Research published by the property website MyHome.ie on the Irish housing market trends today suggests the average mortgage loan for a house purchase in Ireland exceeded €300,000 for the first time last year.

The average residential mortgage loan was €308,200 in the third quarter of 2024, up 7 per cent on the year. In October the average mortgage approval rose to a new high of €321,000, up 8 per cent on the year, the report noted.

The research suggests first-time buyers in Ireland are getting older. On average they were aged 36 years in the first half of 2024, up from 34 in 2020, and putting them two years older than the UK average. And they spend on average about 28 per cent of their post-tax disposable incomes servicing their home loans.

Below are a series of graphics which show some of the key trends in the Irish property market. MyHome.ie is owned by The Irish Times group.

1 - The first graphic shows the median asking price for a three-bedroom, semi-detached property in each county, based on data from MyHome.ie.

2 - This graphic shows how the average loan value for house purchasers in Ireland has changed over the last two decades.

3 - In this graphic you can see the total amount drawn down in mortgages by homebuyers in Ireland since 2020.

4 - This graphic shows the number of properties bought and sold each year since 2010.

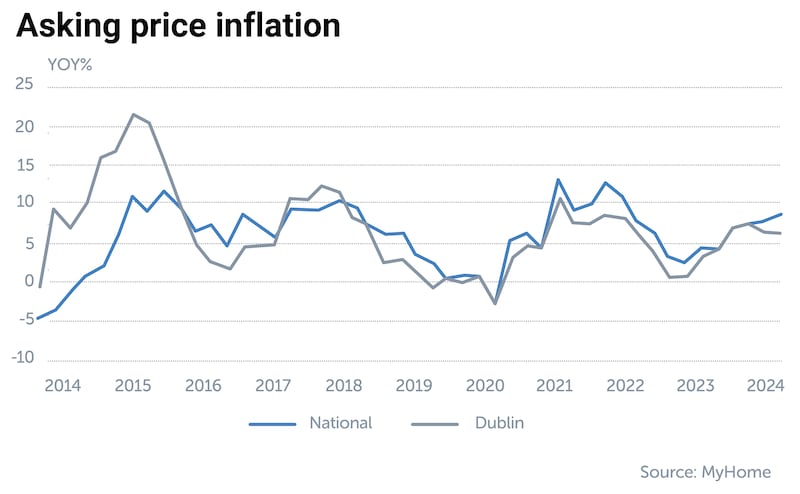

5 - This graphic shows the variation in asking prices for properties offered for sale in Ireland over the last decade.

- Sign up for push alerts and have the best news, analysis and comment delivered directly to your phone

- Join The Irish Times on WhatsApp and stay up to date

- Listen to our Inside Politics podcast for the best political chat and analysis