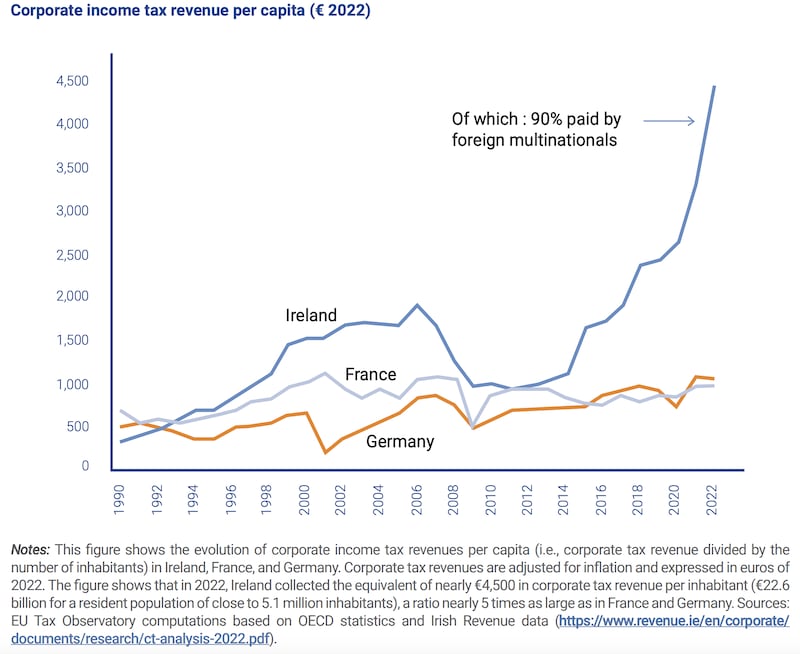

Back in 2014, the State collected about €1,000 per head of population in corporation tax. The Government might have hoped that signing up to the Organisation for Economic Co-operation and Development (OECD) tax deal and introducing the new 15 per cent rate for big companies in the recent Finance Bill would take the heat out of the international attention on the Republic’s policies in this area.

But the strong growth in corporate tax revenues in recent years continues to attract international attention – and the jealous eyes of other countries. Reference to the State as a “tax haven” is now commonplace, even if we don’t have the palm trees and sunny weather.

So what happened this week?

1. The EU Tax Observatory report

The EU Tax Observatory is a research group located at the Paris School of Economics and funded by mainly non-profit and public bodies, including the European Commission.

Mortgages: The five big mistakes to avoid as interest rates come down

What Trump tariff turmoil means for your savings and pension

Trump tariffs: What ‘dark and damaging scenarios’ could economies face in Ireland and worldwide?

Ireland and Trump’s tariffs: From pharma to booze – how will our prices, jobs and economy be hit?

Its work is led by economist Gabriel Zucman, a professor at the Paris School of Economics and associate professor at Berkeley, and the foreword to the latest report is by leading US economic Joe Stiglitz.

The latest report on global tax evasion, published this week, thus got international attention. Based on a range of often-new data sources, it estimates the extent of so-called profit-shifting by big multinationals, the movement of profits to lower tax locations to – generally legally – reduce their tax bills.

Despite international efforts to increase the tax take from big multinationals, the report concludes that some $1 trillion (€950 billion) in profits were “shifted” in 2022 to lower tax countries.

The windfall nature of much of the State’s corporate tax revenues leaves the country vulnerable not only to obvious factors, such as the fortunes of key companies and sectors, but also to unpredictable tax changes in other countries

This is the equivalent of 35 per cent of all the profits booked by multinational companies outside of their headquarter country, it says, estimating that the revenue loss is the equivalent of nearly 10 per cent of corporate tax collected globally.

And Ireland is one of the countries at the centre of this story. There is no way to calculate exactly how much profit is shifted to Ireland, but we know that many billions of profits earned around the globe by EU companies do go through the international headquarters of big US companies based here.

[ Is Ireland’s corporation tax party over?Opens in new window ]

