A gauge of global stock markets touched its highest since late July on Thursday after fresh hints of progress in the US-China trade dispute, sending bond yields off lows hit earlier in the wake of the European Central Bank's new stimulus measures.

On Wall Street, major equity indexes climbed to session highs after a Bloomberg report said Trump administration officials have considered offering a limited trade deal to China that would delay or possibly roll back some tariffs, in exchange for assurances on intellectual property and agricultural purchases.

Stocks in Europe were whipsawed by the trade reports as well after climbing on the earlier ECB policy statement, with the broad Stoxx 600 index rising as much as 0.75 per cent. Frankfurt promised an indefinite supply of fresh asset purchases and cut interest rates deeper into negative territory in an effort to buttress the euro zone economy.

DUBLIN

The Iseq closed down 1 per cent after a volatile session. Dublin-listed housebuilder Cairn Homes fell 6.5 per cent to €1.08 despite announcing it would pay its first dividend to shareholders next month. The company saw revenues jump by 48 per cent to €192.4 million but investors focused on margins, which were less than less than expected.

The State's two main banks moved in oppposite directions. Bank of Ireland dropped 4 per cent to €3.89 after a downgrade from US investment bank Goldman Sachs. Rival AIB, however, rose marginally after a positive note from Goldman Sachs.

Building materials group and Iseq heavyweight CRH continued its good run, rising another 1 per cent to €31.37. Kingspan, however, was down 2.6 per cent at €43.32 amid negative sentiment for the sector.

The reits – Green, Hibernia, Ires – were all down to varying degrees in the wake of a property price report, indicating prices in Dublin were falling for the first time in seven years.

LONDON

London's blue-chip index ended in the black on Thursday as trade concerns were soothed by a two-week US tariff reprieve on Chinese imports and Morrisons jumped on upbeat profit and forecast. The FTSE 100 index was in and out of negative territory through the session but ended 0.1 per cent higher, boosted by a 1 per cent rise in tobacco giant BAT after layoff plans that offset losses in oil majors BP and Shell. The mid-cap index, meanwhile, dipped 0.1 per cent after scaling its highest level in nearly a year. The main index earlier touched a more than one-month high, helped by gains in global miners such as BHP and Anglo American after US president Donald Trump agreed to delay increasing tariffs on $250 billion (€225.7 billion) worth of Chinese imports.

Britain’s number four grocer Morrisons climbed 4.7 per cent after beating expectations for first-half profit and forecasting improved sales in its second half. Heavyweight blue-chip oil stocks fell after Saudi Arabia’s new energy minister said deeper supply cuts would not be discussed before a meeting of the Organisation of the Petroleum Exporting Countries planned for early December.

Brokerage actions also drove some moves, with rating downgrades in Premier Inn owner Whitbread, Intercontinental Hotel and Lloyds taking their shares between 1.3 per cent and 2.5 per cent lower. Inkjet tech company XAAR jumped 21 per cent after it agreed to sell 20 per cent of its holding in Xaar 3D to US company Stratasys for $10 million.

EUROPE

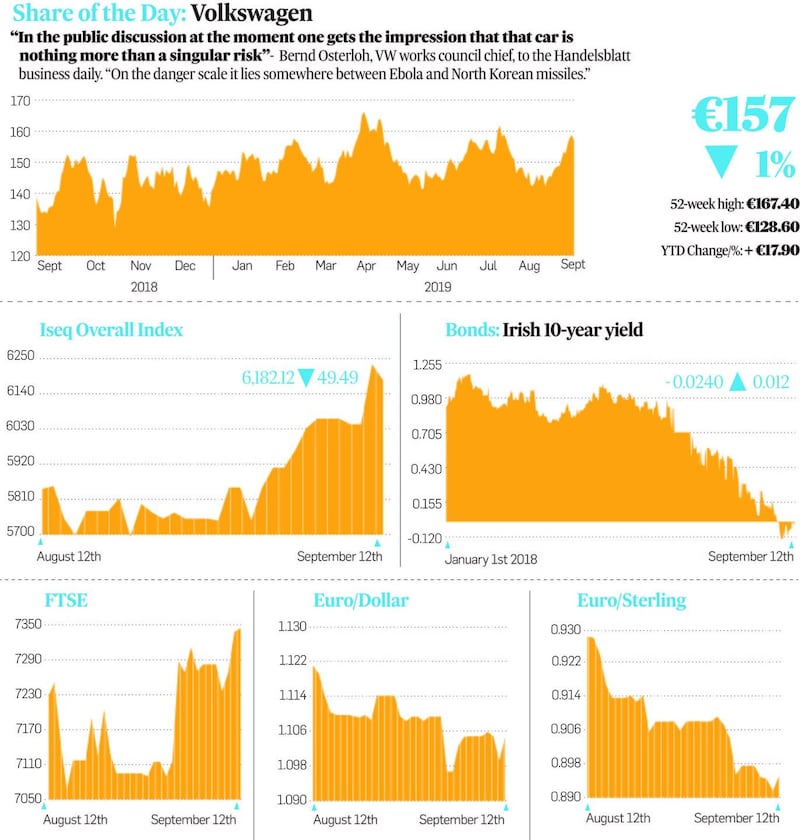

German carmaker Volkswagen fell 1 per cent to €157 after fresh claims that it built so-called “defeat devices” into a second diesel engine model. VW denied that cars with an engine from 2012 on had software that detected if exhaust tests are being carried out.

French nuclear utility EDF saw its shares drop nearly 1 per cent on Thursday, after France's nuclear regulator said at least five nuclear reactors operated by EDF might have problems with weldings on their steam generators, a fault which has raised fears of closures.

NEW YORK

US stocks gained in early trading on Thursday after the US delayed scheduled tariff hikes on billions worth of Chinese imports, and the European Central Bank launched a stimulus drive to boost the ailing euro zone economy. In a tweet that calmed trade tensions that have battered financial markets over the last year, US president Donald Trump said the US would delay increasing tariffs on $250 billion worth of Chinese imports by two weeks as "a gesture of good will".

Energy stocks fell 0.78 per cent and were the biggest drag on the S&P as oil prices fell after a meeting of the Opec alliance yielded no decision on deepening supply cuts. Among industrial stocks, Deere & Co and Caterpillar dropped after Wells Fargo downgraded their shares to "market perform". Baker Hughes fell 1.59 per cent after General Electric began divesting its stake in the oilfield services provider, aiming to raise $2.7 billion. Activision Blizzard rose 2.39 per cent after two brokerages raised their price targets on the stock. - Additional reporting by Reuters