The bailout

Arguably the seminal moment in Ireland’s recent economic history. In late 2010, the country was imploding financially. The crash had sent the economy into reverse and blown a hole in the public finances. Unemployment had rocketed from 5 per cent to 15 per cent in just two years.

However, it was the government’s infamous decision to guarantee the entire domestic banking system back in 2008 – effectively putting the sovereign on the hook for €440 billion of bank liabilities – that would seal the country’s fate.

By September, the guarantee had run out but Ireland was locked out of the bond markets and unable to borrow and no one really knew just how big the problem in the banking system was.

Whether the Government chose the bailout route or was “pushed” as Kevin Cardiff, former secretary general of the Department of Finance, maintains is still a source of controversy. The manner in which it was announced was a “Gubu” moment.

After several denials by the government and various ministers, the then Central Bank governor Patrick Honohan rang RTÉ's Morning Ireland programme to effectively announce that the State was in discussions with the European Union and the International Monetary Fund (IMF) about a financial rescue.

The day before about €900 million of deposits had flooded out of Irish banks, in one of the biggest one-day exoduses on record. The banks had, in the words of minister for finance Brian Lenihan, become “too big a problem for the country”.

On November 28th, the government agreed to a €67.5 billion EU-IMF bailout programme with the European Commission, the European Central Bank (ECB) and the IMF, later known as the troika. The three-year financial aid programme was provided on the condition of exacting austerity measures that would cause great hardship.

The economy was in freefall, in stark contrast with the heady days of the boom when Ireland’s tiger economy was an exemplar of growth and prosperity. We were the sick man of Europe, headed for several years of swingeing cutbacks and another morale-sapping period of emigration.

Anglo Irish Bank RIP

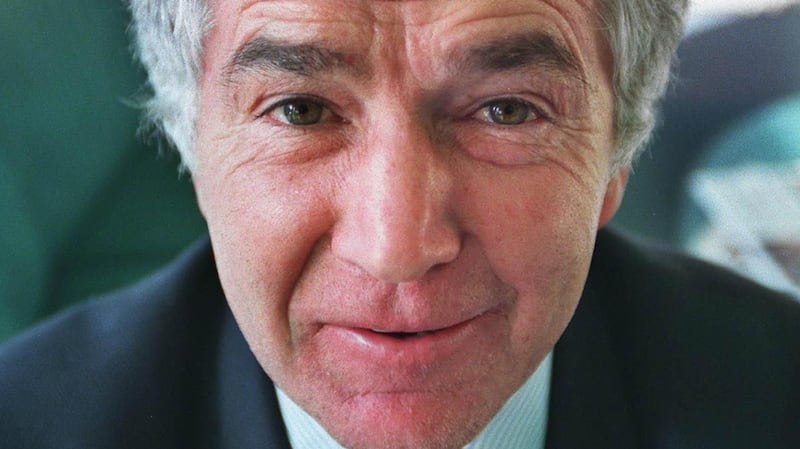

The bank that became synonymous with Ireland’s financial crash was once the poster boy of the industry here. Under the stewardship of Seán FitzPatrick it had morphed from a fringe operator lending to corporates in the late 1980s to one of Europe’s most profitable banks by the mid-2000s – it recorded an annual profit of more than €500 million in 2005 – primarily on the back of what would later been seen as reckless lending to builders and developers.

Its loan book trebled to €73 billion between 2004 and 2008 as it allowed clients double down on their existing loans by taking equity out of one project to fund another. The bank and its clients epitomised the easy-money culture of the Celtic Tiger era.

By mid-2008, shares in Irish banks, and Anglo in particular,were tanking as rumours circulated about their exposure to bad debts. Rumours were also circulating that wealthy businessman Seán Quinn had taken a large position in the bank via CFDs (contracts for difference), which meant his name was kept off the share register as he didn’t actually own the stock.

When the government finally stepped in with a snap guarantee of the banking system in September 2008, weeks after the implosion of US investment bank Lehman Brothers, Anglo was the weakest link, teetering on the brink of collapse.

Later that year FitzPatrick and chief executive David Drumm were forced to resign after hundreds of millions in directors’ loans, kept hidden from auditors, were uncovered.

Not long afterwards the bank was nationalised, and in March 2010 it reported losses of €12.7 billion for the 15 months to December 2009, the largest loss in Irish corporate history.

