The Central Bank will support the Financial Services and Pensions Ombudsman (FSPO) in anything it thinks necessary to close a gap that could mean thousands of people whose mortgages were sold to vulture funds have no recourse to the ombudsman, a senior official at the regulator has said.

On Wednesday, Sinn Féin finance spokesman Pearse Doherty told the Oireachtas Joint Committee on Finance, Public Expenditure and Reform that a loophole in 2015 legislation aimed at protecting homeowners whose loans were sold to vulture funds means they do not have the same protections as customers who have a loan with one of the main banks.

The public had been “sold a pup” when the Credit Servicing Bill was introduced in 2015, Mr Doherty said. He claimed the loophole meant a number of customers whose mortgages were sold to vulture funds following the 2008 financial crisis were not able to raise their complaints with the ombudsman if they were in dispute with the fund about the management of their loan.

The FSPO determined recently that certain complaints are “outside the scope of their investigation”, Mr Doherty said, and remained so for the period between 2015 and 2019 when the legislation was tightened.

“The system was not aware of that determination before now, and it’s of the utmost importance that the ombudsman is supported in any way to close that gap,” said Derville Rowland, deputy governor and head of financial conduct at the Central Bank said in response to Mr Doherty’s questions.

“We are very, very supportive of the ombudsman and his role, and anything that his office thinks is necessary in order to close the gap,” she said.

Ms Rowland said the Central Bank’s code of conduct for regulated firms in their handling of mortgage arrears applied “irrespective of who the lender is”. She said she had “limited information” of the ombudsman’s recent determinations on the complaints raised but that she would come back to Mr Doherty in writing about the loophole.

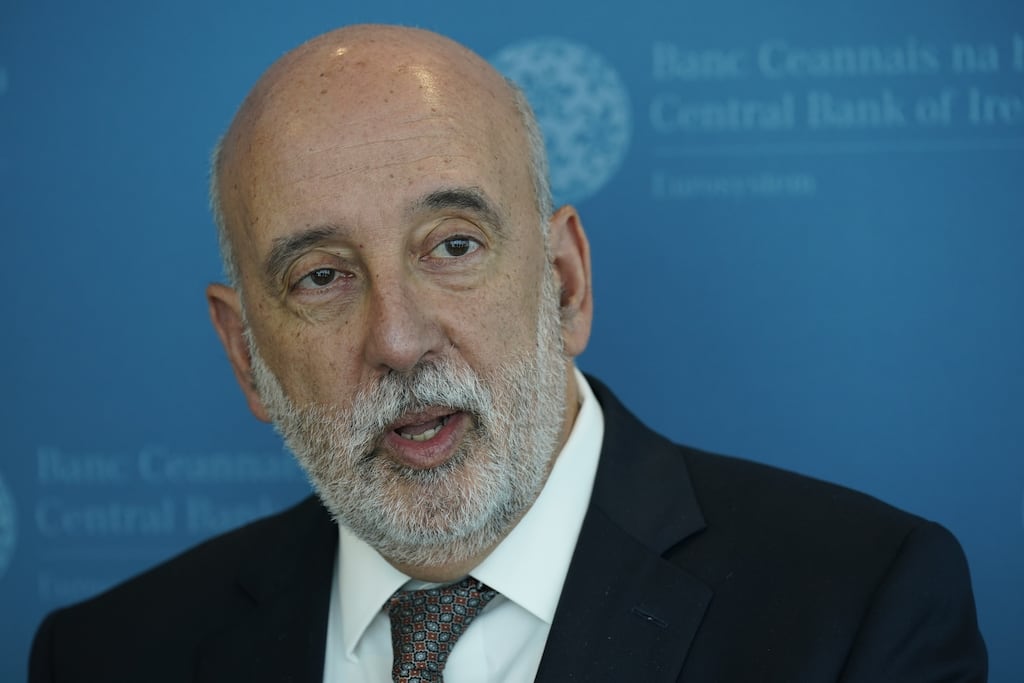

Separately, Central Bank governor Gabriel Makhlouf told the committee the regulator would work with the Department of Finance to implement recommendations from the Government’s retail banking review. Published in 2022, the report highlighted the continuing importance of cash within the financial system as a backstop against financial exclusion.

Last month, the Government introduced new access-to-cash legislation that would, among other things, force supermarkets and pharmacies to continue accepting hard currency. It would also require banks to maintain specific numbers of ATMs within certain geographic and demographic parameters.

“We welcome the draft legislation on maintaining access to cash, which we believe is an important public policy intervention,” Mr Makhlouf said. “It is clear that there is a societal demand and need for cash, and the Central Bank – along with the rest of the euro system – remains committed to the provision of cash.”

- Sign up for Business push alerts and have the best news, analysis and comment delivered directly to your phone

- Find The Irish Times on WhatsApp and stay up to date

- Our Inside Business podcast is published weekly – Find the latest episode here