The hidden financial affairs of 35 current and former world leaders, more than 330 public officials in more than 90 countries and territories have been revealed in a leak of millions of documents.

The documents – which come from 14 offshore services firms from around the world – expose offshore dealings by the King of Jordan, the president of Kenya and, the prime minister of the Czech Republic and former British prime minister Tony Blair.

Among the hidden assets revealed in the documents are:

A $22 million chateau in the French Riviera – replete with a cinema and two swimming pools – purchased through offshore companies by the Czech Republic’s populist prime minister, a billionaire who has railed against the corruption of economic and political elites.

More than $13 million tucked in a secrecy-shaded trust based in the great plains of the US by a scion of one of Guatemala’s most powerful families, a dynasty that controls a soap and lipstick conglomerate that has been accused of harming workers and Earth.

Three beachfront mansions in Malibu, California, purchased through three offshore companies for $68 million by the King of Jordan in the years after Jordanians filled the streets during Arab Spring to protest joblessness and corruption.

The records – dubbed the Pandora Papers – were obtained by the Washington-based International Consortium of Investigative Journalists and shared with 150 news organisation worldwide, including The Irish Times.

The records come from 14 offshore services firms that set up shell companies and other offshore entities for clients often seeking to keep their financial activities out of the public eye.

$11.3 trillion

At least $11.3 trillion (€9.7tn) is held “offshore”, according to a 2020 study by the Paris-based Organisation for Economic Co-operation and Development.

It is not illegal in most countries to do business in offshore jurisdictions but the complexity and secrecy of many jurisdictions means it is possible to avoid scrutiny by regulators.

The system is sustained by multinational banks, law firms and accounting practices headquartered in the US and Europe.

The papers reveal that banks around the world set up offshore companies for their customers with the help of Alemán, Cordero, Galindo & Lee (Alcogal), a Panamanian law firm led by a former Panamanian ambassador to the US.

Other leaked records show that Ecuador's president, Guillermo Lasso, held bank accounts with Morgan Stanley and JPMorgan Chase through a foundation in Panama.

Alcogal said that the firm “complies with all laws in the jurisdictions in which it operates” and that it fully co-operates with government authorities. JPMorgan declined to comment.

The Pandora Papers investigation also highlights how Baker McKenzie, the largest law firm in the US, and other law firms helped create the modern offshore system.

The firm and its global affiliates have used their lobbying and legislation-drafting know-how to shape financial laws around the world.

A spokesperson for Baker McKenzie, John McGuinness, said the firm seeks to provide the best legal and tax advice to its clients and strives “to ensure that our clients adhere to both the law and best practice”.

Stars

The documents link many well-known figures to offshore assets including India's cricket superstar Sachin Tendulkar, pop music diva Shakira and supermodel Claudia Schiffer.

The documents also feature an Italian criminal known as "Lell the Fat One". The criminal, Raffaele Amato, has been tied to at least a dozen killings. The leaked records provide details about a shell company , registered in the UK, that Amato used to buy land in Spain, shortly before fleeing there from Italy to set up his own crime gang.

Amato, whose history helped inspire the movie Gomorrah is serving a 20-year prison sentence.

Attorneys for Amato and Tendulkar did not respond to requests for comment. Shakira’s attorney said the singer declared her offshore companies, which the attorney said do not provide tax advantages.

Schiffer’s representatives said the supermodel correctly pays her taxes in the UK, where she lives.

In most countries, it is not illegal to have assets offshore or to use shell companies to do business across national borders.

Businesspeople who operate internationally say they need offshore companies to conduct their financial affairs.

In all, the new leaks uncover the real owners of more than 29,000 offshore companies. The owners come from more than 200 countries, with the largest contingents from Russia, the UK, Argentina, China and Brazil.