Drumm would later be jailed for his role in the provision of illegal loans to 10 developers to buy shares in the bank, the so-called “Maple 10” controversy. The strategy was devised to support the bank’s sliding share price and unwind Quinn’s doomed bet on its share price.

Most of Anglo was later merged with Irish Nationwide and renamed the Irish Bank Resolution Corporation (IBRC), an entity the government eventually liquidated in 2013. The bailout of Anglo cost the Irish taxpayer nearly €29 billion. In an ironic twist the new headquarters it was intending to move into on Dublin’s North Wall Quay before it collapsed is now home to the State’s financial regulator while its original headquarters on St Stephen’s Green houses a Starbuck’s coffee shop.

Seán Quinn: the fall of Ireland’s richest man

In 2008, the Cavan businessman was officially ranked as the richest man in Ireland with an estimated wealth of €4.7 billion, relating in the main to his hugely profitable insurance and financial services business. Three years later he walked into a Belfast courtroom and declared himself bankrupt, crystallising the most calamitous fall in Irish business history.

His bankruptcy was triggered by the collapse of Anglo. Between October 2005 and July 2007, Quinn built up a 28 per cent stake in the bank, using CFDs, a financial instrument used to gamble on the bank’s share price. When Anglo shares began what would become a steep nosedive, the bank advanced Quinn loans to allow him meet his CFD commitments but the gamble was going only one way.

When the bank collapsed, the Quinn family and their empire owed Anglo €2.8 billion. The calling in of these loans precipitated a series of court battles across several jurisdictions. Quinn’s lawyers argued that Anglo should never have been lent him the money as it was for the unlawful purpose of supporting the bank’s share price.

The jewel in the Quinn crown, Quinn Insurance, fell into administration on foot of a High Court application from the Central Bank in March 2010, leaving Irish motorists – via a 2 per cent levy on all policies – to fund a financial black hole in its accounts estimated at €940 million. The wider Quinn Group, including its manufacturing division which employed thousands in the Border counties of Fermanagh and Cavan, was later seized by Anglo before having its debts restructured.

The process, described as “de-Quinning” by local supporters, provoked a violent backlash – with individuals and company property targeted in a string of attacks, the worst of which was a vicious assault on Quinn Industrial Holdings director Kevin Lunney earlier this year.

Quinn himself was jailed for three months in November 2012 for contempt of court and for his role in a scheme to put the family’s €500 million international property empire beyond the reach of Anglo. When sentencing Quinn, Ms Justice Elizabeth Dunne said: “In my view, he has only himself to blame.”

Earlier this year, Quinn’s five adult children consented to a judgment for €440 million, some €88 million each, on foot of a long-running battle with IBRC. Execution and registration of the judgment was stayed on condition they take steps to help secure the return to IBRC of valuable assets in their international property group.

Seán Dunne: the fall of Ireland’s premier property tycoon

The property developer’s bold deal-making and extravagant lifestyle epitomised Celtic Tiger exuberance but like many of his ilk the 2008 property crash left him with an unmanageable exposure to collapsing property values.

The most spectacular example of Dunne’s ambition was his plan for the redevelopment of the Jurys and Berkeley Court hotel sites in Dublin’s Ballsbridge. Dunne paid €380 million for the seven-acre site in 2005. The deal amounted to €54 million an acre, one of the highest amounts ever paid for land in Europe. His plan was to transform Ballsbridge into the “Knightsbridge of Dublin”. At the centre of the scheme was a Dubai-like office tower cut in the shape of a diamond – it would have been the State’s tallest building. The scheme was rejected by An Bord Pleanála as “oppressive and monolithic”.

After the crash, Dunne and his wife, former gossip columnist Gayle Killilea (the two had met in the Fianna Fáil hospitality tent at the Galway Races in 2002), relocated to Connecticut. The National Asset Management Agency (Nama), which took over the bad property loans of the Irish-owned banks, appointed receivers to several of Dunne’s Irish properties in 2011.

At around the same time, Ulster Bank seized control of the Ballsbridge site before petitioning the High Court to have him declared bankrupt on foot of a €163 million judgment against him. Dunne countered by filing for bankruptcy in the United States, stating he had debts of more than $1 billion and assets of just $55 million.

