Newbridge Silverware, Foxford Woollen Mills, Google Ireland – and even Irish Water – are just some of the Irish-based brands and companies that have been left out of pocket as a result of House of Fraser's administration.

The UK retail chain, which filed for administration on August 10th, before being quickly bought out by SportsDirect's Mike Ashley, had debts of close to £1 billion (€1.1 billion) when it collapsed. More than half is owed to suppliers such as Topshop, Armani and Betty Barclay.

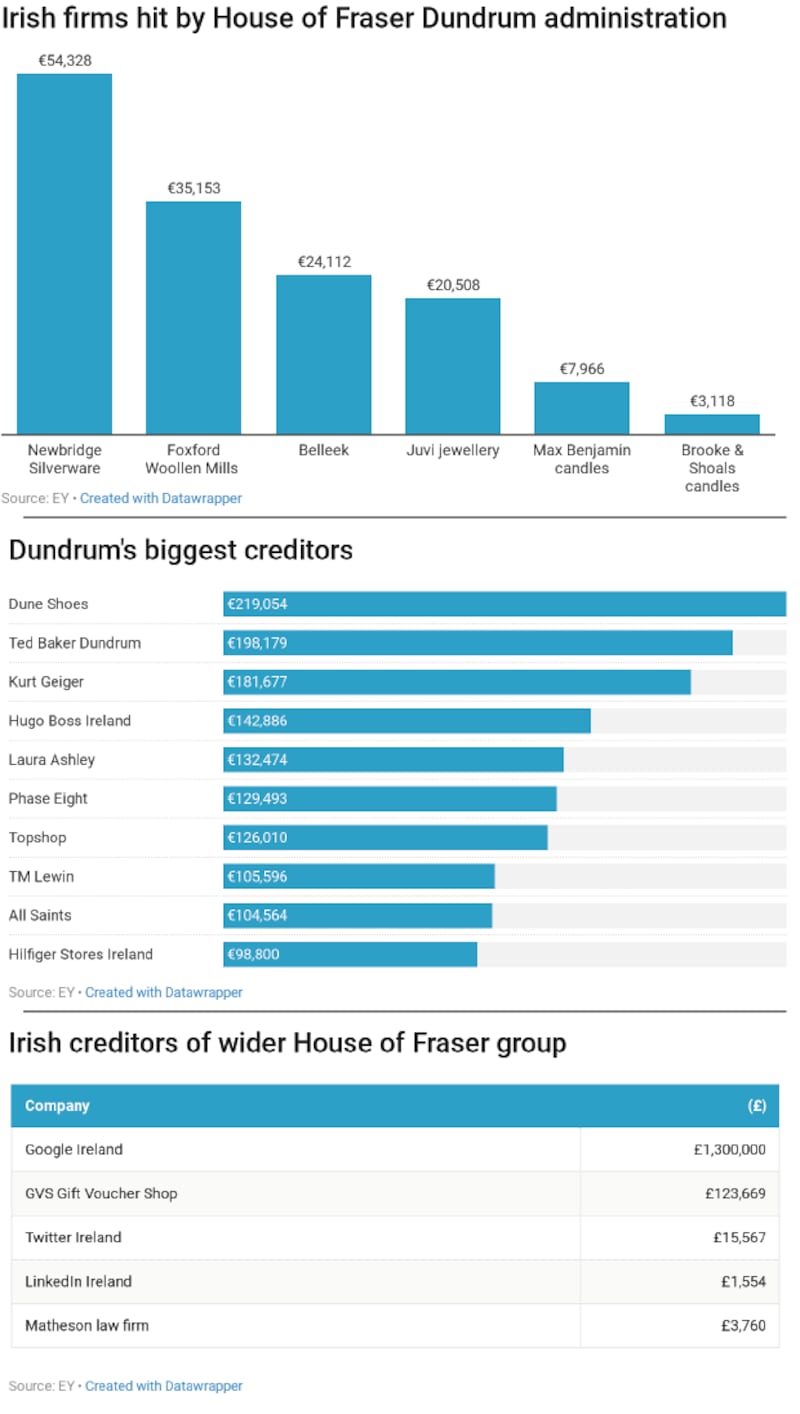

According to documents published by administrator EY, creditors of the chain’s Dundrum store, which is to remain under the direction of the administrators until “regulatory matters” are resolved and the store can be taken over by SportsDirect, are owed some €2.8 million.

Most of the biggest creditors of the Dundrum store are international fashion brands, such as the largest creditor, Dune Shoes, which is owed €219,054. Other substantial creditors include shoe brand Kurt Geiger (€181,677); the homeware brand Laura Ashley (€132,474) which has a sizeable outlet in the Dundrum store; Topshop (€126,010); Hilfiger Stores Ireland (€98,800); and Mango (€84,243).

Unpaid stock

The Dundrum store also stocks a host of Irish brands, some of which are emerging brands and would see House of Fraser as one of their biggest retail channels. Many have been left out of pocket as a result of unpaid stock. Mayo-based textile manufacturer Foxford, for example, is listed as being owed €35,153, while gift and homeware brand Belleek could stand to lose €24,112.

Newbridge Silverware, which hosts a substantial presence in the Dundrum store's homes section, is owed €54,328, according to the document, while other Irish brands owed money include jewellery maker Juvi (€20,508); Max Benjamin candles (€7,966); and Wicklow candle company Brooke and Shoals (€3,117.50).

Stockists at the Dundrum store are likely thankful that the retailer’s entry into administration happened in the quiet summer season. If it had happened in January, rather than August, it could have been catastrophic for some smaller stockists, as they would have been out substantially greater sums on the back of a greater volume of stock which would have been sold in the busy lead-up to Christmas.

Creditors of the UK arm of the business may not get back any money that they are owed, as SportsDirect is not obliged to do so; it has promised to cover only money owed since it bought the business. However, the situation remains uncertain for creditors of the Dundrum store, as it has not yet been transferred.

The documents also give an insight into how Irish-based suppliers to the wider UK retail chain have been left out of pocket as a result of its administration.

Google Ireland is the biggest Irish-based creditor, and could stand to lose £1.3 million as a result of its dealings with the retailer, presumably for unpaid Google ads. Twitter Ireland (£15,567) and LinkedIn Ireland (£1,554) are also owed money, while gift card provider GVS Gift Voucher Shop, which is behind the One4all gift voucher, could be out by a substantial £123,669. Irish law firm Matheson (£3,760) is also listed as a creditor.