King Abdullah II

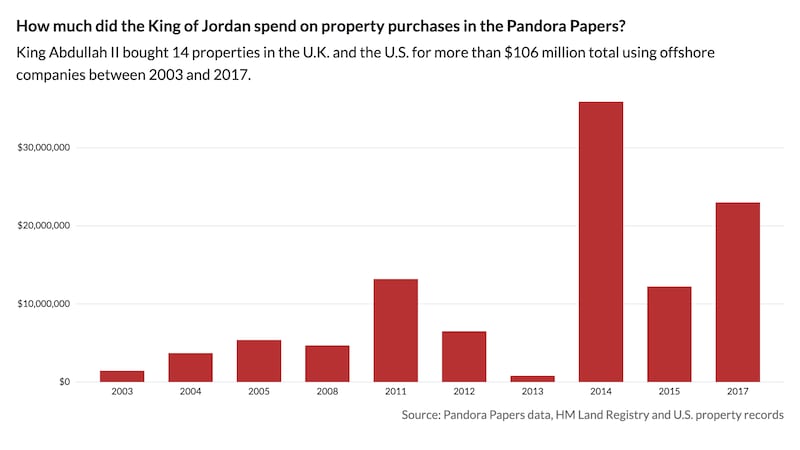

They show that Jordan’s monarch, King Abdullah II, purchased 14 luxury homes, worth more than $106 million, in the US and the UK. Advisers helped him set up at least 36 shell companies from 1995-2017.

In 2017, the king bought a $23 million property overlooking a California surfing beach through a company in the British Virgin Islands (BVI). The king paid extra to have another BVI company, owned by his Swiss wealth managers, act as the "nominee" director for the BVI company that bought the property.

UK attorneys for the king said that he was not required to pay taxes under Jordanian law and that he had security and privacy reasons to hold property in offshore companies. They said the king had never misused public funds.

The attorneys also said that most of the companies and properties identified by ICIJ have no connection to the king or no longer exist, but declined to provide details.

A number of political figures who have spoken out against the offshore system are mentioned in the documents. Some use the system themselves.

“Every public servant’s assets must be declared publicly so that people can question and ask – what is legitimate?” Kenyan president Uhuru Kenyatta told a BBC interviewer in 2018. “If you can’t explain yourself, including myself, then I have a case to answer.”

The leaked records listed Mr Kenyatta and his mother as beneficiaries of a foundation in Panama. Other family members, including his brother and two sisters, own five offshore companies with assets worth more than $30 million, the records show.

Mr Kenyatta and his family did not reply to requests for comment.

Chateau Bigaud

Czech prime minister Andrej Babis, one of his country's richest men, rose to power promising to crack down on tax evasion and corruption.

The leaked records show that, in 2009, Mr Babis injected $22 million into a string of shell companies to buy a sprawling property, known as Chateau Bigaud, in a hilltop village in Mougins, France, near Cannes.

A year later, French records show, he acquired, through another Monaco shell company, seven properties a few yards from the chateau, including a two-storey villa with a pool and a garage.

Mr Babis has not disclosed ownership of these shell companies and homes in the asset declarations he is required to file as a public official, according to documents obtained by ICIJ’s Czech partner, Investigate.cz.

In 2018, a real estate conglomerate controlled by Mr Babis quietly bought the Monaco companies that owned the chateau and the villa.

A spokesman for the conglomerate told ICIJ that the company complies with the law. He did not respond to questions about the acquisition of Mr Babis’ properties. “Like any other business entity, we have the right to protect our trade secrets,” he wrote.

Mr Babis did not respond to requests for comment.

In February, a commentary from the Tony Blair Institute for Global Change urged policymakers to seek, among other measures, higher taxes on land and homes.

Mr Blair, the institute's founder and executive chairman, talked about how the rich and well connected shirk paying their share of taxes as far back as 1994, when he campaigned to become the leader of the UK's Labour Party.

“For those who can employ the right accountants, the tax system is a haven of scams, perks . . . and profits,” he said during a campaign speech in Birmingham in 1994. “We should not make our tax rules a playground for revenue avoiders and tax abusers who pay little or nothing while others pay more than their share.”

The Pandora Papers show that in 2017, Mr Blair and his wife, Cherie, became the owners of a $8.8 million Victorian building by acquiring the British Virgin Islands company that held the property. The London building now hosts Ms Blair’s law firm.