What followed was an extraordinarily drawn out bankruptcy process in two jurisdictions in which it was revealed that the developer had turned over millions of euro in assets to his wife to shield them from creditors. The Irish High Court adjudicated Dunne bankrupt in 2013.

In 2018, however, the High Court extended his bankruptcy for an additional 12 years for what the court said was his “wilful and deliberate” failure to co-operate with the trustee administering the process. In a damning judgment, Ms Justice Caroline Costello described Dunne as being a “deeply dishonest” witness who had engaged in “wholesale non-compliance” of his statutory obligations. Dunne was due to exit bankruptcy in July 2016 and will not now do so until April 2028.

In June, Nama and Ulster Bank won a major victory in the years-long legal battle when a US jury ruled that Dunne had fraudulently transferred assets to Killilea to hide them from creditors and ordered her to pay €18.1 million. To sum up his fall from grace, Dunne told an American court in September that he earns just €200 a month.

Leprechaun economics

Dismissed as “farcical” for an advanced economy and famously mocked by US Nobel-winning economist Paul Krugman as “leprechaun economics”, Ireland’s 26 per cent growth rate in 2015 (later revised down to 25 per cent) implied the economy here was growing at three times the rate of China. The problem was it had little to do with underlying economic conditions and more to do with multinational transactions, in particular the transfer of intellectual property (IP) assets here on foot of a global clampdown on multinational tax avoidance.

The story once again drew unwanted attention to Ireland’s low-tax economy and the fact that it was being used to house billions of euro in multinational assets. It also showed how woefully inadequate traditional measures such as gross domestic product (GDP) were at capturing economic growth in a small, globalised economy.

While the year-on-year increase was put down to several phenomena, including a spate of so-called corporate inversions and the transfer of aircraft leasing assets here, the real driver was the transfer of IP assets to Ireland by large multinationals, including Apple.

On foot of an investigation by the European Commission, Apple restructured its Irish subsidiary in 2014. The iPhone maker made one of its key subsidiaries Irish-resident for tax purposes as part of the restructuring.

The subsidiary, Apple Operations Europe, was one of the three Irish-incorporated subsidiaries that were for years "stateless" for tax-residency purposes and which facilitated Apple in avoiding tax on tens of billions of euro in annual profits on its global sales. The onshoring of these entities fuelled a €75 billion jump in exports. Either way, the 26 per cent figure proved an embarrassment for the Government and the Central Statistics Office (CSO), which later devised a bespoke measure of national income to combat the distortions at the heart of our national accounts.

Apple's €13 billion tax bill

The largest corporate tax fine in history was described by Apple boss Tim Cook as “total political crap”. In August 2016, following a two-year investigation, the European Commission ordered Apple to pay back a whopping €13 billion (plus interest) in back taxes to the Government, claiming the company had received “illegal” tax benefits over the course of two decades that constituted a breach of state-aid rules.

Both Apple and the Government are appealing it and the money sits in limbo in an escrow account.Technically it wasn’t a fine, the issue in dispute was the level of tax Apple should or should not have paid. Nonetheless, it once again shone a light on Ireland’s tax-friendly regime.

In its ruling, the commission concluded that two tax rulings in 1991 and 2007 issued by Revenue had “substantially and artificially lowered the tax paid by Apple in Ireland since 1991” which allowed the company funnel most of its European sales through an employee-less shell “head office” attached to its subsidiaries in Cork but non-resident here for tax purposes.

The commission argued that Apple’s effective corporate tax rate on its European profits in 2014 was just 0.005 per cent, albeit the Government disputes the EU’s interpretation of Irish tax law.

In the appeal, lawyers for the commission claimed Ireland “blindingly accepted” proposals from Apple when it came to how much of its profits could be taxed by Revenue. However, lawyers for the company insist that the valuable IP that the commission has attributed to its branches in Ireland actually lies in the US, where the group’s products and services are created. Either way, the issue remains one of acute embarrassment for the Government.

David Drumm’s catch-me-if-you-can bankruptcy trial

In June 2018, former Anglo chief executive David Drumm was sentenced to six years in jail after being found guilty on charges of conspiracy to defraud the public and of false accounting. His conviction came almost 10 years after he resigned from Anglo, an institution he led through a period of unprecedented profitability but also to financial ruin. It marked an end to one of the most high-profile cases in Irish financial history.