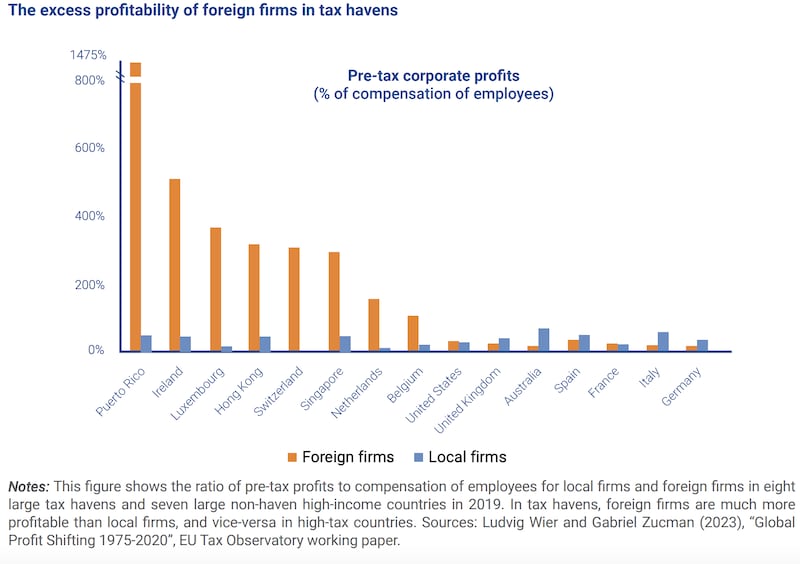

To calculate how much, the tax observatory uses an estimate of the profits earned relative to wages paid in multinationals in each country and compares it with what is earned in local businesses. The Irish figures of €6 in profit per euro of wages paid in the multinational sector is one of the highest internationally.

On this basis, the report’s authors calculate that some $140 billion (€133 billion) in profits are shifted to Ireland each year – along with the Netherlands. This puts the State on top of the European league. In 2019, the report says, these two countries each accounted for approximately 15 per cent of the total amount of profits shifted globally. Ireland gets a slice of tax from all this.

And this has multiplied following the first phase of OECD reform, which led to big companies reducing their reliance on “no tax” traditional tax havens such as the Cayman Islands and the Bahamas – made less attractive by new tax rules – to the benefit of “low tax” countries such as Ireland.

Whatever the precise figures are, the Irish exchequer is cashing in

By relocating intellectual property assets from traditional tax havens to countries such as Ireland, more profits are now being attributed to Irish operations. And while much of this is sheltered from tax for now by tax reliefs, it has clearly benefited the Irish exchequer. As the report says, real investment in Ireland has also risen strongly and it is impossible to know the split, as we don’t yet have a country-by-country breakdown of tax payments by multinationals.

Domestic estimates of the “windfall” element of corporate tax here – the bit not explained by domestic activity in the economy – by the Department of Finance, the Irish Fiscal Advisory Council and the Central Bank, while based on different methods of calculation, such as the rising share of corporate profits in overall tax revenue – also point to huge profits being moved through Ireland not related to economic activity here.

These suggest that about half of tax paid each year – which would amount to about €12 billion this year – may be windfall in nature. When we gross this up to the amounts of profits involved, we get to more than €100 billion (depending on the estimate of the effective tax rate paid).

2. Ireland cashes in

Whatever the precise figures are, the Irish exchequer is cashing in. The report pointed out that in 2022, Ireland collected the equivalent of nearly €4,500 in corporate tax revenue per inhabitant – the likely figure looks roughly the same this year – which is a ratio nearly five times as large as in France and Germany.

So while the State has signed up to the OECD regime and tightened up or abolished some of the more controversial provisions, such as the double Irish tax relief, the global restructures since 2015 and the profits earned by some of the key sectors here – notably ICT and pharma – have led to an explosion in tax revenue.

In turn this has led to jealous eyes from elsewhere in Europe. The Republic is trying to fight off new commission proposals to base some future additional contributions to the EU budget on corporate tax revenues. And, separately, the commission is also trying to launch plans for corporate tax reform across the EU, which would also threaten Irish revenues in the medium term.

[ What the Irish economy needs? More working mothersOpens in new window ]

Separately, the advocate general of the European Court of Justice is to give an opinion on November 9th on the commission’s appeal on a ruling of the lower European General Court in the case of Apple.

The lower court had found that the commission had not proved its case that Apple owed Ireland €13 billion in back-tax from the period 2004 to 2014. While this was based on previous tax rules and a structure Apple no longer uses, the opinion and the final decision from the ECJ will garner significant international attention

3. Where next?

The EU – including Ireland – is pushing ahead with the 15 per cent minimum corporate tax rate. The EU Tax Observatory report warns that the additional revenues gathered by this worldwide will be significantly diminished due to special allowances and reliefs – including a so-called “carve out” which allows companies to reduce their tax bill based on real investment in a country, and also special allowances for investment in research.

However, the Biden administration has not got congressional agreement to legislate for the OECD plan, meaning tensions could lie ahead.

The other part of the OECD plan, planning to move some taxing rights to countries where companies sell their products, as opposed to where their headquarters operations are, would cost Ireland.

What next for workers in the gig economy?

However, there is no sign of agreement on implementing this plan. The risk for Ireland is that if this falls, bigger countries may move ahead on a unilateral basis to introduce digital sales taxes in their own jurisdictions to try to skim off some tax which would otherwise be paid here. In turn this could lead to tensions with the US, where this whole issue has become a hot button one politically.

Meanwhile, Ireland’s huge slice of revenue from US companies‚ including pharma companies selling back from Ireland into the US market, could also lead to pressure for legislative changes in the US.

In short, the windfall nature of much of the State’s corporate tax revenues leaves the country vulnerable not only to obvious factors, such as the fortunes of key companies and sectors, but also to unpredictable tax changes in other countries, notably the US, in a world where exchequers across the world are scrambling for cash.