The Irish pensions landscape is undergoing fundamental change. Many people have a type of pension called a defined contribution scheme, and the number of these pensions in operation is likely to fall from the tens of thousands currently held to less than 200 in a very short period of time. Meanwhile, the advent of the national auto-enrolment pension system will hopefully bring about a much-needed expansion of pension coverage.

“At present, around 800,000 employees in Ireland are not covered by either personal or occupational pension schemes and will be solely reliant on the state pension for their income in retirement,” says Maria Quinlan, head of LifeSight Ireland, which is the defined contribution pension solution from WTW. WTW is a leading global advisory, broking, and solutions company with a long-established presence in the Irish pensions landscape.

“The aim of the auto-enrolment scheme is to bring more people into retirement savings. That’s very welcome.”

This new plan is due to launch early in 2024, but a lot of work remains to be done before then.

“It’s quite an ambitious timeframe,” Quinlan notes. “We are helping employers get ready for it. We are looking at the design of their existing schemes, the profile of their employees, and what might need to be done in advance of the introduction of auto-enrolment.”

The dramatic reduction in the number of defined contribution pension schemes is being brought about by the implementation of the Institutions for Occupational Retirement Provision (IORP) directive.

The directive has brought in enhanced pension scheme governance and internal controls; a requirement for a formal risk management function as well as an internal audit function; new fitness and probity standards for trustees; a much broader scope of requirements for communications with individual savers, known as members; and extended powers for the Pensions Authority along with a range of other requirements.

The burden of these new obligations is simply too heavy to bear for the great majority of defined contribution schemes in Ireland. “What the IORP directive has done for pensions is exactly what has happened with the banking and the life assurance industries in recent years,” explains Ciarán Long, independent chair of LifeSight Ireland Trustees.

“It makes sure that schemes are governed appropriately. Ireland has had a disproportionate number of pension schemes relative to other countries and what the regulator is trying to do now is to impose a certain discipline on them. There were over 100,000 schemes, many of them very small. How do you regulate appropriately and proportionately everything from a one-member scheme to those with several thousand members? Under the new regulations the governance requirements will place an inordinate burden on the schemes of small employers.”

Relatively new to the Irish market, a master trust allows multiple defined contribution pension schemes to be operated within a single structure with centralised governance, administration, investment management, risk management, and member communications. The benefit in combining these services into one structure is its ability to deliver full regulatory compliance along with significant economies of scale.

“The new regulatory framework for master trusts has only been in place for a little over a year,” Quinlan points out, “and the level of governance required for master trusts needs to be significant and will likely increase over time.”

LifeSight Ireland, established in 2018, is bringing considerable experience of running master trusts in other countries. “We already have a significant master trust business in the UK, and we can leverage that experience and expertise to put in place a best-in-class master trust here in Ireland. We have €20 billion in assets and 360,000 members in our solutions around the world,” she continues. “In Ireland, we have €3 billion in assets in our single trust and master trust schemes. That allows us to bring ideas and concepts to Ireland which have been proven to work in other places. Due to our global scale, we can also offer lower costs for members. We have already passed on savings to members because of reductions in investment costs over the last year.”

That focus on individual savers, or members, is at the core of the LifeSight approach. “Member engagement and the overall experience is really important to us and our clients,” says Quinlan. “Historically schemes have tended to inundate people with information irrespective of their age and circumstances. We use a multi-channel approach with engagement tools that are proven to work. Our communication strategy is tailored, targeted, and measured. We sit down with the employer to map out the communication calendar each year so it fits into their wider HR priorities including around financial wellness.

“We also target members with the information they require to make informed decisions and improve their pension outcomes. There is no one size fits all. Importantly the journey is different for every member, therefore our approach looks to engage savers at key milestones that are relevant to them. That information is very different for someone who is just starting out to one who is approaching retirement.”

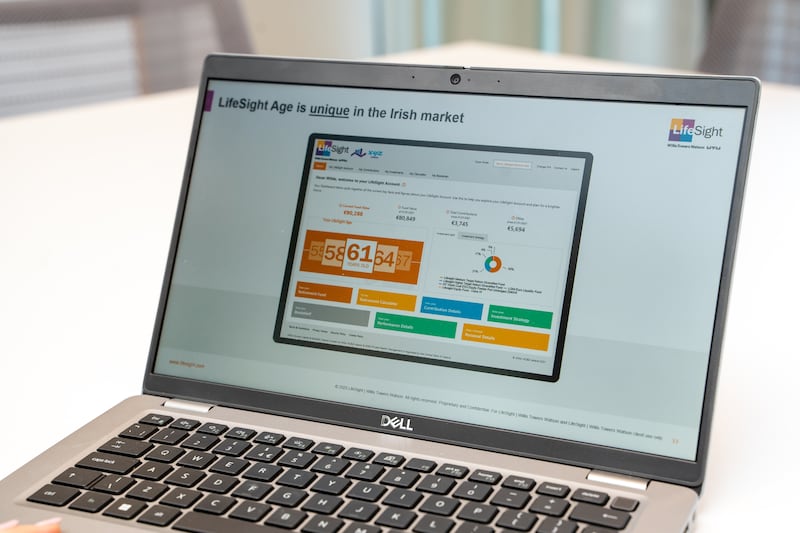

LifeSight takes a multi-channel approach to member engagement. This includes online communications, in person seminars, one-to-one financial support that reviews the entire market, and the company’s novel tool to help plan retirement, entitled an ageometer.

“Available through the online portal, the ageometer enables people to calculate, from their current earnings, the age at which they will be able to afford to retire. They can include other sources of income and benefits in the calculation. This drives them to action, for example by increasing their pension contributions or making additional voluntary contributions after a bonus.”

Finally, we make sure we measure employee engagement using a tool we call Engagement Spotlight. Historically, different employers measure different elements of how engaged people are with their pension, for example by tracking how many log onto their online portal. We bring all our different touch points with members including online activity, feedback, and whether they are maximising contributions into one single metric, which is our Engagement Spotlight. We sit down with the employer each year to consider this and compare the movement in the metric over time. We then use that information to agree the communication strategy.”

Independence is also of key importance when it comes to the running of a master trust offering. “It is embedded in everything we do,” says Quinlan. “Our investment management is independent, our financial advisers are not tied to any provider or product, and most importantly, our governance is independent.”

That independent governance is vital, according to Long. “Independent oversight is a key aspect of the regulations,” he says. “Trustees of the pension scheme have to get regulatory approval and be appropriately qualified. They have an obligation to act in the best interests of those saving into a pension. Their role is to ensure members are getting the best outcomes. They ensure that the companies running the schemes are getting the best value in the market for the services they use. They have no vested interest whatsoever in any of the service providers and can ensure schemes look around for better alternatives to the ones being used.

“The regulator will look to independent trustees to report on how schemes are run. It has the right to inspect documentation and to challenge trustees that the services provided are in best interests of the members.”

Market response to LifeSight Ireland’s single trust and master trust solutions has been overwhelmingly positive. “The feedback has been very positive, and employers recognise that the LifeSight master trust will greatly enhance their pension offering to their staff,” says Quinlan. “We now have €2 billion committed to our master trust as we continue to welcome new clients on board, and we have been delighted with the response since we launched LifeSight in the market.”

Pensions are moving up the business agenda, driven by government reforms and greater awareness of the importance of financial wellbeing. LifeSight is a high-quality and innovative pension solution that offers brighter futures for employees and commercial benefits for employers.

To learn more about the benefits of LifeSight click here