As the full extent of Anglo’s financial woes became clear, Drumm fled to Boston, where he filed for bankruptcy under US law, a more lenient system than Ireland’s at the time, catching authorities here by surprise.

However, IBRC, Anglo’s successor entity, fought Drumm’s bankruptcy claim on the basis of loans he owed his former employer, while alleging that he had transferred money and assets to his wife so they would not be seized.

In January 2015, the US court declared his application inadmissible, ruling that he could be held liable for debts in Ireland. In a damning ruling, the bankruptcy judge said the former banker was “not remotely credible” and that his conduct was “both knowing and fraudulent”. The ruling paved the way for Drumm to be extradited back to Ireland in 2016 on separate criminal charges relating to the collapse of Anglo.

He was eventually found guilty of falsification of the bank’s assets back in 2008 when he presided over a series of circular transactions that made Anglo’s deposits look €7.2 billion larger than they were, a desperate attempt to window dress the bank’s ailing balance sheet, and in relation to the Maple 10 controversy.

Drumm has railed against what he describes as “the blame culture” here which paints him as chief villain of State’s financial crisis and the epitome of Celtic Tiger hubris. The Anglo tapes, secret recordings from inside the bank, which record him joking about how he and others lied to government about Anglo’s financial health at the height of the crisis, convincing officials to invest in the failing bank with figures “picked out of my arse” did little to help his cause.

He has apologised for the language used in those tapes but insists the bank that broke the State never sought a blanket guarantee, which he says was “not in the best interests of the State”.

AIB: back from the brink of extinction

The most striking thing about AIB’s implosion in 2008 was the size of the financial crater it it left for the taxpayer, some €20.8 billion. It was much closer to Anglo’s bailout bill than many had thought and a multiple of the €4.7 billion used to support its rival Bank of Ireland. While Anglo is now a relic of Ireland’s financial burnout and a byword for banking failure, AIB remains one of the State’s biggest banks and a significant plank of the financial establishment here. AIB holds the dubious honour of commanding the biggest bailout for a bank that survived the crash.

The trouble started in the mid-2000s when the bank, then under chief executive Michael Buckley, set up “win-back teams” to regain market share from the likes of Anglo. It ramped up lending, bankrolling big developers from Liam Carroll to Ray Grehan, whose property empires failed during the crisis.

By the time the music stopped and global financial markets went into meltdown in 2008, almost 36 per cent of AIB’s Irish loan book was out to the construction/development industry, with a further 29 per cent comprising of residential mortgages. Even late into 2008, when the tide had almost gone out on the Irish banking system AIB-owned Goodbody Stockbrokers maintained a “buy” recommendation for its then parent.

In December 2010, the government was forced to take a majority stake in the bank to save it from collapse, a shareholding that grew to 99.8 per cent. The bank racked up €25.5 billion of losses between 2009 and 2013.

AIB has been profitable since 2014 and its return to financial health was franked by an oversubscribed initial public offering (IPO) in June 2017, when the Government sold off 29 per cent of its stake for €3.4 billion. It was the largest IPO in Europe that year and marked a significant milestone in its and the State’s financial rehabilitation.

Tracker mortgage scandal

It had been widely known for some time that there had been issues with how banks were treating customers with tracker mortgages before the Central Bank announced in late 2015, rather belatedly critics have argued, that it was overseeing an industry-wide examination of the issue.

