaked – for example some construction sites could stay open to finish homes nearly completed, but will close completely soon. The “other” sectors, including personal services such as hairdressing, already has almost 35,000 claimants, versus 39,000 at the start of May 2020.

So the evidence is that while the impact of this lockdown may not be quite as severe in terms of numbers out of work in the key sectors as the first one, it may not be far off. And with indications that hospitality may not start to really reopen until the summer, the length of this lockdown will create problems. A number of sources believe that this will inevitably leave a significant minority unable to reopen at all. The cumulative impact of the lockdowns is taking its toll.

The latest breakdown also confirms earlier evidence that younger employees are much more exposed. Of the 460,000 on the PUP, 110,600 are under 25 and 213,500 are under 35. So under-25 year-olds represent around 25 per cent of PUP recipients, but they make up just 12 per cent of the overall labour force. And under 35s account for 46 per cent of the PUP total, but around 34 per cent of the overall labour force.

3. The lockdown and movement

It is impossible to get a compete picture on the impact of lockdown of movement . One of the rationales for closing sectors such as non-food retail – and imposing a 5km limit – is to stop people moving around, and meeting up. Anecdotal evidence this time is mixed – city and town centres are empty now in evening times, reflecting the closure of hospitality. However, there is more traffic around during the day than during the first lockdown. What evidence do we have?

Data compiled by the AA, largely from Transport Infrastructure Ireland traffic count cameras, is that traffic volumes are indeed well down on normal – but up on the first lockdown. An analysis of junction 9 on the M50, for example, would show traffic much reduced from levels before the pandemic hit, but not far off twice the lowest levels reached in March at the start of the first lockdown.

In rough terms, traffic would have averaged 120,000 journeys on a weekday before the pandemic hit, not far above 40,000 during the lowest level of the first lockdown one and 80,000 or so now. The picture varies across the country, but is broadly similar – traffic down by a third since December and well down on the second lockdown – but well above Lockdown One. The AA analysis finds levels more akin to Mid-May, after the first easing of the initial lockdown.

Now, a somewhat higher number of people may be at work in construction and retail than at the height of the first lockdown. Also, it appears that those who do have to go to work are increasingly avoiding public transport and thus many are driving.

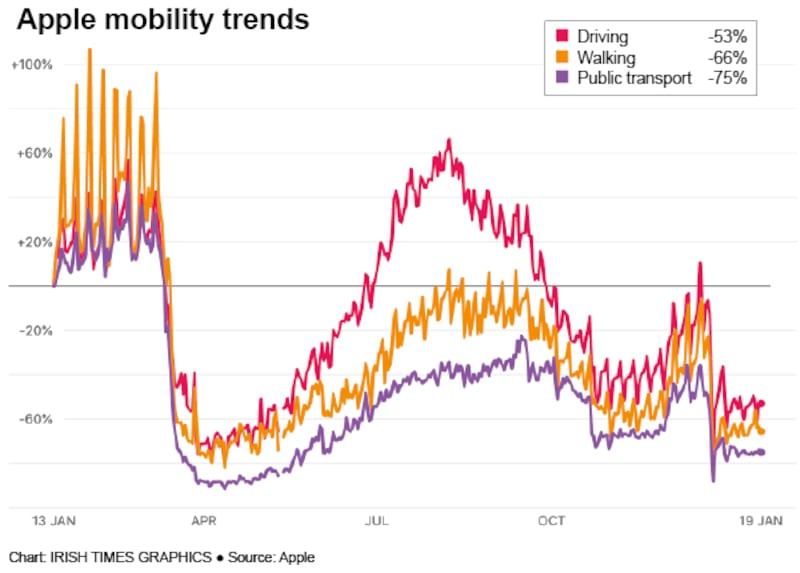

What other evidence do we have? Apple produces data based on searches on its mobile devices. As can be seen from the graph, this confirms that this lockdown, in terms of moving around, is more like the first one than the second. It suggests somewhat lower car movements than shown by the hard traffic data covering main roads.

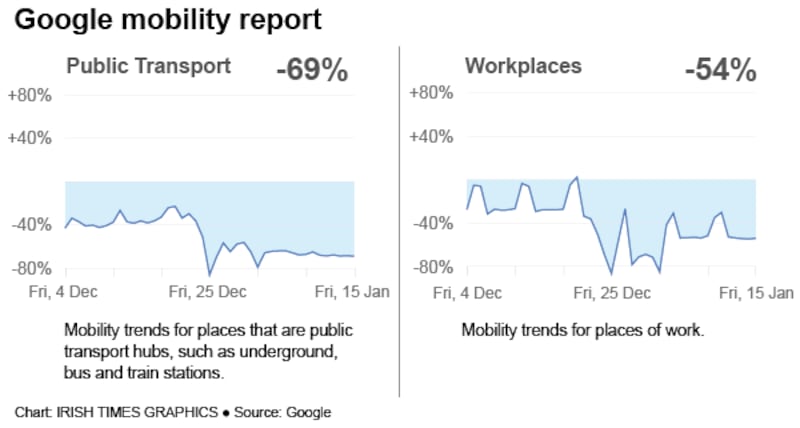

Finally we have Google mobility data, again based on people carrying devices and comparing with pre-pandemic levels. It confirms a major fall-off in public transport use, now running at 70 per cent below normal, not far off the drop during the first lockdown. With more people at work, this suggests there is indeed some substitution between public transport and cars for those who do have to go to work. There is also a huge fall-off in time spent in retail and recreation settings,with many of these now closed.

The Google data also shows a decline in people at work, though variations in this figure suggests it may now be judging home as the workplace for some people.

4. The bottom line

The latest lockdown will lead to another big fall in domestic economic activity in the first quarter of this year and stockbroking firm Davy has predicted a 3.5 per cent quarterly fall in overall GDP. For the year as a whole, Davy now forecasts a rise of just 2.7 per cent in the indigenous sectors of the economy, assuming a recovery in the second half of the year. This follows a fall of close to 10 per cent in the domestic sectors last year.

Continued buoyancy in the multinational sector supported taxes last year and should do so again in 2021.However Davy believes that the need to continue support for affected businesses and individuals will keep borrowing high this year – the general government deficit is expected to fall from €19 billion last year to €18 billion in 2021.

As Covid supports costs the exchequer up to €300 million a week during the kind of lockdown we are now in, the costs will rise quickly. The current focus is more on businesses looking for more help, rather than any push for an early reopening. And given our experience in recent weeks, plotting our way out of the third lockdown will be a significant challenge, albeit one which should be helped by the increased numbers who will be vaccinated in the months ahead.