World stock markets broadly rose on Thursday and bond yields eased as an absence of hawkish surprises from the latest US Federal Reserve minutes helped to soothe immediate worries over the impact of interest rate hikes on economic growth.

DUBLIN

The Iseq index was ahead by 1.1 per cent by the close of the session as the major Irish multinationals posted strong performances on the back of an easing of worries over the growth rates of the US economy.

Irish companies with global and US exposure performed well. Building materials giant CRH, rose by 1.1 per cent to close the session at €38.36 per share. Insulation group Kingspan finished ahead by more than 2.1 per cent at €73.98. Meanwhile, the Smurfit Kappa Group of paper and packaging companies rose by more than 2 per cent to finish at €37.45.

It was a mixed day for Irish-listed travel stocks as further evidence emerged of the strong bounce back in travel, although inflation in the sector continues to cause concern. Ryanair finished ahead by 1.6 per cent to close at €14.70. The country’s largest hotel operator Dalata was up by 4.8 per cent to €4.22. Brokers recently upgraded their forecasts for the company.

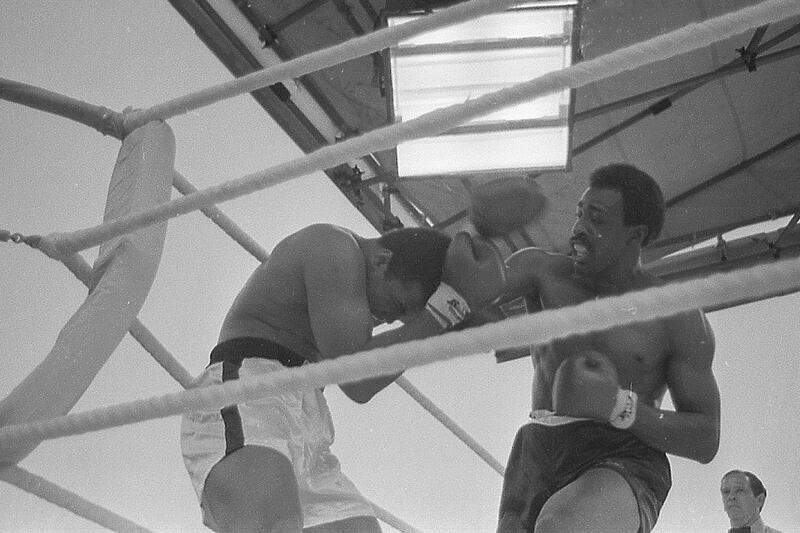

The Big Fight by Dave Hannigan: Account of Muhammad Ali in Croke Park a strange time capsule of 1970s Ireland

Sandymount cycle path decision frees council from weeds of lengthy planning process

Trump’s uphill battle to ‘get’ Greenland: persuasion, not invasion

I want to learn more about wine. What are the best books to buy?

LONDON

The UK’s top share index rose on the back of gains in banks, but shares of utilities slumped after Britain announced a 25 per cent windfall tax on oil and gas producers’ profits. The blue-chip FTSE 100 was up 0.6 per cent, with banks leading the gains with a 1.4 per cent rise, while the domestically focused FTSE 250 index inched 1.6 per cent higher.

Facing intense political pressure to provide more support for bill payers coping with what political opponents and campaigners have called a cost-of-living crisis, British finance minister Rishi Sunak said energy firms were making extraordinary profits while Britons struggled. Shares of power generators Drax, Centrica and SSE fell between 4.5 per cent and 6.6 per cent, while the wider utility stocks were down 4.1 per cent. Global oil majors BP and Shell, which are less affected by UK policy, were up more than 1 per cent.

Water company United Utilities’ shares slid 6.6 per cent after it warned of higher costs due to inflationary pressures. Asset manager Intermediate Capital Group jumped 7.6 per cent after it reported its full-year results.

Chemicals maker Johnson Matthey fell 3.6 per cent after forecasting a 2022-23 operating profit at the lower half of market estimates as supply disruptions from China and component sourcing from Ukraine hurt its auto customers.

EUROPE

The pan-European Stoxx 600 index closed higher for a second straight session, up 0.8 per cent. Gains were largely broad-based, with retailers up 4.7 per cent. The Dax in Frankfurt rose 1.6 per cent while Paris’s Cac 40 closed up 1.4 per cent.

Luxury stocks ticked up, with Louis Vuitton owner LVMH up 3.7 per cent, the biggest boost to the Stoxx 600.

Sentiment remained fragile, however, on lingering worries about slowing economic growth from central bank tightening.

Some markets in Europe, including Switzerland, Sweden and Finland, were closed for a local holiday.

NEW YORK

US stock indexes climbed in a broad-based rally after upbeat annual forecasts from several retailers, while data confirmed the US economy contracted in the first quarter, easing concerns about aggressive interest rate hikes.

All of the 11 major S&P sectors advanced, with consumer discretionary up 4.1 per cent, followed by a 1.9 per cent rise in the financials sector. The small-cap Russell 200 index added 2.1 per cent.

Macy’s surged 16.2 per cent after the department store raised its annual profit forecast as party-wear demand rebounds.

Dollar General Corp and Dollar Tree gained 11.7 per cent and 18.4 per cent respectively after lifting their annual sales forecasts as more Americans turn to discount store shopping with inflation at a four-decade high. - Additional reporting: Reuters/Bloomberg