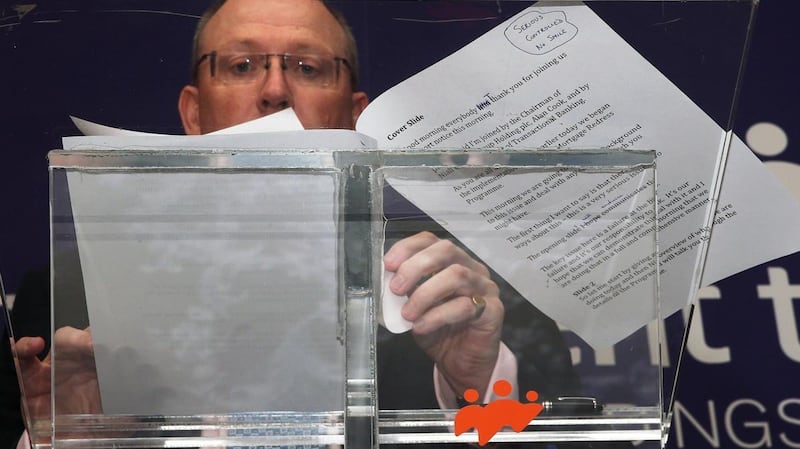

Few suspected, however, how big the scandal would ultimately turn out to be. Following much kicking and screaming and – on occasion – threats from both sides of legal action, the Central Bank’s final report into the matter, published in July, showed that 40,100 mortgage borrowers had either been wrongly denied their right to a cheap loan linked to the ECB’s main rate, or put on the wrong rate entirely.

It took the emotional testimony of four affected customers before the Oireachtas finance committee in late 2017 to pressure regulators, Government and banks to deal decisively with the debacle.

But even the final number – following years of drip-drip updates – proved short-lived. Regulators said in October that a further 400 cases had been added to the list of victims. It’s likely to rise again once the financial services and pensions ombudsman Ger Deering completes his work reviewing complaints outside of the Central Bank review.

All told, the country’s banks have paid out almost €700 million in refunds and compensation, but the actual bill is now well above €1 billion when other costs are included – making it the biggest overcharging issue in the history of the State.

Permanent TSB was the first bank to be fined for its role in the fiasco, when the Central Bank sent it a €21 million bill in May. The other four banks under investigation – AIB and its EBS unit, Bank of Ireland, Ulster Bank and KBC Bank Ireland – can look forward to similar penalties in the next year or so.

The banks have set up an Irish Banking Culture Board to help raise standards in the industry as a direct result of the scandal. And the Government has promised to bring in a new regime to make individual bankers more accountable for failings on their watch.

Brexit: the UK’s divorce from the EU

The UK’s 2016 referendum wasn’t mandatory, it was held ostensibly to quell internal Tory party divisions on Europe. Its instigator, former UK prime minister David Cameron, subsequently quit the scene, leaving his successors to deal with the consequences and those consequences look set to play out for some time to come.

Because of its close trading ties with the UK and its porous land border with the North, the Republic was always going to be one of the big losers from Brexit.

In the immediate aftermath of the 2016 vote, it was thought that the UK would opt for a soft option, exiting but remaining in a close economic orbit to the EU. The rise of hardline Brexiteer Boris Johnson and the strength of his recent electoral victory might yet set the UK on a course for a hard Brexit, or even a no-deal Brexit, which would have extremely damaging consequences for certain sectors of the economy here, most notably the agrifood industry.

Either way, Brexit will be the first fracturing of the EU since its inception in 1957 as part economic pact, part postwar alliance. At the heart of the ongoing saga is one intractable problem that supersedes all others, namely the UK can’t have full access to EU trade and travel while ditching what it considers the undesirable bits of the union, namely immigration and having to pay into a central pot. It has taken Brexiteers an extraordinarily long time to realise that the promised land of an independent trade policy comes at a price. And the price is impeded access to the EU single market.

What’s left to decide is just what form of Brexit it will be. The free-trade negotiations that will follow the UK’s formal exit will determine this. They could be as protracted as the current battle over the withdrawal treaty and may still result in Ireland’s nightmare outcome, a no-deal departure and a hard Border with the North.

Other notable stories from the decade

2010: Halifax/Bank of Scotland exits markets

2011: Twitters opens its international headquarters in Ireland

2012: Eir applies for examinership amid mounting debt

2012: Ireland’s oldest stockbroking firm Bloxham collapses

2013: Irish Life sold by State to Great-West Lifeco

2014: US moves to close loophole allowing tax inversion deals

2015: Central Bank introduces mortgage lending rules

2015: Nama launches sales process for soured loans, triggering spate of sales of non-performing loans

2015: Government sells stake in Aer Lingus to Willie Walsh’s IAG

2015: Outcry as Dublin department store Clerys closes after sale

2016: Stripe valued at more than $9 billion after $150 million fund raise

2018: Ryanair agrees to recognise trade unions

2019: Independent News and Media sold to Belgian media group Mediahuis for €146 million

2019: Government signs €3 billion contract for National Broadband Plan