The records indicate that Ms Blair and her husband, who served as a diplomatic envoy in the Middle East after stepping down as prime minister in 2007, bought the offshore real estate company from the family of Bahrain’s industry and tourism minister, Zayed bin Rashid al-Zayani.

By purchasing the company shares instead of the building, the Blairs benefited from a legal arrangement that saved them from having to pay more than $400,000 in property taxes.

The Blairs and the al-Zayanis said they did not initially know about each other’s involvement in the deal.

Ms Blair said that her husband was not involved in the transaction and that its purpose was “bringing the company and the building back into the UK tax and regulatory regime”.

She also said that she “did not want to be the owner of a BVI company” and that the “seller for their own purposes only wanted to sell the company”. The company is now closed.

Through their lawyer, the al-Zayanis said their “companies have complied with all UK laws past and present”.

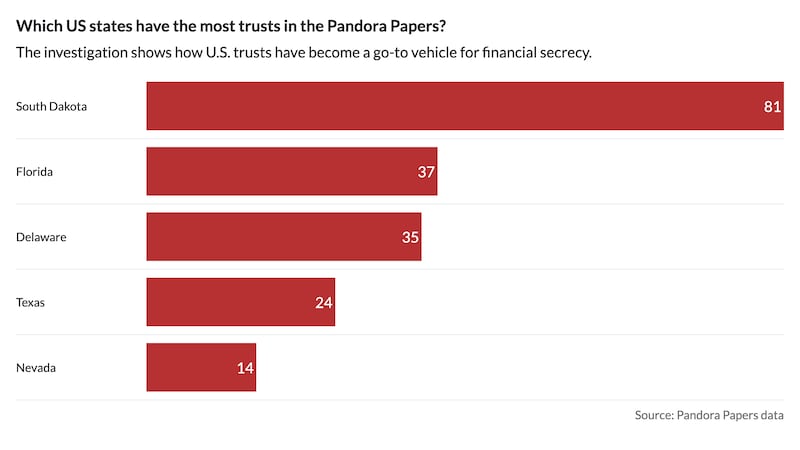

South Dakota

The Pandora Papers provide an insight into how South Dakota, Nevada and more than a dozen other US states have transformed themselves into leaders in the business of selling financial secrecy.

Meanwhile, most of the policy and law enforcement efforts of the world's most powerful nations have stayed focused on "traditional" offshore havens such as the Bahamas, the Caymans and other island paradises.

Year after year in South Dakota, state politicians have approved legislation drafted by trust industry insiders, providing more and more protections and other benefits for trust customers in the US and abroad.

Customer assets in South Dakota trusts have more than quadrupled over the past decade to $360 billion. One of the state’s largest trust companies says it has clients from 54 countries and 47 US states, including more than 100 billionaires.

By 2020, 17 of the world’s 20 least-restrictive jurisdictions for trusts were American states, according to a study by Israeli academic Adam Hofri-Winogradow. In many cases, he said, US laws have made it more difficult.

Using documents from the Pandora Papers, ICIJ and The Washington Post identified nearly 30 US-based trusts linked to foreigners personally accused of misconduct or whose companies were accused of wrongdoing.

Among them is Guillermo Lasso, a banker and former Ecuadorian provincial governor who was elected president in April. Leaked records show that Mr Lasso set up trusts in South Dakota four years ago amid media reports that he had used offshore companies to conceal his interests in a bank. Mr Lasso was not charged with a crime.

Mr Lasso said that his past use of offshore entities was “legal and legitimate” and that he complies with Ecuadorian law forbidding public officials from owning offshore companies.

Another wealthy Latin American who set up a trust in South Dakota is Federico Kong Vielman, whose family is of one of Guatemala's economic powerhouses.

Trusts set up in the US remain cloaked in secrecy, despite enactment this year of the US Corporate Transparency Act, which makes it harder for owners of certain types of companies to hide their identities.

"Clearly the US. is a big, big loophole in the world," said Yehuda Shaffer, former head of the Israeli financial intelligence unit. "The US is criticising all the rest of the world, but in their own backyard, this is a very, very serious issue."

This is an edited extract of an article published on https://www.icij.org/investigations/pandora-papers