Excise duties on petrol and diesel should be slashed as an “exceptional” measure to combat rising consumer prices and inflation, the industry has said.

With further increases anticipated at the pumps, the representative body Fuels for Ireland (FFI) has written to Minister for Finance Paschal Donohoe arguing any immediate reductions would be offset by a rise in VAT income.

“When you have an emergency your response needs to include the exceptional,” chief executive Kevin McPartlan said.

On Friday, Tánaiste Leo Varadkar also signalled that the Government will intervene on costs before the budget, saying energy costs were going to go higher and stay higher for longer due to Russia's invasion of Ukraine.

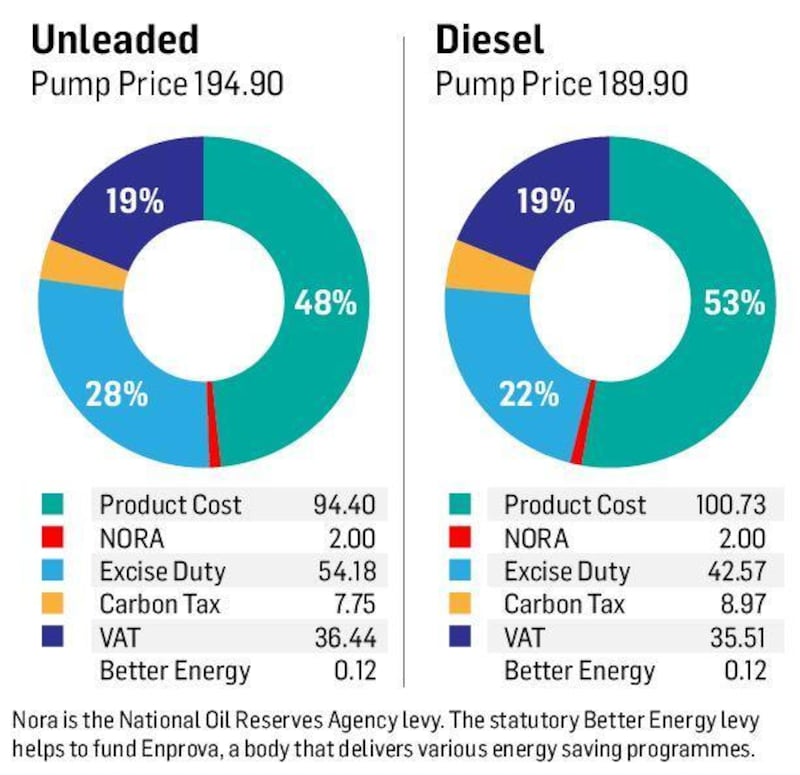

According to figures provided by FFI, taxes, levies and excise currently account for 47 per cent of retail diesel costs and 52 per cent of petrol.

In the case of diesel, a current €189.90 per litre charge constitutes a product cost of €100.73; 42.57 cent in excise; 35.51 cent in VAT; 2 cent in Nora levy (National Oil Reserve Agency); 8.97 cent in carbon tax; and 0.12 cent in the Better Energy levy.

Data from the Department of Finance shows taxes and charges account for 55 per cent of the cost of petrol and 51 per cent of diesel.

With some debate about the ability of EU member states to unilaterally reduce VAT rates, FFI is pressing for a cut in excise duty, at least as a temporary measure.

In a letter to Mr Donohoe this week, the organisation said rising fuel prices also threatened further inflationary pressure.

“Furthermore, the unpredictable nature of the price rises could also lead to a dynamic where people are buying – and hoarding – fuel in anticipation of further increases,” it said, although FFI has stressed that supply is not under threat.

“Ultimately, such a measure would be revenue neutral, as the lower rate will be balanced out by the higher prices and accordingly the tax take should still be as forecast.”

Concerns

These concerns were echoed by the Irish Road Haulage Association (IRHA) which, in a letter to Taoiseach Micheál Martin and other Government party leaders on Friday, said shortages and price rises have "placed our sector in a perilous position". It too called for a reduction in excise.

Previously flagged reductions are due to come into effect on April 1st – a temporary reduction in mineral oil tax (MOT) of 1 cent per litre of petrol and diesel, matched by the same reduction in the Nora levy – but for many, including FFI, this will not go far enough.

“The excise duty is absolutely within the domain of the domestic government,” Mr McPartlan said. “All they have to do is put a zero after the 1 cent [pending reduction] and that will make a big difference.”

He explained that price rises as a consequence of the Russian invasion of Ukraine – and following those from Brexit and Covid-19 effects – will come not only from direct sanctions but from ripple effects through the supply chain. Russian exports of oil, once bound for western countries, will be replaced with others, all at a cost.

Meanwhile, a Green Party minister has indicated support for measures to offset the impact of the war in Ukraine on fossil fuel prices, favouring policies supporting people who cannot avoid driving

Ossian Smyth, Minister of State at the Department of Public Expenditure and Reform said the party’s goal is to reduce emissions but was faced with the reality of a market deeply disrupted by the war.

“With a war or a pandemic you’re faced with a very large short to medium term problem, and you have to be pragmatic about it, you can’t just get into your entrenched position,” he said.

“It’s becoming harder and harder if you spend a large portion of your income on vehicle fuel and it keeps going up.” He said that while those living in cities could switch to public transport when faced with high fuel cost, options were being developed to address the fact that rural dwellers or hauliers cannot.

“We’re working on options taking that into account, they’re the group that are affected who don’t have an alternative,” he said.

The Department of the Environment, meanwhile, said its understanding is that the petroleum industry is “fully confident” it can meet normal fuel demands in the coming months. It said 90 days demand of strategic oil reserves is held by the National Oil Reserves Agency, 85 per cent of which is on-island.

Earlier, IRHA president Eugene Drennan, said some members had received less than the full amount of their orders as ships had not arrived due to stormy conditions - which he feared could be exacerbated by the Ukraine crisis.

Dr Muireann Lynch of the Economic and Social Research Institute (ESRI) said about 40 per cent of Ireland's energy needs are for transport.

"It certainly is the case that energy prices are going to rise in Europe… if we do see these restrictions of Russian fossil fuel companies towards Europe, " she told RTÉ. "And that's going to feed through to petrol, diesel, home heating and electricity prices."

Spiralling costs

In the Dáil on Thursday, Roscommon-Galway TD Michael Fitzmaurice outlined the deleterious effects of spiralling costs across a number of sectors, particularly bus and truck drivers, and farmers.

“An explosion is about to happen in the next week or two if something is not done by the Government,” he said.

The economist Jim Power said excise cuts were justified in the circumstances.

“You are creating a precedent definitely but when you are in an environment like this I think you have to throw the concerns about precedents out the window,” he said. “This is a crisis situation and it does require an intervention.”